The Greek referendum was a clear vote against further austerity and we should see this week whether the ECB bluff that the Greeks have called is in fact a bluff. I suspect it isn’t and that a grexit is now the most likely outcome. If so then I think that’s great news for the Greeks, who can finally default and start rebuilding. It’s a rare country that still has a shrinking economy a couple of years after default. If that’s the way it goes then it would nice for that to be quick, as the constant headlines have become a serious bore.

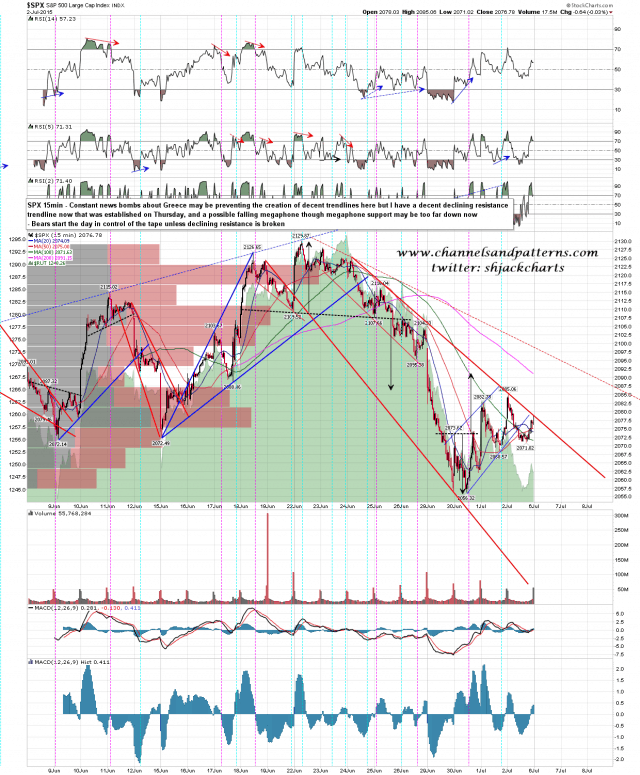

SPX hasn’t been generous with trendlines since the last high. I do now have a three touch resistance trendline established on Thursday and I’ll be watching to see whether that survives the day. As long as it survives my lean is bearish. SPX 15min chart:

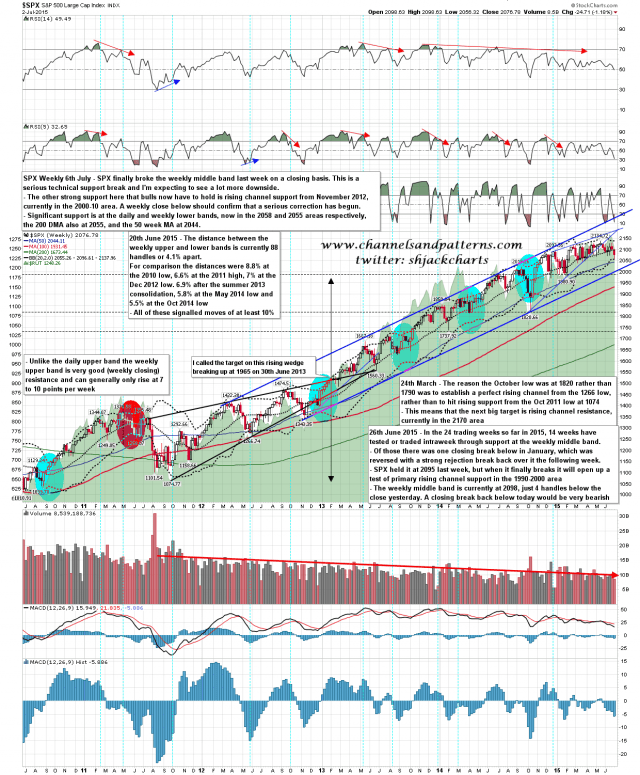

SPX broke the weekly middle band on a closing basis last week and that was a serious support break that I’m expecting to deliver a lot more downside. Confirmation that a serious correction has started also needs a break below rising channel support from the November 2012 low, and that is currently in the 2000-10 area. Important levels to watch today are the daily lower band at 2058, the weekly lower band at 2055, the 200 DMA also at 2055 and the 50 week MA at 2044. On a break below the 2039 low I would then have no serious support above channel support at 2000-10. SPX weekly chart:

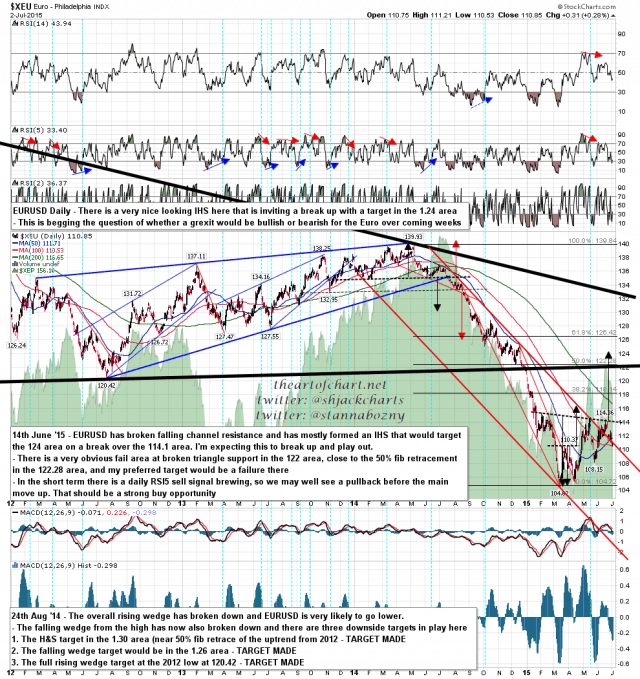

There is a very nice bull setup here on EURUSD, and it’s sufficiently nice that I’m wondering whether the reaction to a grexit on EURUSD might actually be a large rally. Watching with interest. EURUSD daily chart:

I’m leaning short but am being very cautious as this is still a headline minefield. Hopefully the Greeks can now default as they should have done years ago, and that may calm the news down. In the meantime trade safe.