It’s a little early, I suppose, to be doing any kind of “end-of-year wrap-up” kind of post, but frankly, I don’t have anything new to say about the market, and I might as well share the one semi-pithy reflection I’ve got about 2015 at the moment.

My two errors this year actually contradict one another. My first error was not holding on to positions long enough. My other error was holding on to them for too long.

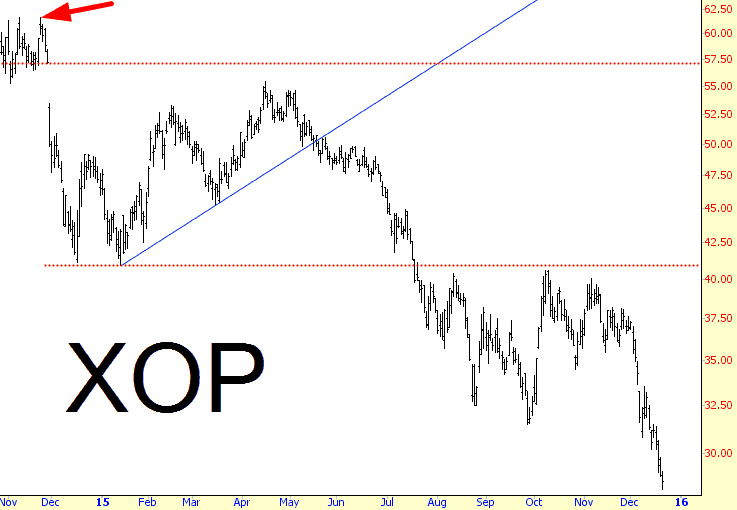

To address the first error: as some readers may recall, I made a post back in November 2014 called Shifting Sands which, even at the time I marked as a “Best of Slope” post since I considered it so important. My basic thesis was that oil producers were going to be wrecked, just like gold miners had. As I wrote, “I am inclined toward individual energy-related shorts, because I think they’re going to suffer the same gruesome fate as precious metals miners have”

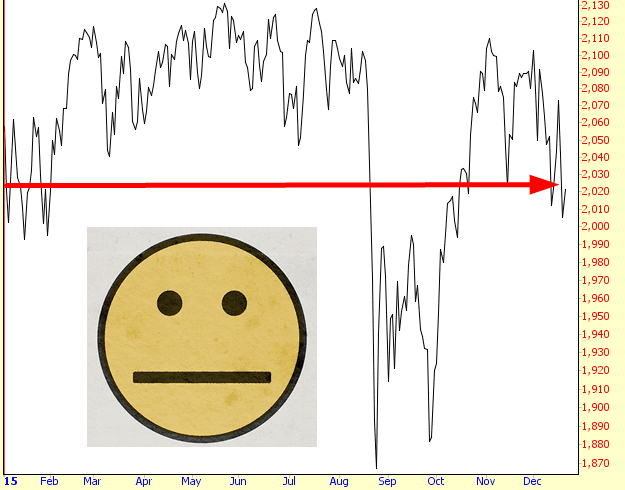

Well, the post was spot-on, and I’ve marked with an arrow the approximate date that I put forward my “energy is doomed” post:

To be clear, I’ve certainly made plenty of profits from my energy bearishness, but they have tended to be in bits and chunks, not in the overwhelming king-sized infernos of destruction that some energy stocks offered. Simply stated, going hog-wild with energy stocks at the time of my post and taking 2015 completely on vacation would have been a wise strategy (albeit reckless). So I regret not just “hanging tough” with this very broad theme (which, frankly, continues to this day to do quite well).

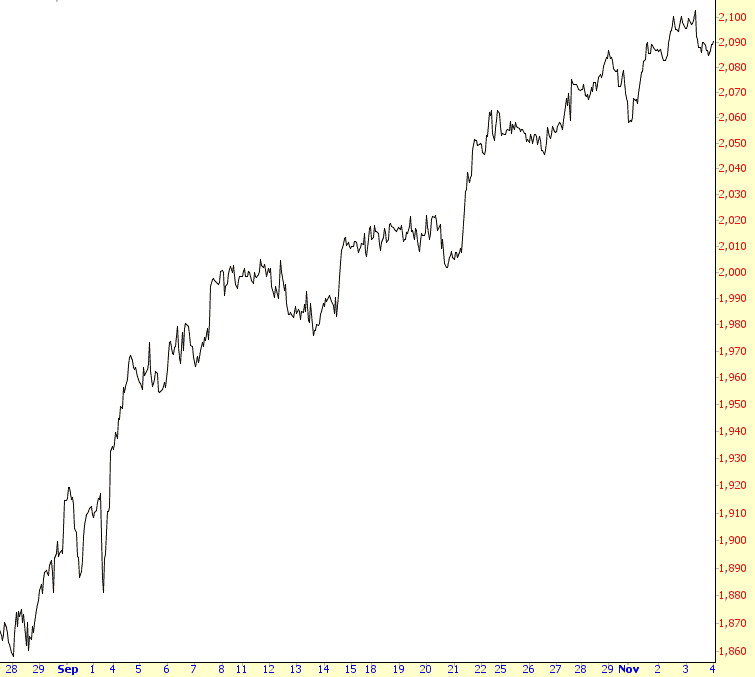

On the other hand, my willingness to “hang tough” with terrific short setups cost me dearly during some periods. October 2015 leaps immediately to mind, because it single-handedly threw a gallon of gasoline on all my VERY hard-earned profits for the year and lit a match under them. Day after day, the market charged higher, and it was almost impossible to keep my spirits intact.

Since then – again, through very hard work – I’ve been able to undo most of the damage. But it’s simply agonizing to see one’s achievement (in this case, equity profits) gunned down in a hailstorm of machine gun fire. Thus, during instances like this, I go into “Take profits whenever you have them and end every day in cash” mindset, which frankly I cannot stand. I’m a swing trader, and that isn’t swing trading.

So it’s a quandary for me. On the one hand, 2015 tells me to be more patience and stick with what I judge are good charts. On the other, 2015 tells me that profits are ephemeral, and that paranoia and meekness are the keys.

I don’t have some brilliant conclusion to this paradox (“Now that I use the 187 1/2 day moving average, my worries are over!”), and it’s something I continue to ponder. The weird thing is, I actually did go into profit-taking mode late in September and through early October, but only a get-out-of-everything stance would have really saved me. I suppose what was hard for all of us is that what is effectively an unchanged market for the year looked like this: