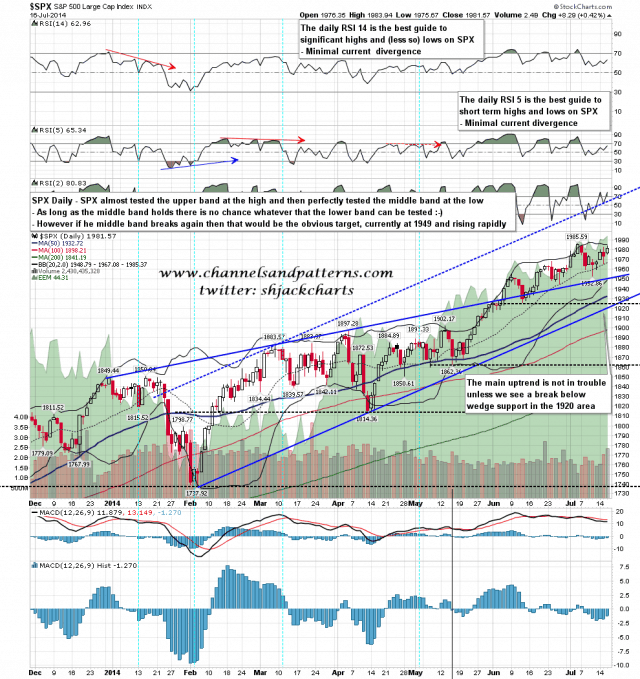

SPX just missed hitting the daily upper band yesterday and has retraced hard overnight. The daily middle band is at 1967 now and if that can be broken then the obvious target is the daily lower band, currently at 1949, with a likely hit tomorrow or Monday. SPX daily chart:

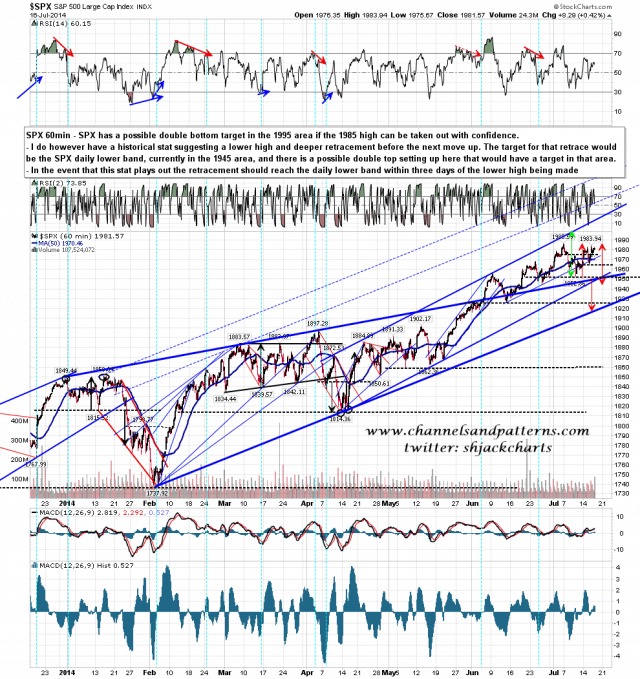

There are two double top support levels in play here, and they are at 1965 and 1952. I’m going to disregard the 1965 one as in my view it is oversized compared to the preceding trend. If this is valid at all then the target is the low on the preceding trend at 1952. The larger double top would target 1919 on a conviction break below 1952, and that is the current level of rising support from 1737, so I’m not disregarding that as a possibility. What I would say though is that my stat from last week’s candle gets us to the daily lower band and no further, so the 1952 area may well hold on this retracement. SPX 60min chart:

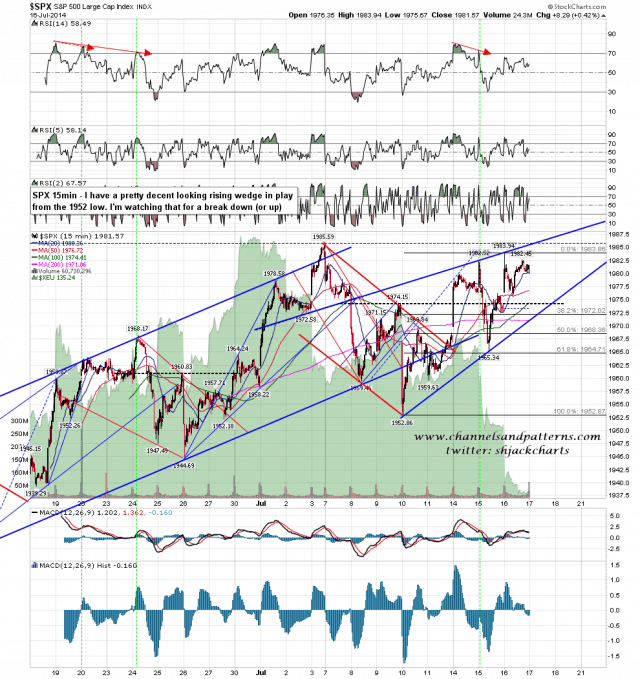

At the close yesterday there was a decent rising wedge from the 1952 low, and that we may well see SPX gap below wedge support at the open. If that breaks then the technical wedge target would be back at 1952. SPX 15min chart:

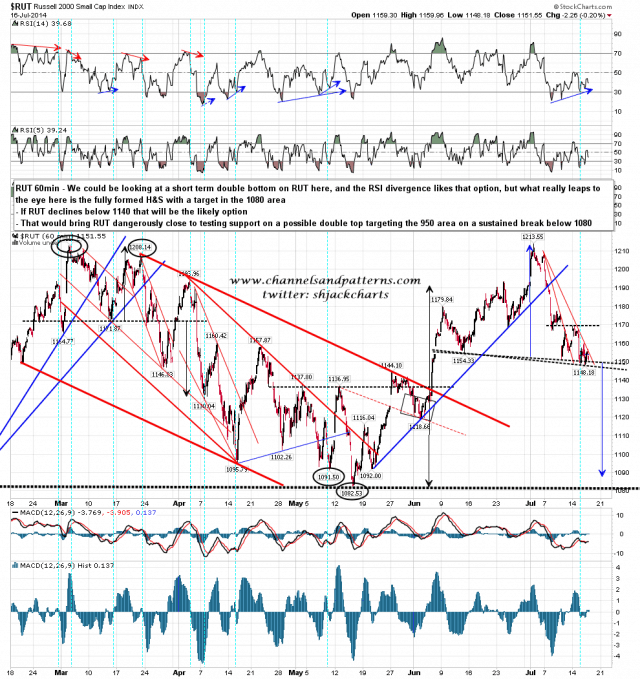

It seems likely that the H&S on RUT that I posted on twitter on Tuesday will break down with a target in the 1090 area. That won’t of itself harm the bull case here. RUT must however hold the larger double-top support area at 1080, as a sustained break down there would damage the ongoing bull case a lot. RUT 60min chart:

I’ve taken some flak this week over my looking at the rare candle stat from last Thursday and the RUT H&S. I’m not going to say ‘I told you so’ but I would say two things here. The first is that I don’t want people ever thinking that I don’t post these things because I don’t see them. Is that vain of me? Possibly but even so. The second thing is that sometimes, even in a very strong bull trend like the one we have been seeing since October 2011, these setups play out, as these seem likely to do. That makes them interesting. If you just can’t bear to read any suggestion that the market can ever retrace even a short distance, then there are message boards on Yahoo that can shade your eyes from such heresies. I am an analyst, not a cheerleader.