Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

10-Year Yield Transitioning Out of Multi-Year Bear Market

My intermediate and longer term technical set-up work on 10-year US Treasury yield argues that benchmark yield is in transition from a 35-year bear Market (dominant downtrend) into a multi-year bull market (dominant uptrend).

From 1981, when 10-year yield peaked at 15.84% amid concerns about rampant, uncontainable inflation and stagnant growth (“stagflation”) precipitated initially by the 1973 OPEC oil embargo, benchmark yield steadily and relentlessly declined to a post-financial-crisis 2016 low at 1.32% (see Charts 1 and 2).

From a technical perspective, I can make the case that all of the action in yield from mid-2011 into early 2017—a 5-1/2 year period– represents a major base formation at the conclusion of a generational yield bear market (see shaded area on Chart 1). That said, to confirm the end of the 5-1/2 year transition from bear to bull market, yield must climb and sustain above significant resistance lodged between 2.75% and 3.30%. Yield currently is circling 2.50%.

Fitbit’s Post-IPO Performance

New Digital Digs

The Google problem I was trying to resolve on Friday was trying to renew my primary domain at www.channelsandpatterns.com. That attempt was unsuccessful and the domain expired on Saturday. The domain now spends a few days in digital limbo where I can still renew it if Google astonish me by sorting out the problem successfully. In the meantime I have moved the blog to www.channelsandpatterns.net which, needless to say, isn’t registered with Google. More out of optimism than any kind of faith I am giving Google this week to get their act together before moving my Disqus comments over to the new domain, so for this week comments will need to be on my twitter.

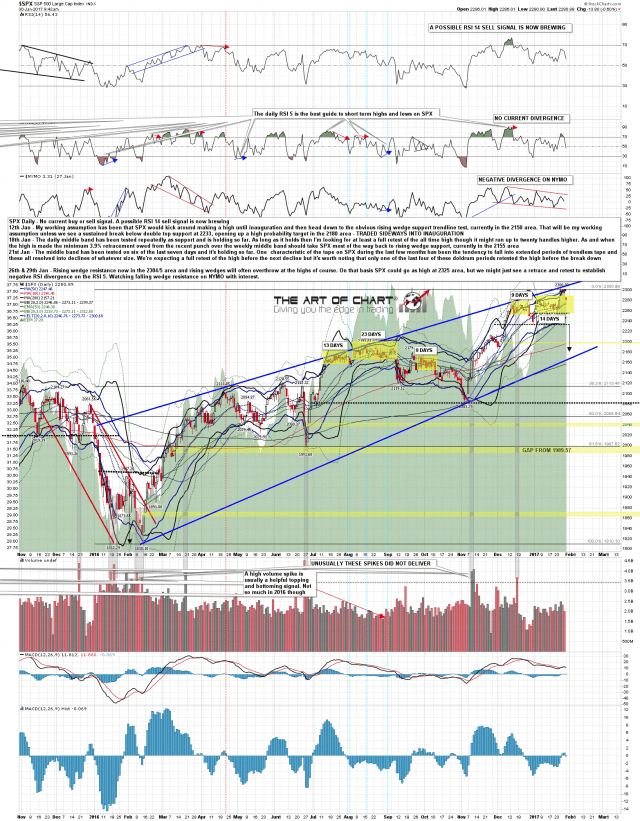

ES broke down from the bull flag channel at the open last night which opened up the downside today, and the obvious support not far below at the time of writing is the backtest of the daily middle band at 2272 (approx 2267/8 on ES). SPX daily chart: