Happy Post-Thanksgiving Slope!

I will keep today's post brief, but as I believe this chart is important… Here we go.

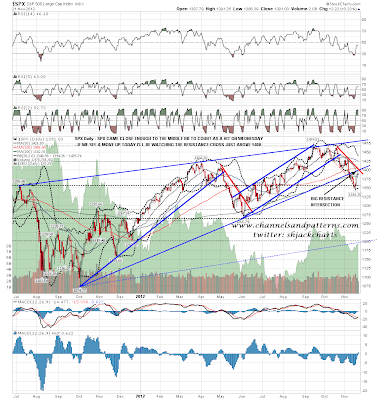

As I described in my last post, the wedge that has developed on SPX over the past 2 years has broken, and is now backtesting the wedge breakdown. I continue to believe that the wedge breakdown was very significant, and is ushering in a large bearish move in the weeks/months to come. You will notice in the chart above that the MACD trendline break is also being backtested, as well as approaching the zero line. Daily stochs are also approaching overbought territory. A reversal here is likely, and could lead to the large bearish move that I have been stalking. Have a great weekend Slope!