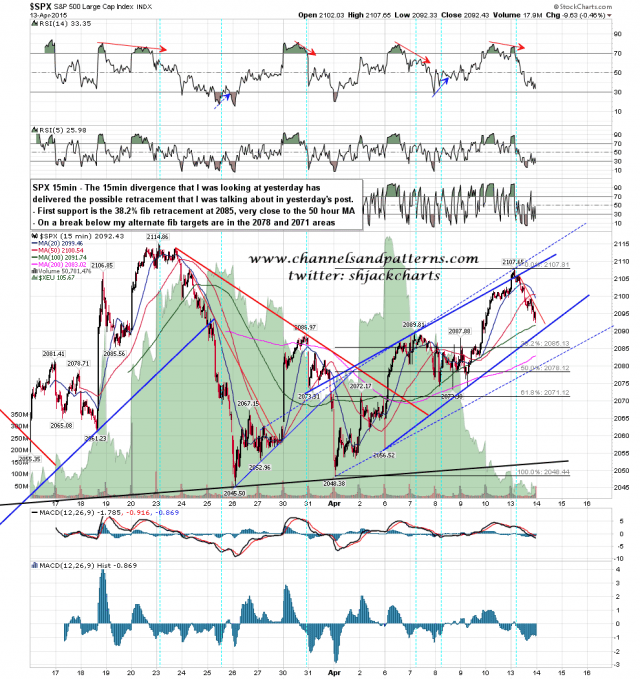

I was talking yesterday morning about the negative divergence on the SPX 15min RSI and that has delivered a retracement. If rising wedge support breaks this morning then I have strong support at the 38.2% fib in the 2085 area, as that is very close to the 50 hour MA. I have alternate fib retracement targets in the 2078 and 2071 areas. SPX 15min chart:

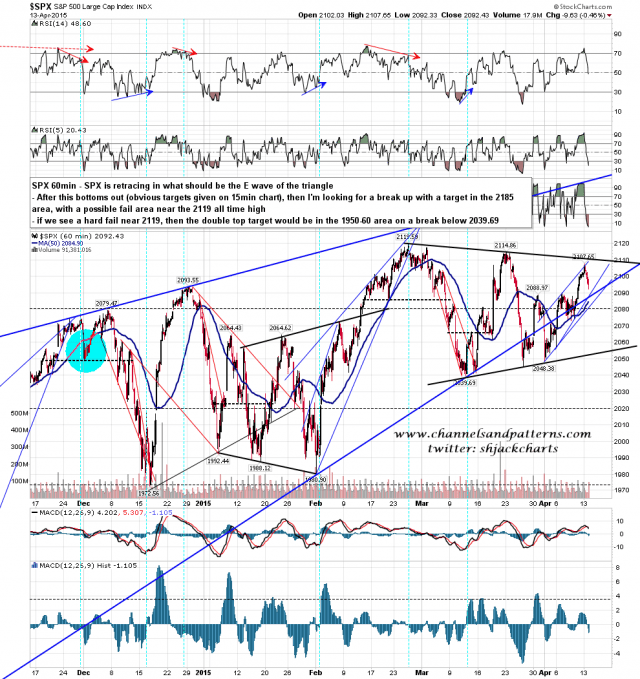

This retracement should be the final E wave within the triangle. If so then there are three main options here. My preferred option is that the triangle breaks up with a target in the 2185 area and very strong resistance there. I’d be looking for a hard fail there if seen to make the spring high and kick off a likely 15% to 25% retracement from there. The second option is that the triangle breaks up to fail hard in the 2119 high area. The third option is that this retracement reverses all of this last move up. For the last two options I’d then be expecting a break down through the 2039 low, triggering a double top target in the 1950-60 area. SPX 60min chart:

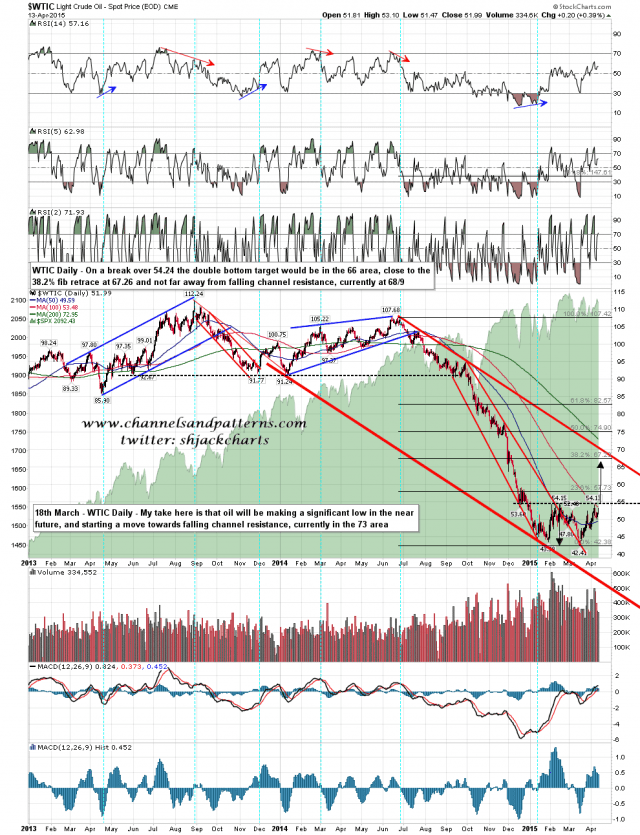

I’m watching oil with very great interest here. WTIC broke up from the wave 3 falling megaphone last month and has formed a very nice double bottom targeting the 66 area on a strong break over 54.24. As I have the 38.25 fib retrace at 67.29 and falling channel resistance in the 69 area I’m thinking that we may well see that double bottom play out in the next couple of weeks. WTIC daily chart:

SPX is at a major inflection point here, and whichever way it breaks we should see a big move very soon. I’m leaning towards the (short term) bull scenario but if we see a break below 2039 it has gone the other way and 2119 was the spring high. Either way I am expecting a very strong retracement this summer.