My wife has been watching what I've jokingly been calling the riot channel here in the UK, where a riot after an unarmed civilian was shot by police in London has spread to a number of other areas in London, and also to other UK cities. It has been an education so see how helpless the police have been to curb the riots, or to protect property from the wholesale looting and arson that seems to be the prime motivation for the rioters.

As the UK is one of those 'civilized' countries that has ferocious gun controls preventing law-abiding citizens from defending themselves and their property, the rioters have been untroubled by anyone other than the police, and not much troubled it seems by the police. The riots seems to be spreading mainly because potential rioters have realized that they can take control of the streets easily, and without much fear of consequence. Worrying to see this happening before the austerity that is coming everywhere over the next few years really starts to bite

SPX closed down 80 odd points yesterday and ES then fell as low as 1077 overnight. That settled one question at least, which was the question whether this might just be a flash in the pan panic. It seems not, and I'm expecting that SPX will at least now go to test 1000 or to support at 870 before we see a major low. I've marked in the key support / resistance levels on the SPX daily chart:

Short term however, the setup here looks more promising for a bounce than anything that we have seen since the failed attempt to recover 1300 at the beginning of last week. ES has bounced strongly from the overnight lows with positive divergence on the hourly RSI:

Copper also looks very promising for a bounce on the hourly chart:

I've been posting the NYMO chart in recent days showing it as increasingly oversold. I was amazed yesterday to see it reach a level that is the lowest on my chart, with data going back to 1998. NYMO is therefore more oversold now than it was at any point in the post-tech bubble meltdown or the 2008/9 crash. Amazing:

Interesting things have been happening in the forex markets too, though you'd never know looking at EURUSD or GBPUSD. EURUSD is still bouncing around the 1.427 level:

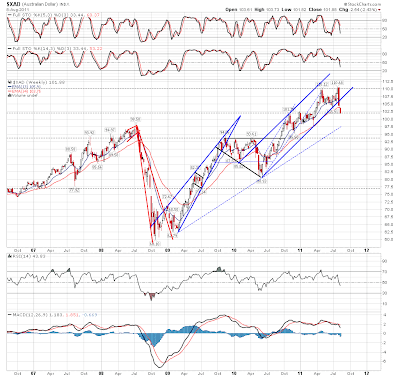

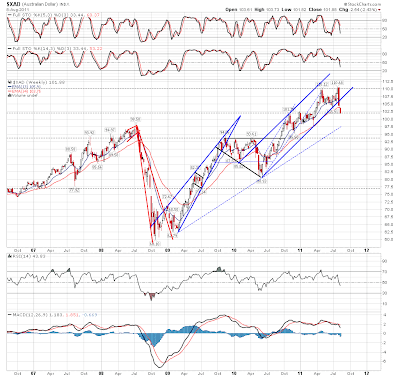

While EURUSD hasn't moved much, the commodity currencies have been falling hard. AUDUSD broke the important 1.04 support level yesterday and traded below parity overnight. A retest of 1.04 looks very possible today or tomorrow, but more downside after that looks likely:

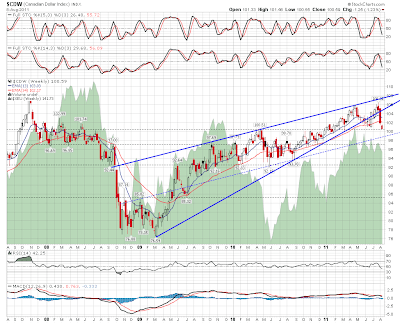

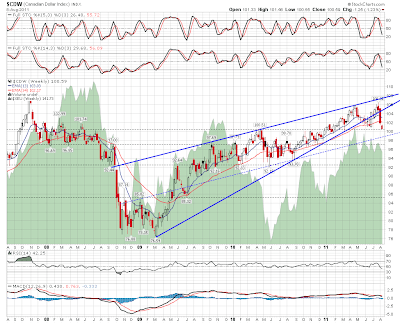

CADUSD has fallen less hard but is also now approaching parity again. As with AUDUSD the longer term charts suggest more downside after any bounce we see here:

I think we're approaching a bounce here and it should be a decent one. If we do see that bounce, it will be a bounce to sell and I'm hoping to see a decent trendline or pattern develop during the retracement to show when best to short again. I'd be surprised to see another move down like yesterday's, but if we do see that then this move down will start to be described as a crash, and correctly so. If we see more downside today then I'd be looking for support on SPX at 1100, 1085, 1040 and 1010.