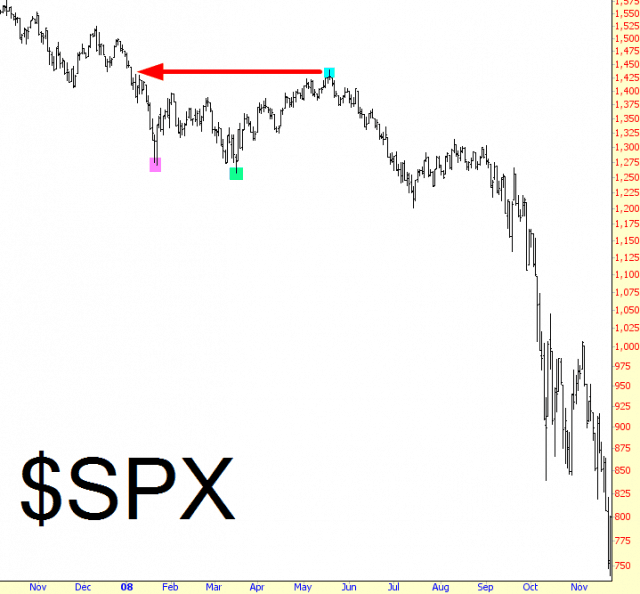

I used to be a bigger fan of analogs than I am these days, but they still intrigue me. I’ve noticed on some other sites, the notion that the start of 2016 is similar to the start of 2008 has been bandied about. Here’s the basic thrust of the argument………..

(1) The year starts off with a rapid drop that takes everyone by surprise, since they’ve enjoyed years of market strength. The stop terminates late in January (magenta tint);

(2) The market rebounds, but then it exhausts itself, falling to a slightly lower level (green tint);

(3) Then the market really roars higher, exhibiting so much strength that it undoes the entirety of its drop for the year (cyan tint);

After which time, all holy hell breaks loose.

I don’t have a strong opinion about this analog. It’s intriguing, but three data points does not an analog make. I at least wanted to share this view here. Of course, the main argument against it was that in the spring of 2008, central banks hadn’t seized a license to print however million trillions of dollars are required to artificially prop things up. They got that blessing in the following October, and they’ve adopted the mantra “Never Again” ever since.