Another Ominous Chart

On Twitter recently, macro trader “Dividend Master” shared this ominous chart of NYSE margin debt, noting that previous spikes coincided with the end of last secular bull market, in March, 2000, and preceded the end of the previous cyclical bull market by a few months in 2007.

Dividend Master isn’t the only market participant to share a scary chart recently — fund manager John Hussman tweeted another last month, suggesting the market was in the late stages of a Sornette Bubble. One of these crash predictions is bound to be right eventually. But there’s an opportunity cost to having a constant bunker mentality: if you put most of your money in cash, you’ll miss out on any further upside; if you pour money into an inverse ETF, you’ll rack up losses while you wait. Here is a way to hedge against a significant market correction which won’t put a lot of drag on your returns if that correction doesn’t happen over the next several months.

Hedging With Optimal Puts

0.80% cost, uncapped upside.

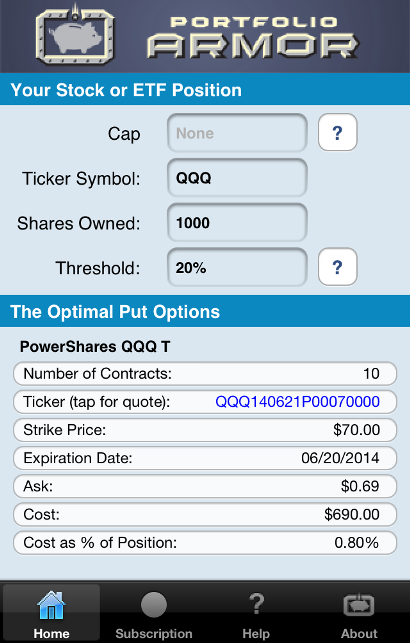

These were the optimal puts*, as of Friday’s close, to hedge 1000 shares of the Nasdaq 100 tracking ETF (QQQ) against a greater-than-20% drop over the next several months.

As you can see at the bottom of the screen capture below, the cost of this protection, as a percentage of position value, was 0.80%. Note that, to be conservative, the cost was calculated using the ask price of the optimal puts. In practice, an investor can often buy puts for less (i.e., some price between the bid and the ask).

With this hedge, you’ll limit your downside if a major correction occurs over the next several months. And if the market keeps roaring higher, assuming you’re otherwise fully invested, so will your portfolio minus the 0.8% or less you allocated to this hedge.

Possibly More Protection Than Promised

In some cases, hedges such as the one above can provide more protection than promised. For an example of that, see this post about hedging shares of the SPDR Gold Trust ETF (GLD).

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze the available puts for your stocks and ETFs, scanning for the optimal ones.