Well, it is a while I wrote my last post about this crazy and manipulated market. But today’s event can be probably marked as a big V-Day (V for the victory). To be short – /ES dropped over 40 points after release of FED minutes, which appoints a probable end of QE program.

The Big Picture

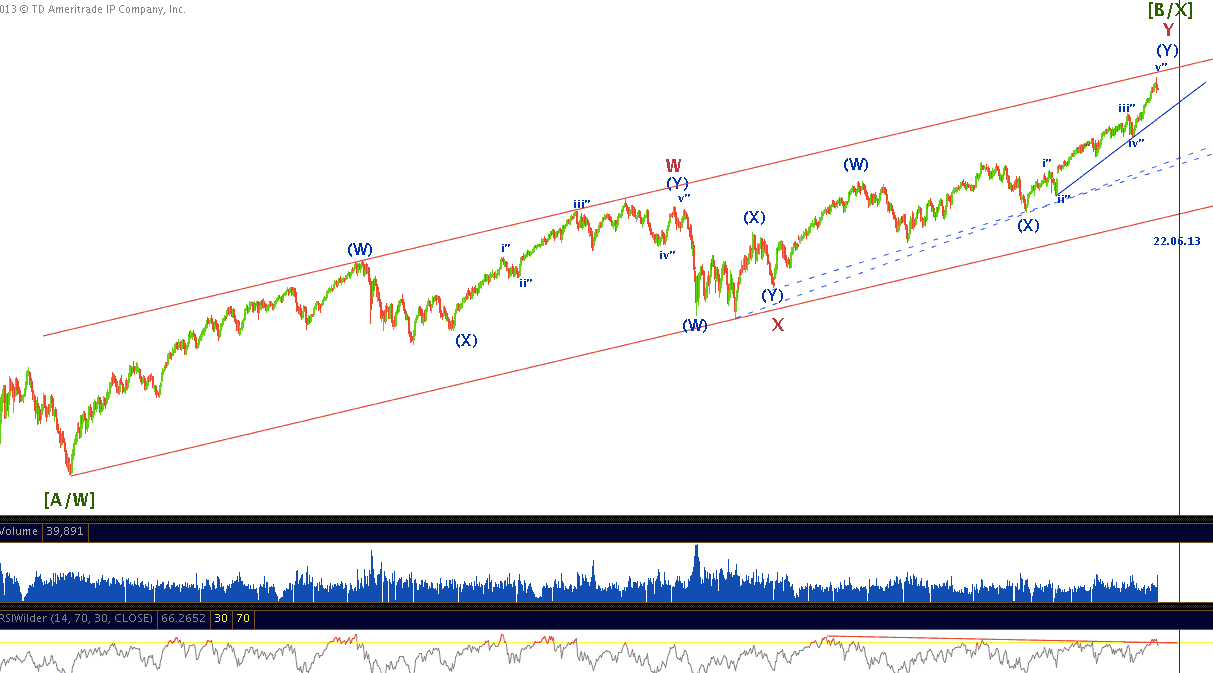

But in EW trading you need to ignore the news and focus only on the price moves and counts. First I would like to show my global EW count of the current market move and you could compare it with my analysis from March 2010 about the Big Picture, which is very similar to where we are now.

Based on today’s move (including timing, count and price channel) we have a very good chance to see a begin of a corrective [C/Y], which could last 1,5-2 years and correct the [B/X] wave by 61.8% of [A/W], which has a minimal EW target of 1126 in SPX.

