Yesterday was a good start for the retracement that I’m expecting to see here, with a daily bearish engulfing candlestick on SPY. I am concerned though that there was no daily RSI 5 negative divergence at the high, and am wondering whether the high will need to be retested. Either way the engulfing candlestick, while a strong reversal signal, needs to be confirmed with more downside in the very near future. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Now It’s Dark

I’ll throw charts at you tomorrow. For now, pour a glass of cabernet, kick back, and watch one of the greatest movies ever made. It’s a strange world.

The Start of Something Bigger?

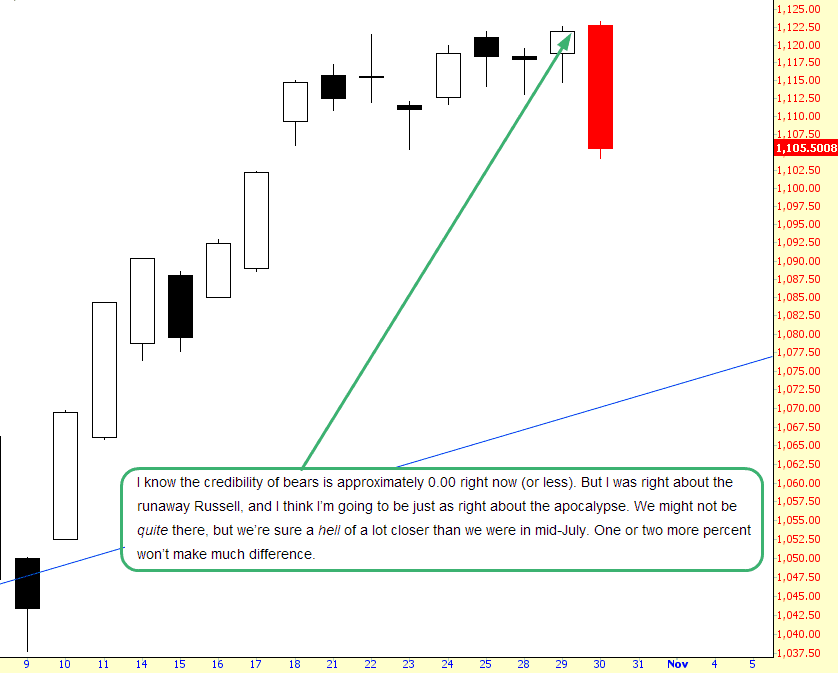

My post last night was riskier than normal, because daring to say anything bearish in front of Mr. Bernanke and Mr. Yellen is typically foolhardy. But I’d say we’re off to a decent start.

As busy as I am, I normally get to read maybe 5% of the comments, but moments ago, I happened to notice the following was the highest-rated comment from last night:

I’ve lurked about this bearish site for a couple of years but I mostly trade long because, after all, the trend really is your friend. I am not a complete dope and I understand that there will a change for the worse one day, possibly much worse. There could be much pain for many people, not just for long stock market investors, but for many innocents in the forms of unemployment, hunger, war etc. What I can never understand here is why such pain would “put a twinkle” in anyone’s eye?

Long-time readers know that as malicious as my quote might have sounded, my sentiment emanates from a heartfelt desire to see an honest and rational market, not some wrong-headed lust for the masses to suffer. (As for Blankfein, Dimon, Yellen, and Bernanke – – – bring the suffering on; show them no mercy). But the twinkle in my eye has far more to do with sensible markets than the beleaguered public. I only wish the aforementioned public would turn off their televisions, grab a straight-edge, and show Blankfein how well it works.

At the moment, I’m a bit blogged-out, but maybe I’ll catch a second wind later (or maybe you won’t see a new post until Springheel Jack in the morning). Today was a good day, to be sure, and I can only express my delight and relief that FOMC is done with. We shall resume the attack on the ‘morrow.

Pity the FB Call Owners

Can you imagine having bet a ton of money on Facebook calls before the close today? In a very short span of time….. (more…)