Dying To See Star Wars

One of the trending hashtags on Twitter in recent weeks was #ForceForDaniel, a campaign to get an early screening of the new Star Wars movie for a dying fan, Daniel Fleetwood. Director J.J. Abrams had the film screened for the man at his home, as The Verge noted below.

J.J. Abrams helped a dying Star Wars fan see The Force Awakens early https://t.co/mXv5d0gAVv pic.twitter.com/bSjd5tdjEc

— The Verge (@verge) November 5, 2015

It wasn’t the first time, incidentally, that Abrams accommodated a dying fan: In 2009, he gave the late Randy Pausch (of Last Lecture fame) a cameo in his Star Trek reboot.

A Boost For Disney

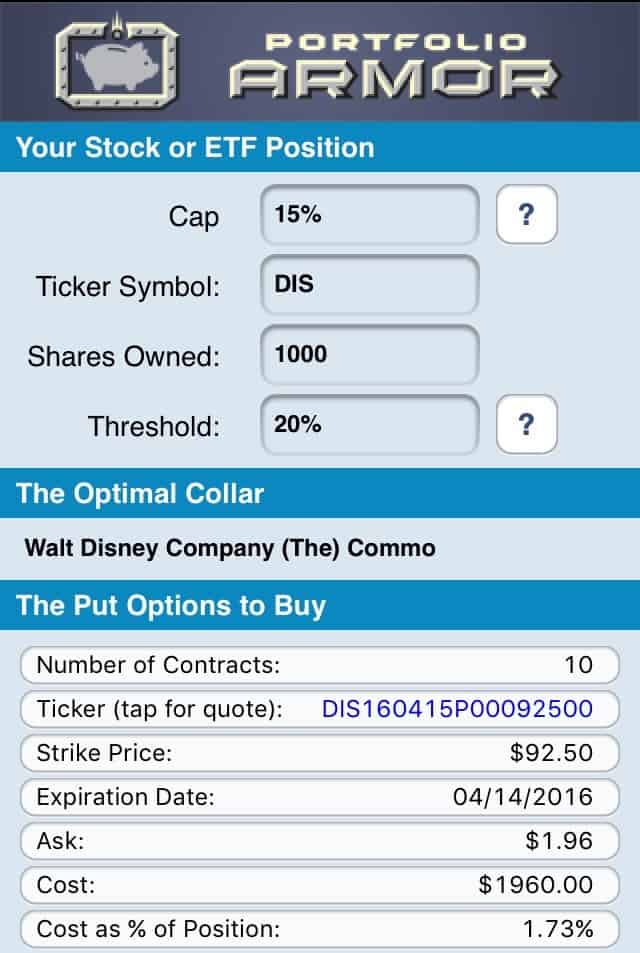

The new Star Wars movie isn’t coming out until next month, but apparently it’s already contributed to strong earnings for Disney (DIS), which bought the Star Wars franchise from George Lucas. As a result of its earnings this week, and the #ForceForDaniel thing, Disney was one of the top trending stocks on StockTwits on Thursday, so I thought I’d take a look at the cost of hedging it. Below are two ways of doing that, as of Thursday’s close (screen caps via the Portfolio Armor iOS app*).

Higher Cost. Uncapped Upside

These were the optimal puts as of Thursday’s close to hedge a thousand shares of DIS against a greater-than-20% drop over the next several months.

As you can see at the bottom of the screen capture above, the cost of this put protection was $1,960, or 1.73% of position value. To be conservative, the cost of the puts was calculated at the ask price; in practice, an investor can often buy puts for less (i.e., at some price between the bid and ask), so the actual cost of these puts would likely have been less.

Lower Cost. Upside Capped at 15%

A DIS investor could have wiped out nearly all the cost of hedging against a >20% drop over the next several months by capping his upside at 15%, with the optimal collar below.

As in the optimal put example above, the cost here was calculated conservatively, assuming the put leg was bought at the ask and the call leg was sold at the bid; since, in practice, you can often buy and sell options within the bid-ask spread, in reality, this optimal collar likely would have had a negative cost.

As we mentioned in a previous post, in some cases, hedges like the ones above can provide more protection than promised. Here is a recent example.

*In the small world department, a portion of the proceeds from each download of the iOS app goes to Apple, whose co-founder, Steve Jobs, was a director and large shareholder of Disney, which bought his Pixar animation studio — which started out as a division of Lucasfilm.