As a bear in a world stuffed to the gills with bulls, I have been the target of plenty of derision in the seven years I've been doing this blog. I thought it was high time to reveal the various levels of sophistication that go into debating a person with a different viewpoint. I will note that calling someone an "ass hat" – – which is a term-of-art over at IBC when it comes to describing me – is the most base of these choices.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

European Money Supply and Private Loans Dip

Another time-out from my mini-holiday to slip this in:

Data released pre-market today showed a drop in European Money Supply, as shown on the graph below (courtesy of www.forexfactory.com). As can be seen, the total quantity of domestic currency in circulation and deposited in banks is still well below the levels seen from 2000 to 2009…not a healthy sign that would point to additional spending and investment in Europe.

Additionally, data released pre-market today showed a drop in Private Loans to consumers and businesses, as shown on the graph below. As well, the level of loans taken out are well below the levels seen from 2003 to 2009…which indicates that consumers and businesses are not confident in their future financial position, nor do they feel comfortable spending money.

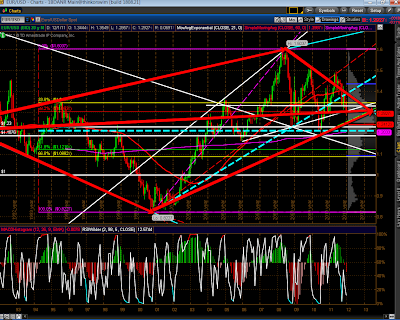

Below is a Monthly chart of EUR/USD. At the moment, price has dipped below the 1.30 level and is hovering below trendline support. It has had difficulty moving above the 1.50 level since 2009 and has been, basically, range-bound from around 1.90/20 to 1.50. There is confluence support around 1.24…a break of that level could send price down to 1.20…a break of that level with confidence could see price drop to a confluence support level around 1.09/10.

This big picture view of the Euro tells me that it is weak and has not been able to sustain its rallies above 1.20 since October 2008. I wouldn't be surprised to see it retest that level sometime in the new year, with a possible dip, or significant drop, below. Also, the economic releases out of Europe lately (which I've posted) all point to a shrinking economy…there's no reason the currency shouldn't also follow suit.

Back to my holiday…

http://strawberryblondesmarketsummary.blogspot.com/

Euro Analog Has Been Incredibly Spot-On

My Bearishness on PMs was Well-Founded

EURUSD Still Important (by Springheel Jack)

There have been quite a few people saying that as EURUSD has kept falling since late November while equities have rallied, then that means that these have decoupled and the relationship is no longer important. As we saw yesterday that simply isn't the case. While it is true that the multi-week trends on them have decoupled for the moment, as is often the case, on the daily timescales a big move down or up on EURUSD will still generally be shadowed by a move on equities.

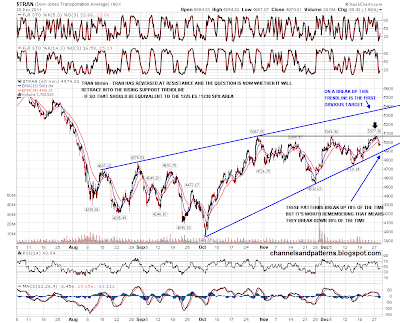

Short term I'm still using TRAN as my leading index for equities, and the obvious next move there within the ascending triangle is to rising triangle support in the 4900 area. That should roughly equate to a move to the 1225/30 area on ES, and that's where I'm expecting this move to finish as ascending triangles break up 70% of the time: