Subprime City

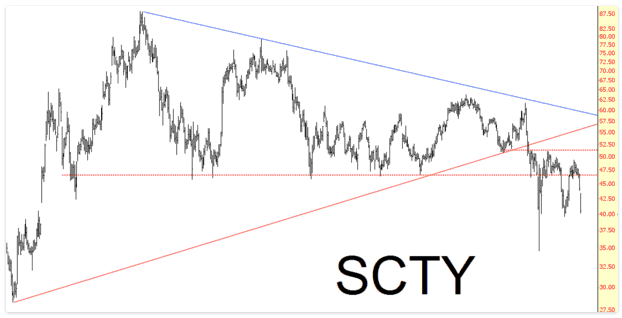

In a recent post (“If Only They Had Shares”), Tim shared this bearish chart on SolarCity (SCTY), and his lamentation about having been unable to borrow shares to short it recently.

With that post in mind, I thought I’d share a couple of items related to SCTY.

- The passage about SolarCity included in this tweet I came across on Monday includes a couple of interesting points: that Jim Chanos has compared the company to a subprime mortgage lender and that SolarCity’s head of sales is a former mortgage salesman whose mortgage company was accused of false advertising by a Washington State regulatory agency.

Solar City has an interesting head of sales pic.twitter.com/UChkCdxLWe

— modest proposal (@modestproposal1) October 19, 2015

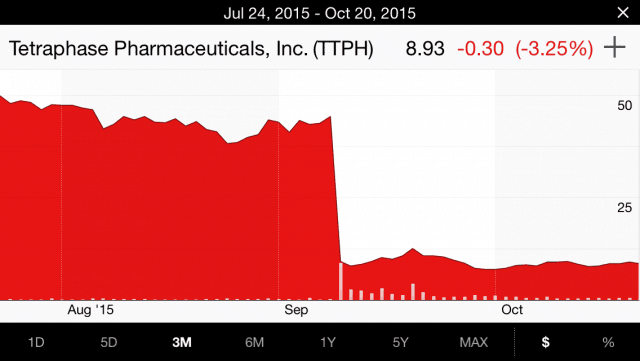

- SolarCity’s high hedging cost. In an article elsewhere recently (“Tetraphase Pharma Offers A Lesson In Risk Management”), I mentioned how high hedging costs can be a bearish indicator, as exemplified by the nosebleed hedging costs for the biotech Tetraphase (TTPH) last month, before the company reported a failed drug trial after hours and this happened:

