There’s an old saw that you should “dance like no one is watching” (and I strongly suspect most Slopers have the same fondness of going out on the town and dancing as I do: that is, none).

I was reminded of this phrase since we are approaching the Fed announcement this Wednesday. I confess to being apprehensive about the event. It will, in all likelihood, define the behavior of the market for the rest of 2013 and probably bleed into the first part of 2014 as well. I think it’s a fairly big deal.

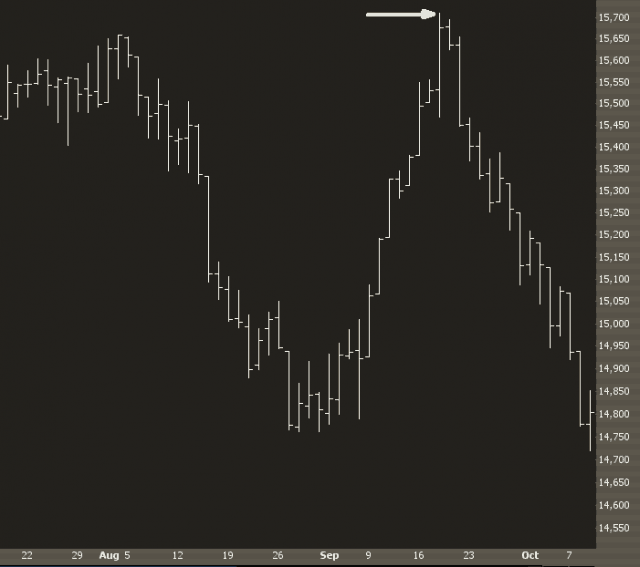

The last time the Fed did one of their “big kahuna” announcements (that is, the press release, the update of forecasts, and a press conference) was September 18 of this year, and because they didn’t taper (and everyone was expecting they would), the market zoomed higher. Of course, the market peaked that very day, falling 1000 Dow points in the weeks ahead (and, naturally, recovering every single one of those afterward). The point is that anticipation often outweighs reality.

Ideally, I should be positioning myself as if no such meeting was forthcoming. After all, not only do we not know what they’re going to say, but we don’t know how the market will react based on whatever they do say. If you someone knew on September 17 that the Fed would announce no taper on the 18th, would you have concluded the Dow would fall 1000 points thereafter? Probably not. You would probably judge it as insanely bullish news which, for a couple of hours, it was.

This is a tough balancing act, and I am “typing out loud”, as it were, while I think through this.

The safest thing, of course, would be to go completely flat. This removes the risk. It also removes the opportunity. The other extreme would be to be completely oblivious to all binary events, such as the FOMC, and let the chips fall where they may.

I am leaning more toward the latter than the former, although I am definitely tuning risk down. I came into the trading day on Monday morning about 120% committed, and by day’s end, I had reduced it to just under 100%. I will probably keep it there until Wednesday is totally done.

Let’s face it, 2013 has sucked out loud for bears anyway. One more thrust of the knife won’t make that much difference. But if…….if……..things start to break apart after Bernanke’s final press conference, it might have been worth waiting for.