My wife and I had some shocking news this morning when she was told that the husband of an old friend of hers was stabbed to death by a random nut in a pub last night. I didn’t know him that well but we’d spent some time with them and he was a very decent, hard working, family man who leaves a wife and two children behind. Just incredible, and a reminder that very bad things can happen to good people, and that people don’t always make it to three score years and ten even nowadays. After two close friends of mine died within three months of each other two years ago that is now three people in my circle all dead from various causes in their early to mid-40s. Very bad luck and extremely thought-provoking.

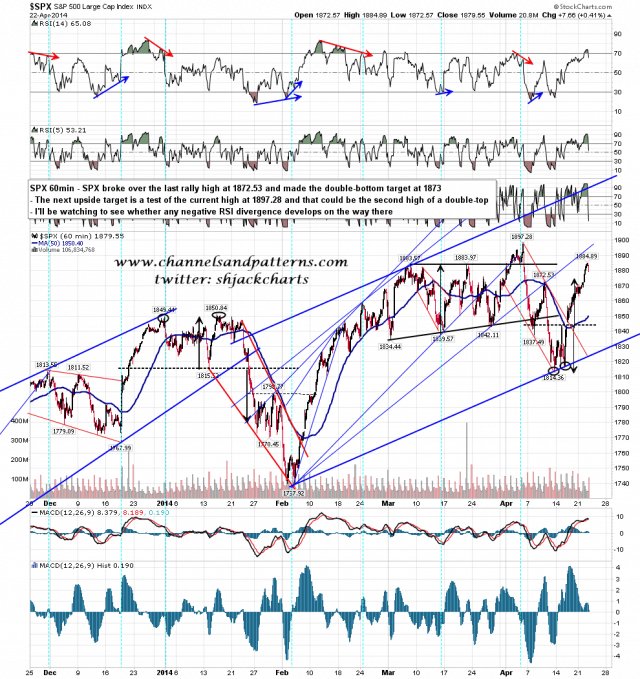

Back to the markets where SPX broke over the last rally high at 1872.53 as expected. The next major target is a test of the current high at 1897.28, and the possible second high of a double-top that could be made there. We may well see some retracement today, with the obvious target at a retest of that broken resistance, and that could set up negative RSI divergence on the 60min chart for the retest of the highs. SPX 60min chart:

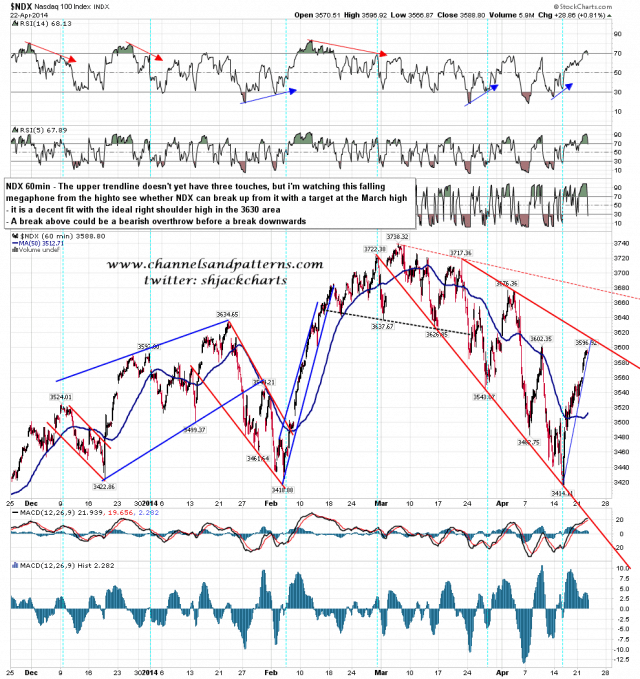

Supporting the possibility of a double-top on SPX are the NDX and TRAN charts. I showed the possible H&S forming on the NDX daily chart yesterday and today I’ll show the falling megaphone from the March high on the NDX 60min chart. NDX came close to testing megaphone resistance yesterday and I’ll be watching that carefully on the next push up. It’s worth noting that a break over megaphone resistance could be a bearish overthrow before this patterns breaks down, and that the megaphone resistance area is a decent fit with the possible H&S ideal right shoulder high in the 3630 area. NDX 60min chart:

