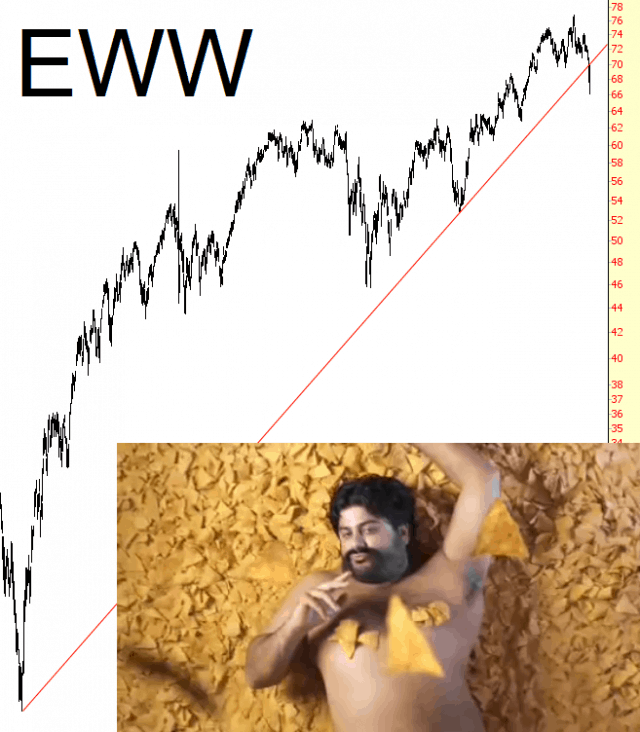

I’m going to wait until we get a bounce up close to $70, but this Mexico-based ETF is going to get a bad case of Montezuma’s Revenge………

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

I’m going to wait until we get a bounce up close to $70, but this Mexico-based ETF is going to get a bad case of Montezuma’s Revenge………

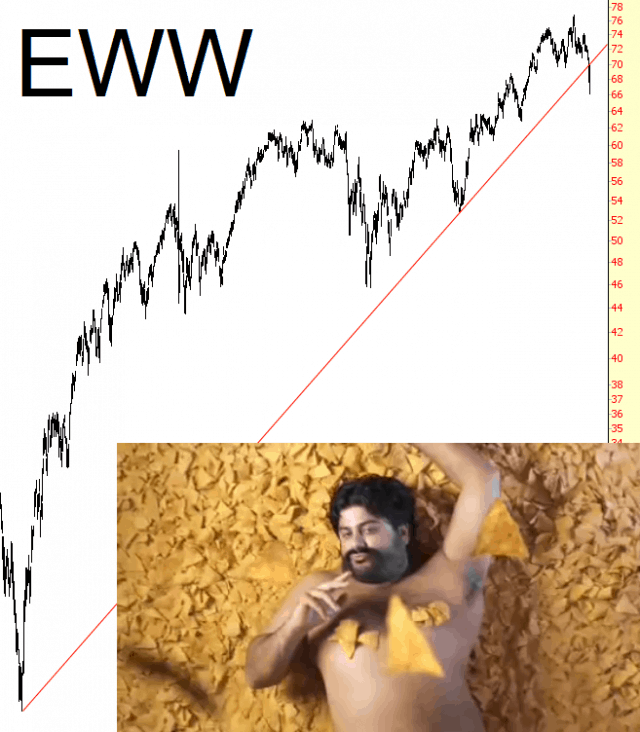

For me, one of the big appeals of down-markets is that they are really, really fast. Most of you know the Nikkei got absolutely slaughtered last night (can you imagine waking up to a Dow that was down over 1000 points? Oh, the glory!)

The chart below captures it nicely; twenty days of bulls mincing, prancing, getting their hair done, and picking out furniture together – – – all laid waste in a single session. God bless our bearish brethren.

Most days recently I’ve been posting a rising channel from the 1536 low, and I posted on twitter yesterday that channel resistance was hit at 1684.6 and there was leeway for a push through to 1685/6. I was frankly irritated when SPX then reached 1687.18, which was a clear breach of my channel resistance trendline.

I have commented before though that sometimes we see a pinocchio through a smaller pattern or channel trendline to reach a target trendline on a larger pattern, and with that high yesterday the pattern from the November low has finally been clarified. That pattern is a perfect broadening ascending wedge, and you can see that on the SPX 60min chart below: (more…)

Back in April the market experienced a similar sell off for 63 points. What happened after the initial major down day was a few days of very large gaps (10pts and greater), before the market settled down and eventually resumed the up trend. Also in late February the markets went through a similar increase in volatility before stabilizing and continuing to the upside.

Ultimately there was shock from Bernanke’s comments about toning down QE and last night the Nikkei made a splash of its own. Which has put the market into a state of increased volatility and uncertainty in the short term. Ultimately there are two scenarios likely to unfold; the market remaining in a state of relatively high volatility, leading into a down trend. Or the market will stabilize and slowly revert to historically lower levels of volatility, possibly leading to further upside. Either way, we can expect a large trading range to develop over the coming days with plenty of opportunities to be both long and short.

My expectation today is for a gap size of roughly 15pts, which puts the gap fill below a 40% probability of filling. Typically expansion leads to contraction so I wouldn’t expect much today. I am going to sit today out, see how the market behaves around already established key levels and then proceed from there.