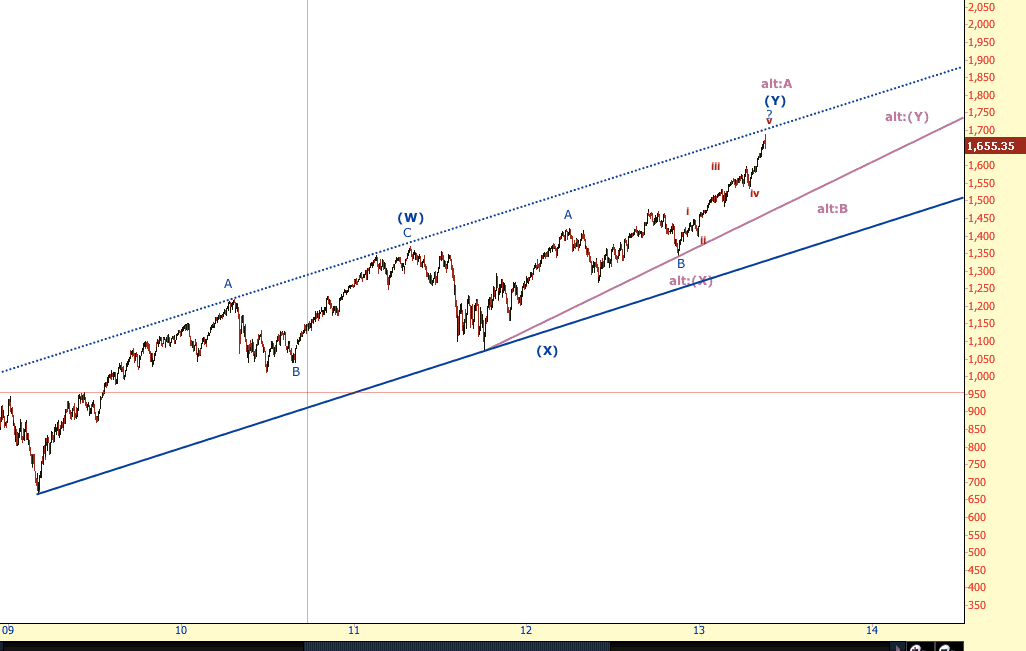

The Risk

Unfortunately there is always a risk of EW alternatives, which means the Y-wave is not over yet. The down move can only be confirmed, if we break the 61.8% of the entire move from March 2009 and the blue line of the next alternative count:

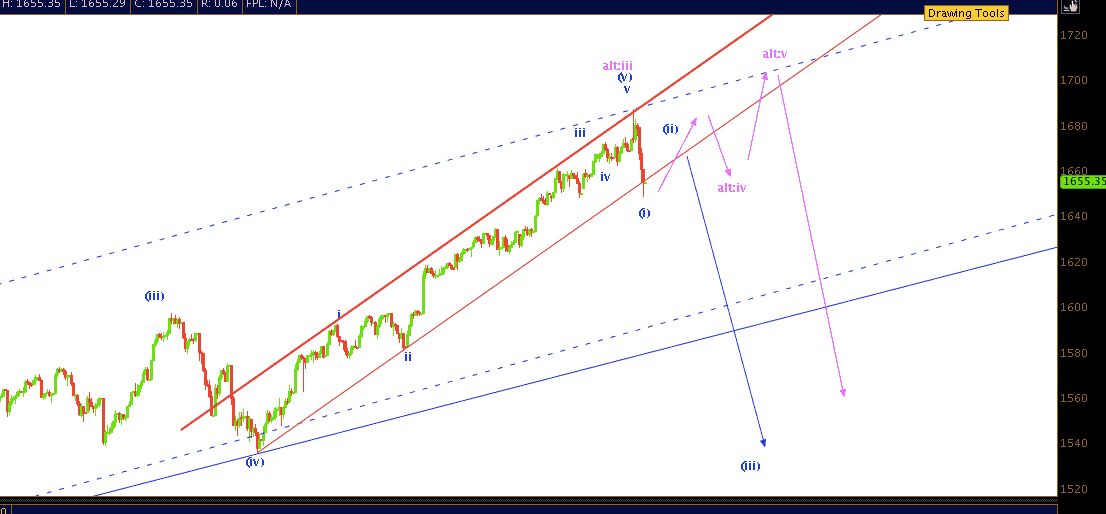

Short Term view

Right now I see two main options from the short term perspective: the long up-move is over and we go into a massive correction in the next 2-week and price target of 1536 and lower (favorite scenario) or the move is not over yet and we will need an another up-leg to finish it, before we drop (alternative scenario).

Wish you all good trading and hunting. If can access my EW counts and updates via Epic call on trading fate blog.

Dr. Livesey