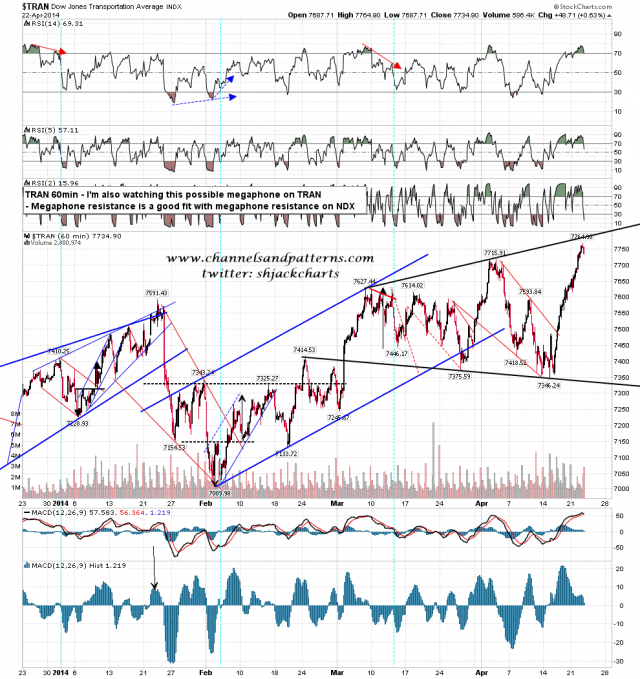

On TRAN I have a standard megaphone, and resistance there is a very good fit with the megaphone on NDX. With all three of SPX, NDX and TRAN I’ll be watching for any negative divergence on the 60min RSI 14 at the hit of these resistance levels. TRAN 60min chart:

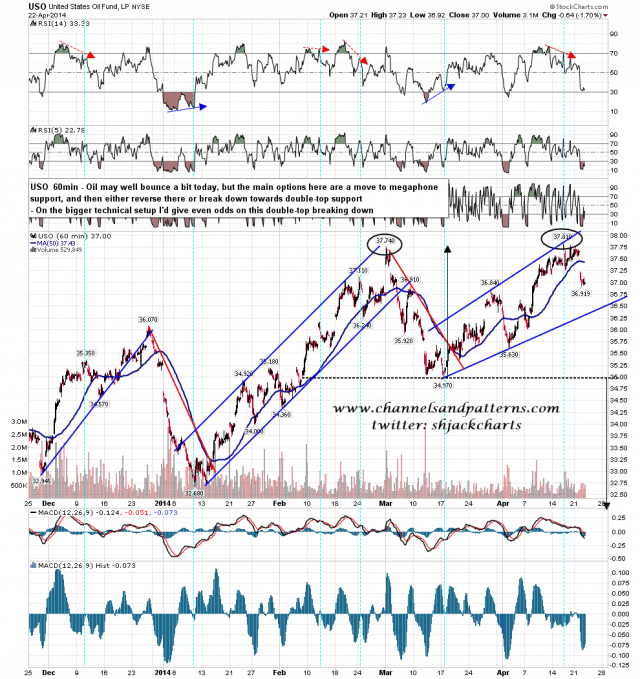

On other markets I’m been watching for the possibility that oil would make a double-top at the test of the last highs and that may be happening. On the USO chart below I have oil falling to rising megaphone support and if that breaks then the next stop is double-top support. On the bigger picture the setup supports the double-top and I’d give even odds here on that playing out. USO 60min chart:

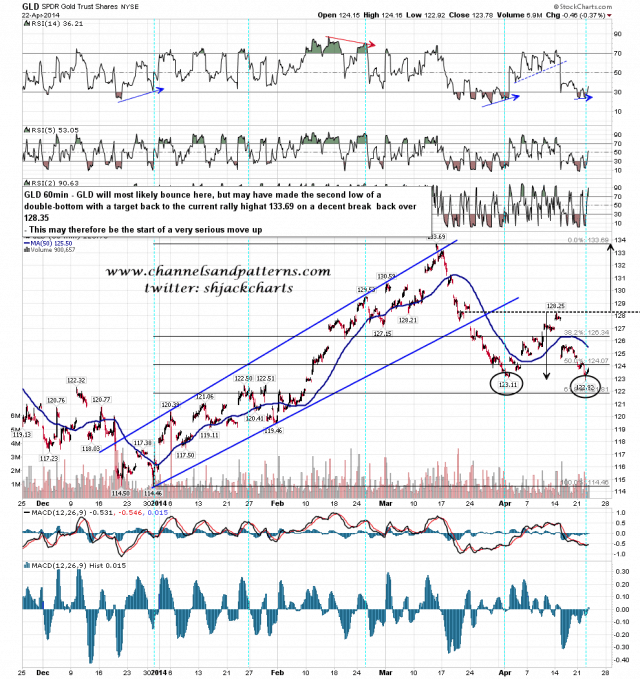

On GLD the second low of a double-bottom may have just been made, and if so then on a break over 128.25 the target would be a test of the last high at 133.69. I’m expecting that GLD and USO will both most likely bounce today but on GLD that may just be the start of a big move up. GLD 60min chart:

I’m leaning towards seeing some retracement today with the obvious target being a retest of broken SPX resistance at 1872.53. That should set up the next push up at which time we will see whether we are going to see a major reversal into the main spring/summer decline in the next few days, or SPX, NDX and TRAN all break up through resistance in a move that would most likely last several more weeks.