Another U.S. government shutdown looms this week on February 9th.

Another U.S. government shutdown looms this week on February 9th.

Will it…won’t it? That’s the $64,000 question as more volatility is in store for markets.

Given the fact that there are great political divides over a variety of policies, increased volatility in the markets, and, now, the information that’s being revealed that may determine whether or not civil and/or constitutional rights were violated in the months leading up to and after the 2016 presidential election (and any political and/or legal fallout that may occur), will only add to the increased odds of chaos ahead, making future events less predictable.

Layer on top of that, the unlikely chances of any additional fiscal stimulus economic benefits that would be generated by programs such as infrastucture spending, over and above that which will trickle out into the economy from last year’s Tax Cuts & Jobs Act, to offset a resulting increase in inflation and interest rates.

Furthermore, if we see a collapse in the US $, these odds will increase dramatically, so keep an eye on it, as I’ve mentioned recently here.

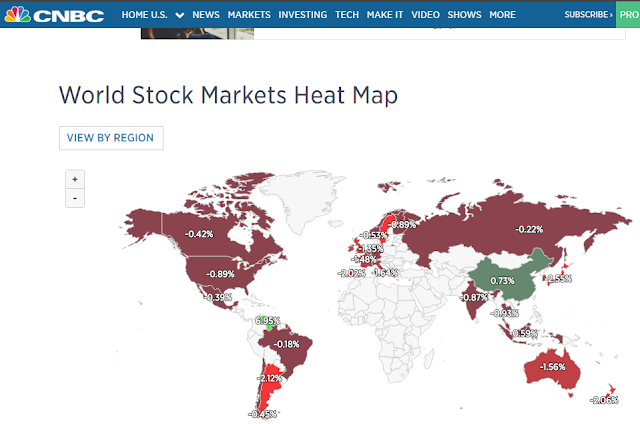

As well, further world market weakness, that we’ve seen of late, is noted on the daily chart of the World Market Index below (as of Friday’s close). A new “SELL” signal has also been generated by the RSI, MACD and PMO technical indicators. Major support sits at 2000.

The following heat map shows how world markets are trading as of 12:20 pm ET today (Monday).

There’s no doubt that a lot more uncertainty lies ahead…so, buckle up!