It has been ten weeks since the market bottomed on February 11th. To me, it feels like ten years. It’s been a grueling, awful grind, but it didn’t get really beyond-belief miserable until March 17th, when Yellen went uber-dovish and patterns and trendlines started getting smashed like turkeys being thrown from helicopters.

As I sit here now, the last decent down day we had was back on April 7th, and otherwise the market is just grinding higher and higher, in many cases making highs never seen before in human history. I really thought we were done with all this; that, as I put it, “the wind was at our backs.” Well, the central banks learned their lesson in 2008, and they’re not just going to roll over and let market forces take control. No way, no how.

Thus, I’m been feeling increasingly despondent about the nature of the markets. Let’s face it, if we all know for a fact that day after day, week after week, year after year, the markets are just going to keep grinding higher, fueled by unlimited supplies of fresh debt, what do any of us have to examine or talk about? We should all just put our money into our brokerages, shut down MarketWatch, ZeroHedge……….and Slope, for that matter………and just let the profits stack up. There’s as much to say about this market as there is about the weather in Antarctica. It’s predictable, it’s boring, and it’s not worth analyzing.

A couple of days ago, I was shuffling around in my attic, going through some old boxes and such, trying to get things organized. Whenever I am excessively frustrated or bored with the market, I reach a point where I’d rather do anything else than look at charts, so even tidying up an attic space beats looking at the markets.

There was one old box I found labeled “Old Files”, and I started thumbing through them. There were all kinds of things in there, including invoices from back in 1982 for things like floppy discs (remember those?) and serial cables. I’m a sentimental soul, so I love looking at old junk like that, and then I was surprised when I pulled out a long letter I had written to myself.

The letter was from almost exactly sixteen years ago, and here it was in my hands. I didn’t remember writing it, but it was written about a long attempt on my part to try to make money shorting the market in 1999 and into early 2000. Quite obviously, this was a fool’s game, and I had reached such a horrible point of despair that I decided to give up trading forever. I tried to salve my emotional wounds in the letter by reminding myself that a couple of very large long positions made up for the countless losses in shorting the market, but it was clear my spirit was broken.

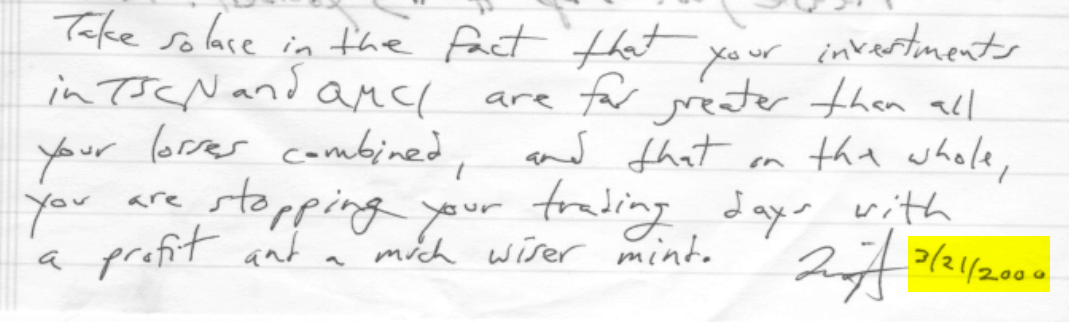

The letter went on, page after page, castigating myself for being so stupid as missing out amazing new companies like go2net (don’t bother looking; they are long extinct). I listed the many good reasons to stop trading forever, and I decided it was time to basically shutter the account, turn off the charts, and just focus on Prophet, my little business. Here’s the last little bit of my long letter, and I’d like you to note the date, which I put next to my signature, since I was making a contract with myself.

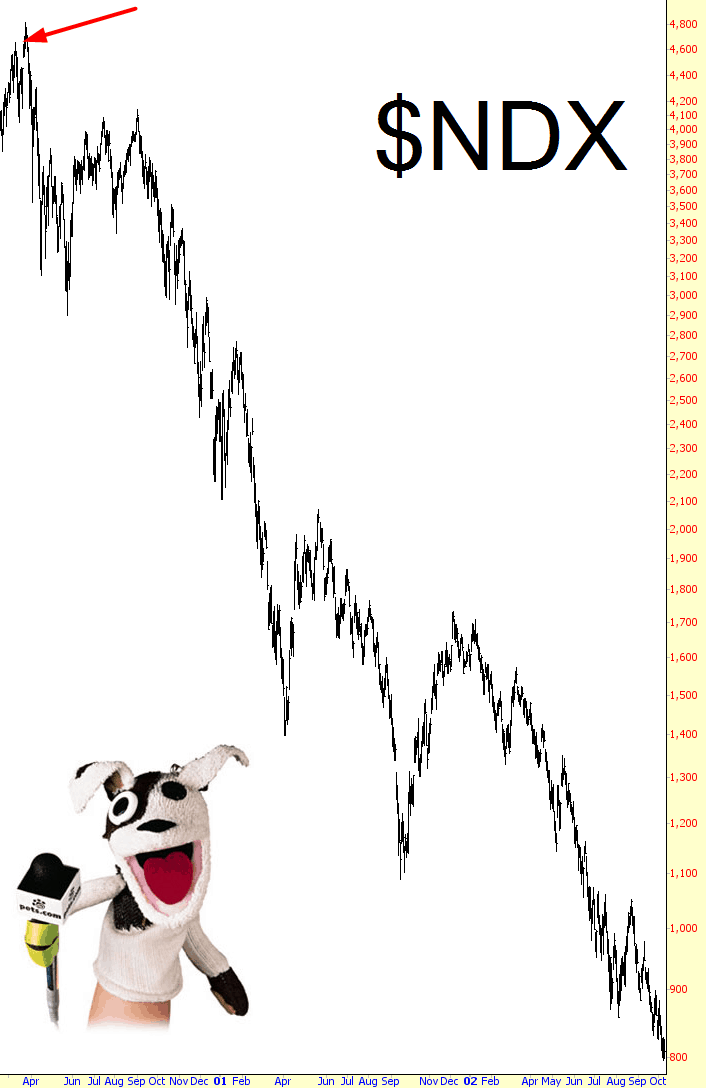

My writing is pretty terrible, but the date is 3/21/2000. Perhaps that date rings a bell. It should, if you follow the markets closely, because when I finally gave up – – – when my spirit was finally, utterly broken, and I decided to abandon my dreams of being a stock market trader – – – the market would, within about 16 more regular-session trading hours, make a top in the NASDAQ 100 which it hasn’t beaten even to this day. The precise peak was on March 24, so for a couple of days, I got to pat myself on the back for finally getting out of the never-ending ascent. And then this happened:

By no means am I saying that my despair means the top is in. My confidence in myself looks like the UVXY graph right now, so I’m not willing to predict that the sun will rise in the eastern horizon tomorrow.

I did find it remarkable, however, that of all times, I suddenly found myself holding a 16 year old piece of paper that was so utterly germane to how I was feeling. Maybe it’s telling me that I simply never learn. Or maybe it’s reminding me that, as I say on my Trading Rules page, “fear often accompanies reversals in your favor and hubris often accompanies reversals against your positions”. I wouldn’t describe my feeling as “fear” right now; it’s much worse than that. But if you are feeling anything like I am feeling, I’d like you to keep the little anecdote from a much younger Tim in mind.