Politics is the art of looking for trouble, finding it everywhere,

diagnosing it incorrectly and applying the wrong remedies. – Groucho Marx

Just a short post today as I am having fairly serious computer troubles since yesterday afternoon. I suspect my hard drive is failing, so I have a new one arriving tomorrow which I can install at the weekend. In the meantime I’m expecting my main trading computer to crash several times a day which is time-consuming.

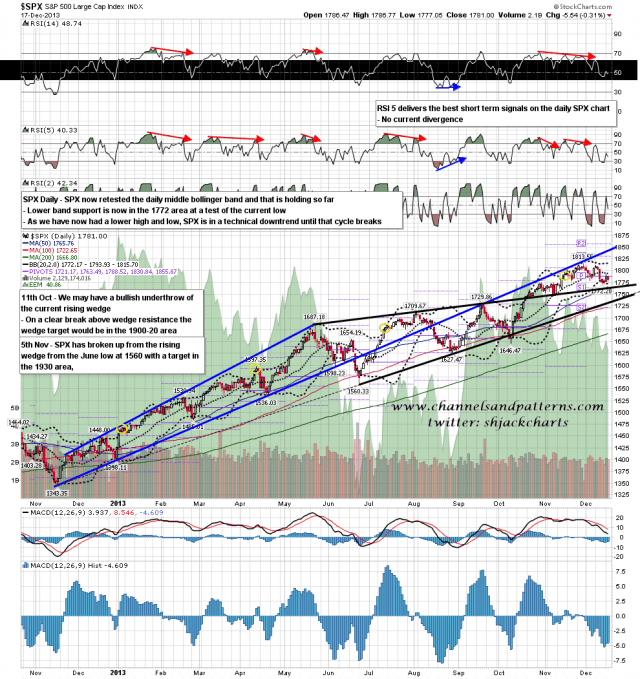

The Fed may well dominate the rest of the week, with a Fed Press Conference at 2.30 today and $10bn in POMO on Thursday and Friday. As ever it seems when the Fed is rolling out the big guns, SPX is poised just below resistance and it may well be that we will see a strong Santa Rally start today on a break over that resistance. The weekly upper bollinger band is now at 1841 and if we see a strong move up from here that may well be the target, most likely to be hit at a higher level than it is now.

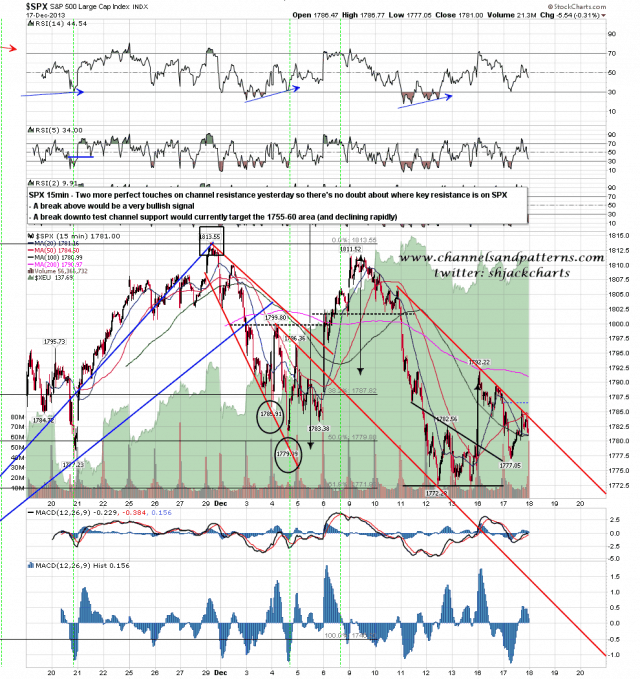

Our blind and bumbling central planners apart, how does the technical setup look here? Well on SPX falling channel resistance was hit two more times yesterday, and the multiple hits in the last two trading days are the sort of action where I would normally be looking for a break up in the near future. If we see that break up today then the obvious next target would be a test of the highs and most likely beyond into January. SPX 15min chart:

