Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

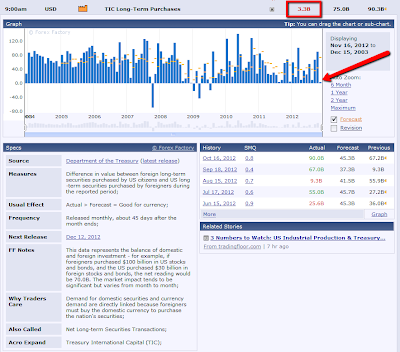

Foreign Demand for Long-Term Securities Plunges (by SB)

Bouncing Bar

Ginormous Head and Shoulders in Formation?

Semi-Retreat

I've received a number of compelling reasons to trim back my shorts, not the least of which is the LDI, which has historically been infallible. But let me share a little story about why I'm not gobbling up stocks.

About a week or so ago, I was tempted to buy a number of positions that seemed very "cheap". I came THIS close (imagine me holding up my fingers very closely together) to doing so, but instead, I simply put the positions into a spreadsheet to see what they would have done if I did go long.

Well, a week later, they are all down, and collectively the loss would have been something like $20,000.

Moments ago, I faced the same temptation, because the same stocks are even cheaper (obviously). I again came THIS close, but again shoved the symbols into a spreadsheet instead, where they are harmless hypotheticals.

I maintain that, as of September 14, the tide turned, and we are in a true, honest-to-God bear market again. I will thus endeavor to keep cash as my only "long", scampering back into retreat mode when I believe the likelihood of a bounce is strong. As of now, I have gone from a 95% commitment (late Wednesday) to 40%, all of them shorts, all of them small, and all of them carefully-selected.

If we keep falling, fine, I'll keep accruing profits (albeit slowly). If we rally, fine, I'll take on some water, but I'll simply be waiting for the juicy moment around 1400 when short opportunities will engulf us all in their gorgeousness. Just to be clear, today is a little disappointing, since I went from a hefty profit to a small loss in the span of half an hour, but Ithink a bounce at this point is long overdue, and a rally anywhere a little above 1400 will be a gift from the trading gods above.