Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Swing Trade MA, WYNN, MGM, CVX, JOY

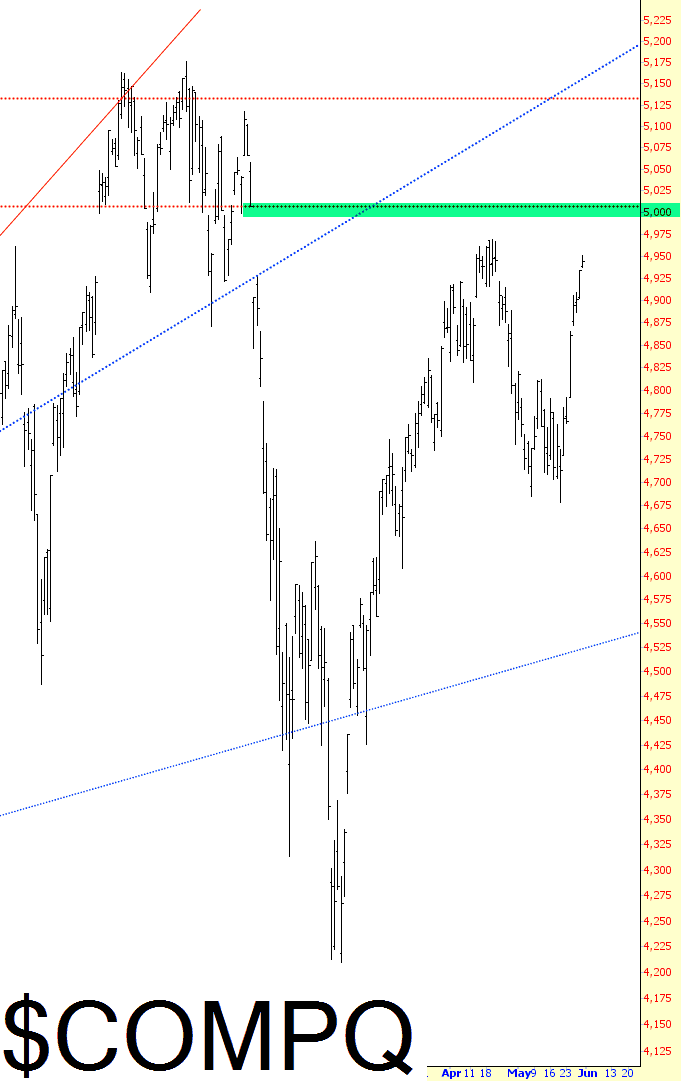

NASDAQ Nears Yearly Gap Closure

Last Post for May

Today is the last trading day of May and unless we see a really serious decline today, the monthly candles for May on NDX and SPX are going to confirm breaks above the monthly middle bands, which at the least isn’t going to do any harm to the bull case.

Shorter term SPX is still within a rising channel and is close to a test of the April high at 2111. Given that the retracement from that high was in effect a bull flag channel, that retest is the first target for that flag, and may be the second high of a double top, if SPX retraces enough after the test to break the rising channel.

AMAT Chirps, b2b Ramps, Yellen Hawks and Gold’s Fundamentals Erode

Following is the opening segment from the May 29 edition of Notes From the Rabbit Hole, NFTRH 397:

If we are going to highlight improving fundamentals, which we did as gold out performed commodities and stock markets, then we also have to highlight and respect eroding fundamentals; no ifs, ands or buts.

The plain and simple fact is that the Semiconductor Equipment sector is firming, with the April Book-to-Bill (b2b) joining Applied Materials’ quarterly report noted in NFTRH 396’s opening segment as another bullish [economic] indicator. Semi Equipment was a leader to the general Semi sector in early 2013, which in turn led the economy and job creation. Our fundamental gold view improved in January 2016 as gold launched upward vs. global stock markets, joining its positive status vs. commodities.