Not Reading Slope Can Be Expensive

Back on Tuesday, February 12th, our host Tim noted natural resources stocks were weakening and suggested shorting Cliffs Natural Resources (CLF).

The next day, Cliffs dived 20% after announcing a cut in its dividend after the close on Tuesday.

From A Mess To The Masses

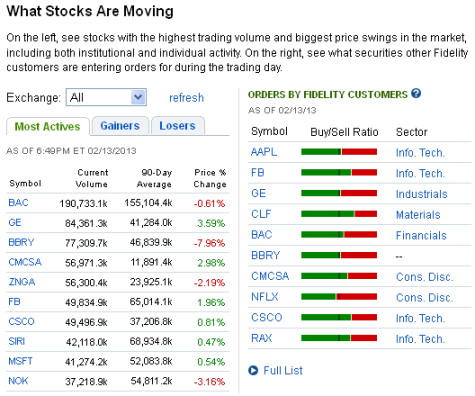

The old Odd Lot Theory was based on a simple premise: the average, small investor (those who couldn't afford round lots of shares) was usually wrong. Guess which stock Fidelity customers were buying with both hands as it dropped 20% on February 13th?