Anyone else feeling the summer doldrums? I am. It can vary from day to day. Yesterday, for instance, seemed like kind of a kick. Today was three letters: M, E, and H. Oh, well. There’s just not much going on. Earnings season hasn’t started, and the political scene just has boring nonsense like this Trump/Russia thing, whose bombshell news today rocked the market for about seven minutes.

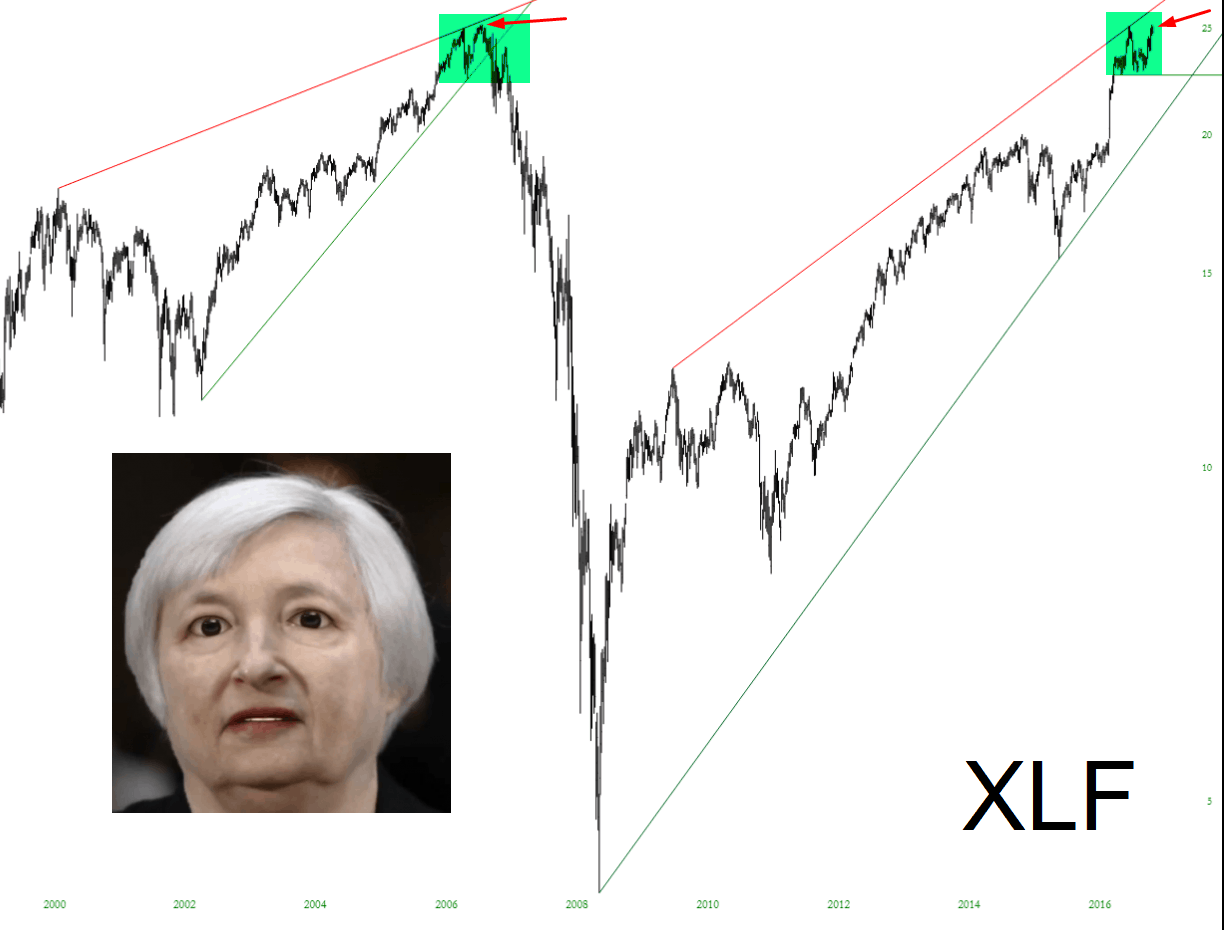

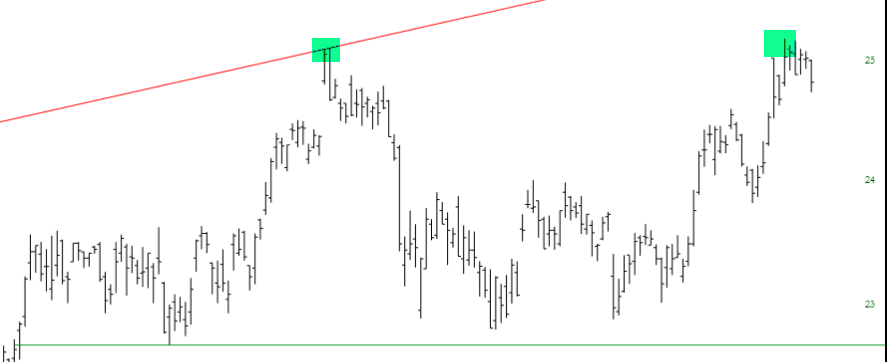

In spite of all the ho-hum, I’d like to offer up one chart that kind of grabbed me: the financials ETF. As you can see below, there’s quite a compelling analog happening (click the chart to see a bigger, easier-to-read version). Hopefully the simple colored lines and arrows on this SlopeChart speak for themselves………

Looking closer, you can see how the latest peak – – a lifetime high, I believe – – has been gently turned away. I went ahead and shorted this beast today, in spite of Yellen’s two-day testimony (speaking of beasts……..) commencing on Wednesday.

I still find the lack of any trend lasting more than a few days to be exasperating. My ETF-Only portfolio was at a lifetime high a couple of days back, but it has eased off a bit. I’d rather be able to mark a few notches on my belt several days in a row, but instead it’s an endless series of backing and filling. For what it’s worth, my three positions in that portfolio remain QID, ERY, and TZA, none of which I have screamingly huge amounts of faith in blossoming.