To confirm any break above the falling channel on SPX I would then be looking for SPX to close back over the daily middle bollinger band, which closed yesterday at 1793. That would therefore require a conviction break above the opening high on Monday. That would open up the daily upper, which closed yesterday at 1815.70. If we see any weakness today I have lower band at 1772 at the current SPX retracement lows. SPX daily chart:

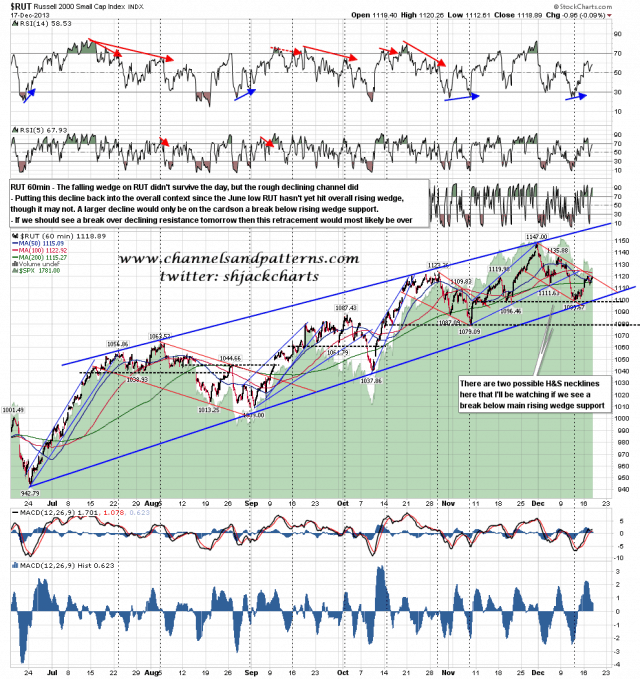

My perfect falling wedge on RUT from yesterday morning didn’t survive the day but the rough declining channel I posted on Monday morning did. a break up with confidence would also look bullish but looking at the RUT chart from June I’m wondering about seeing a retest of the lows to hit the rising wedge support trendline from the June low, which looks like unfinished business here. RUT 60min chart:

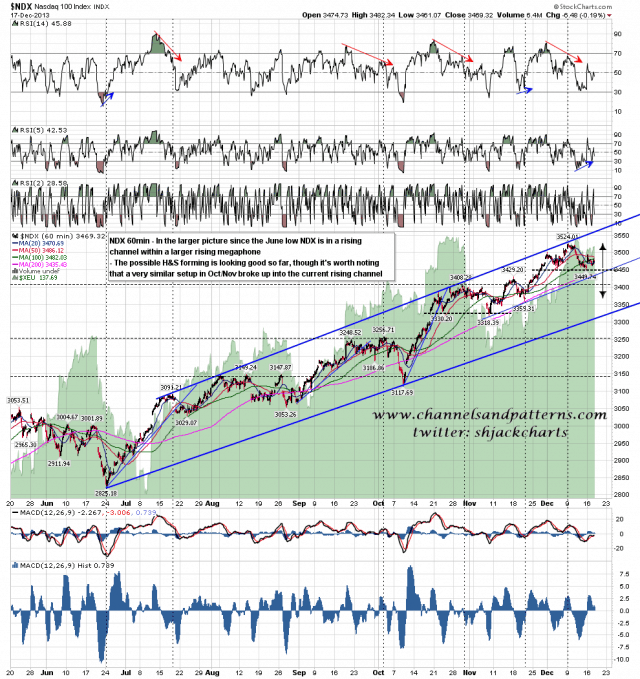

I’ve also put the H&S forming on NDX into the larger context since June, and there is similar unfinished business there at rising channel support from November. If this H&S survives the Fed this week and breaks down, the obvious target would be at rising megaphone support from June. I would note on this chart that an H&S very similar to the current one was forming in Oct/Nov before breaking up during the formation of the right shoulder. NDX 60min chart:

A lot of traders will be sitting the day out today as there may well be some extreme volatility. I’ll be choosing my own trades carefully and would suggest that anyone trading today do the same. If we see strong resistance breaks today that may well kill off the current downtrend and start a strong Santa Rally and if so, those breaks should be respected.

The nine most terrifying words in the English language are: ‘I’m from the government and I’m here to help.’ – Ronald Reagan