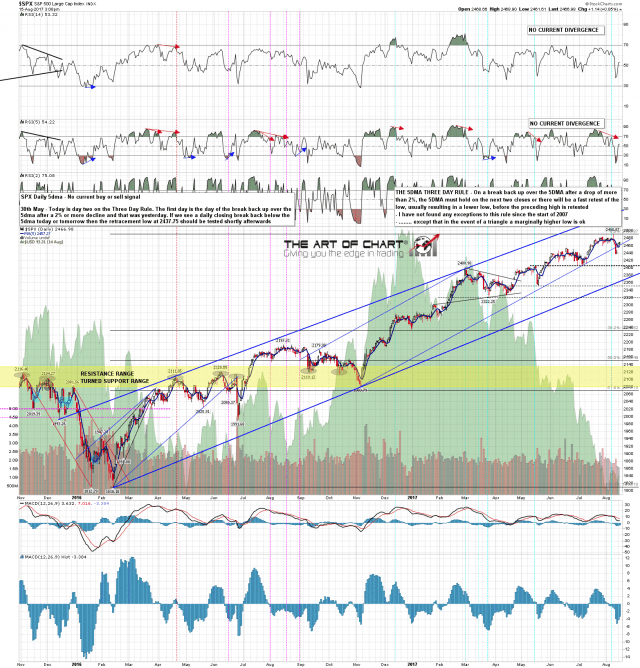

The decline into last week’s low was slightly over 2%, so the break back over the 5dma, now at 2457/8, has put SPX back on the Three Day Rule. In the event of a daily close more than two handles below the 5dma today or tomorrow, then historically there would be a retest in the near future of last week’s low at 2437. This is the highest probability historical stat that I watch. SPX daily 5dma chart:

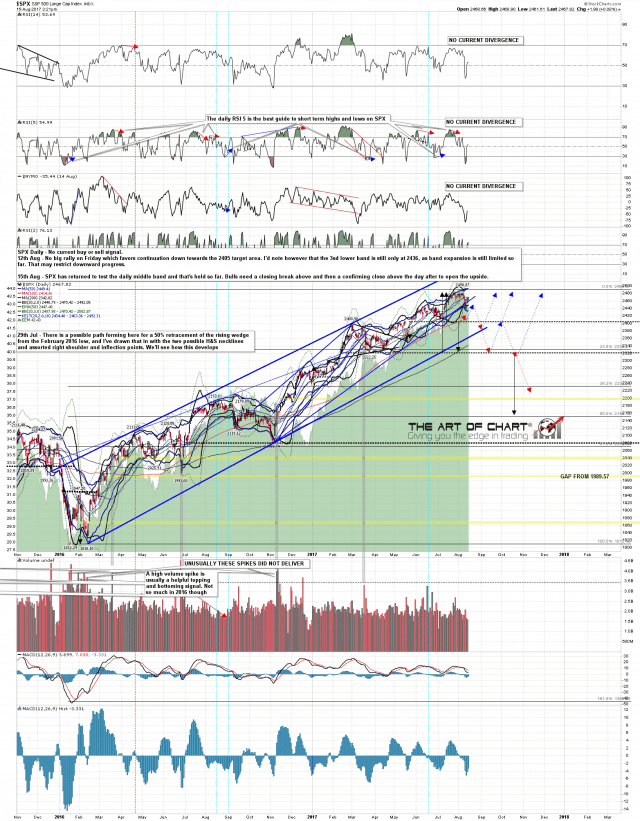

So far the rally high is at the test of the daily middle band. That’s not bullish …… yet. On a confirmed break above the retest of the all time high opens and Stan would have an extension up to 2502 as the likely target. Obviously the daily middle band is a classic target area for a rally within a downtrend though, so a failure to break back above leans very bearish. SPX daily chart:

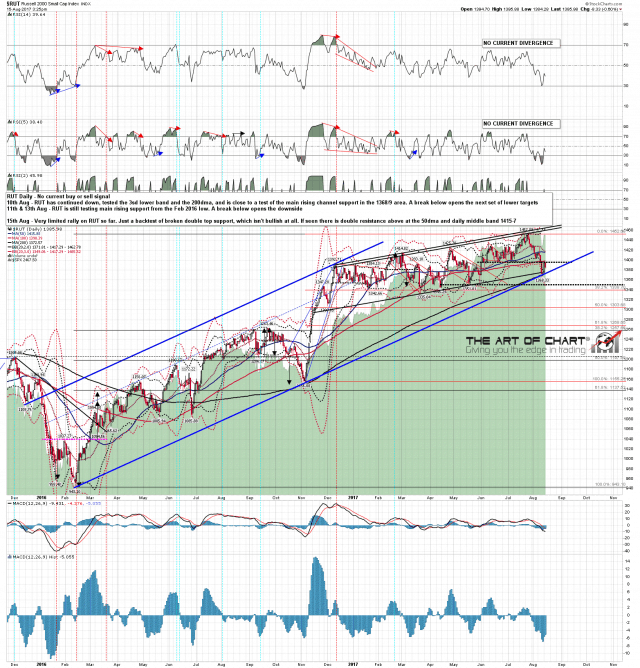

RUT hasn’t even managed a backtest of the daily middle band, managing only a backtest of broken double top support. Again a classic rally target and fail there if RUT can’t manage more. RUT daily chart:

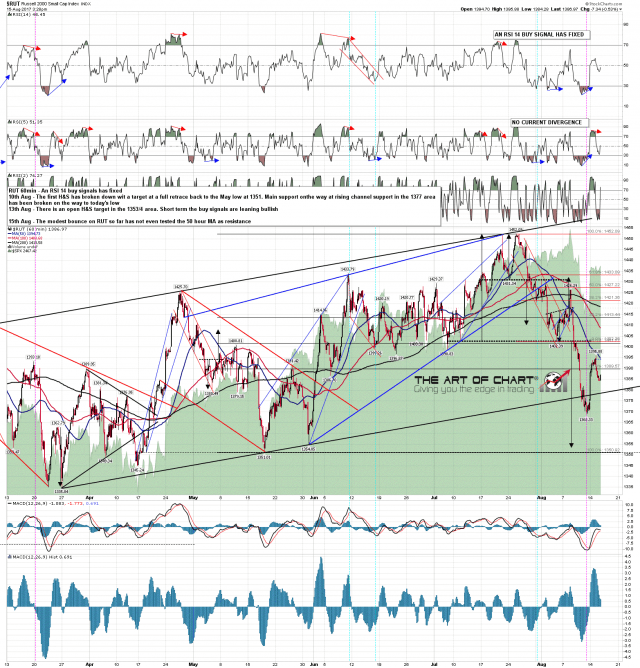

The one ray of light for bulls here really is the hourly RSI 14 buy signal that fixed on Friday on RUT. It’s not definitive, but it is suggesting more upside on RUT. If so there is strong double resistance at the 50dma and daily middle band at 1415-7. RUT 60min chart:

Overall this setup still favors the bears, but until we see that closing break back below the 5dma the bulls still have a decent shot. We’ll see.