We saw some big moves last week on the basis of talk by Draghi, backed up by Merkel, that the ECB would take whatever action necessary to save the Euro. Talk is cheap though and Merkel hasn't yet confirmed that she will accept the ECB printing money to save sovereign EU nations in trouble. I suspect she won't, and unless she does this move doesn't look likely to last long. Be that as it may some interesting things happened from a technical perspective last week so we'll go through those.

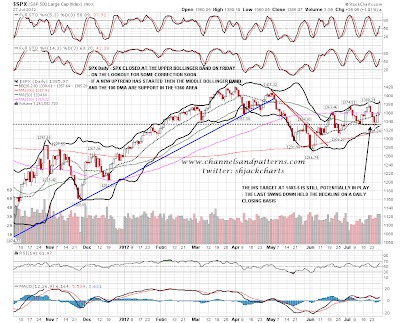

On the SPX daily chart the SPX closed at the upper bollinger band on Friday. This is an obvious time to look for some retracement though I note the overnight action on ES looks like a bull flag so far. If a new uptrend has started then there should now be strong support in the middle bollinger band and 100 DMA area around 1360: