I am preparing to leave on a five-day journey, so I’ll go ahead and deploy this for the first day of the year. I have reached out to a few of the most prolific writers that occasionally contribute to Slope, beseeching them to add content in my absence. I’ll do my best to get their stuff posted in a relatively timely manner before things return to “normal” for me on Monday, January 6th.

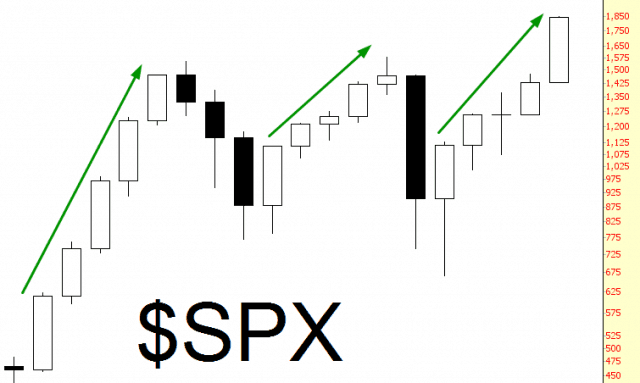

In any event, I noticed kind of an interesting phenomenon when I looked at the big U.S. markets with very crude granularity: that is, yearly bars. Over the course of the past three bubbles (we never learn, do we?) there seems to be a pattern of five bars of ascent followed by a swift drop. Observe:

It’s actually kind of amusing to see that the so-called financial crisis, which everyone was so freaked out about, and about which scores of books and articles were written, is neatly contained in a single bar. Ah, those were the days. But I digress.

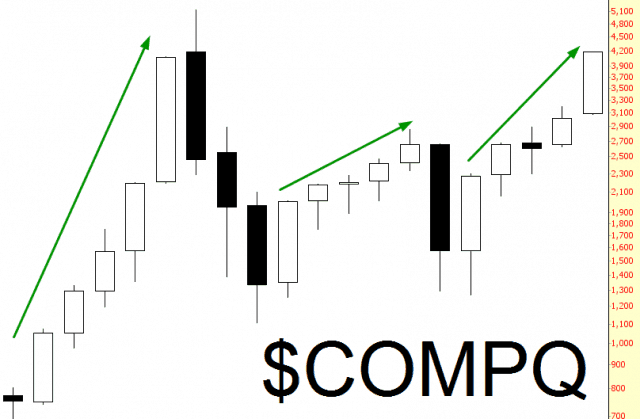

This “five steps and a stumble” is also visible with the NASDAQ Composite:

Does this guarantee drop in 2014? Absolutely! The guarantee is iron-clad. OK, OK, cut the crap. Of course it doesn’t guarantee a thing. It’s just……interesting.

For a bit more “long-term” perspective, I would also quietly point out that the NASDAQ 100, whose ascent in the late 1990s was considered the bubble-to-end-all-bubbles, has reclaimed its former glory. Setting aside the 2000 spike (or, in candlestick parlance, “shadow”), we’re basically at the loftiest levels seen in late 1999 and early 2000, as marked by the green horizontal line. Insane, wouldn’t you say?

And so there we have it. The Crazy and been upgraded to Crazier, and there’s no reason Even Crazier Still isn’t just around the corner. People are funny that way.