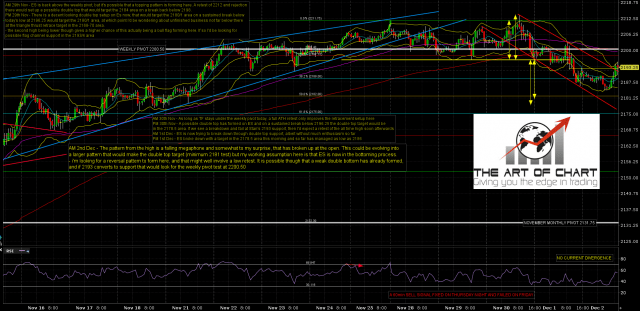

The alternate asymmetric double top targets on ES were at 2178.5 or 2181, and the current low at 2184 is a fairly close miss of both. The pattern setup here though is suggesting that the retracement low is probably already in. Hopefully some of you saw me mention that on twitter just after the open.

The pattern on ES was a very nice falling megaphone that broke up on the opening spike. This is the kind of setup that strongly suggests that the low is in barring a possible retest to set up a bottoming pattern of some kind. Is it possible that the megaphone is evolving into a larger pattern? Yes, but historically it would be a bad idea to hold your breath waiting for another leg down that wasn’t just into a low retest or marginal new low. ES Dec 60min chart:

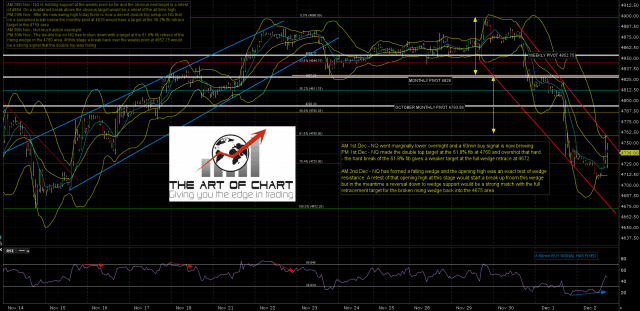

NQ made the double top target there and overshot it by some distance yesterday, so there was no strong reason to go lower. The opening spike though was a perfect test of falling wedge resistance which was encouraging for bears until that broke as well at about 11.40. Both ES and NQ likely in bottoming action here and while that might include a retest of the lows, that’s a maybe, and will look like a long entry if seen. NQ Dec 60min chart:

TF almost made the H&S target yesterday, with the low just one handle above. Only ES has failed to make target here, and that’s not hugely surprising given the very bullish tape recently, and December not being bear-friendly historically. I’m looking for reversal patterns here and am moving ES making the target area to being a lower probability option at this point.

Just a reminder that Stan and I are doing our monthly public Chart Chat at theartofchart.net on Sunday, that’s free to all and we’ll be running through the usual 35-40 tickers across equity indices domestic and international, forex, bonds, precious metals, commodities etc. It will be the usual awesome display of skill and hard work, and if you’d like to attend you can register for that on this page here. If you’re interested then on the same page you can also find and register for the webinars that we are doing in mid-December with our longer range forecasts for next year.