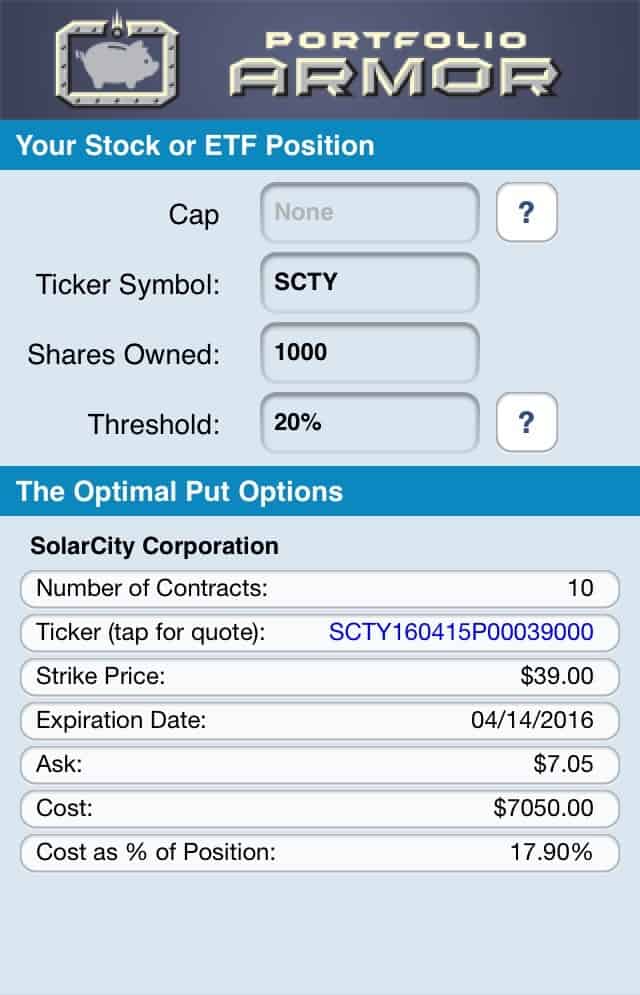

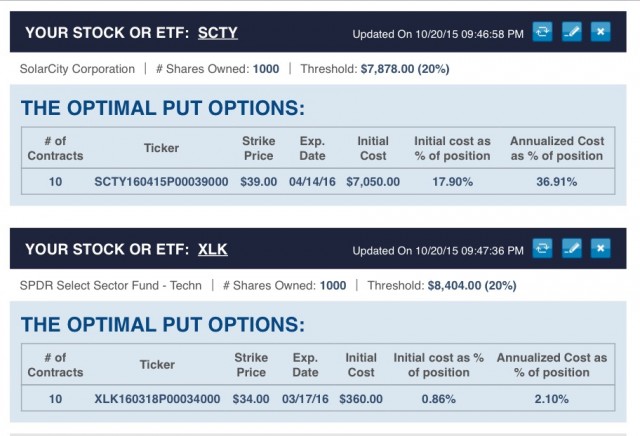

SCTY’s hedging costs now aren’t quite as high as TTPH’s were, but they’re still alarmingly high. Take a look at the cost of hedging SCTY against a greater-than-20% decline over the next several months with optimal puts as of Tuesday’s close (screen cap via the Portfolio Armor iOS app):

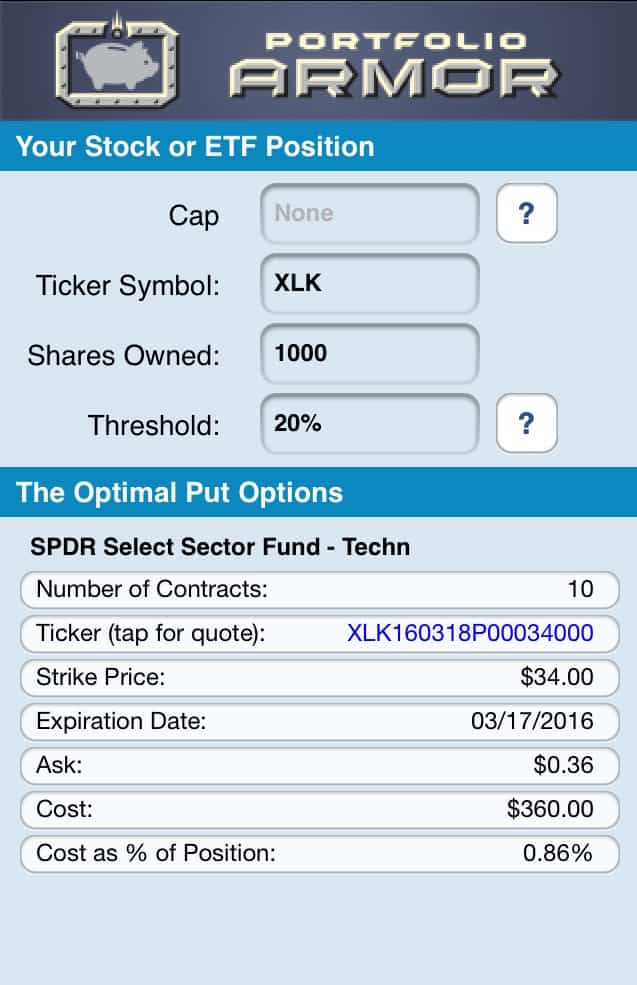

By way of comparison, this was the cost of hedging the tech sector ETF against the same decline:

Eagle-eyed Slopers may have noticed that that comparison wasn’t entirely apples-to-apples, as the XLK puts expire a month before the SCTY ones. So here’s an annualized cost comparison: