Short Las Vegas Sands (LVS)

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

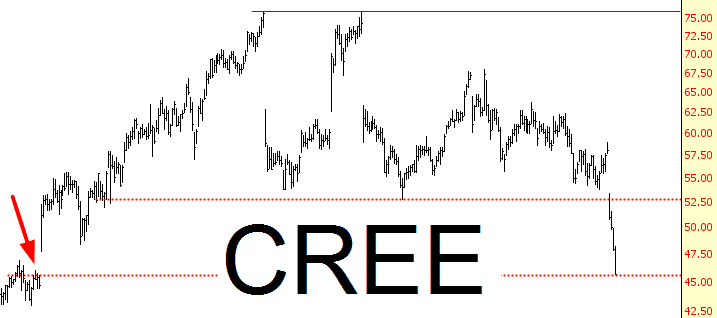

I have only two small screens today, not my usual eight large screens, but even in these primitive conditions, I am loving what I am seeing. Blood, chaos, and crumbling stock prices everywhere. Keep this up for a few years, and I can find my bliss. I’ll mention one stock in particular (which I’ve pointed out many, many times both here and on TT) – CREE – that has fulfilled its destiny of closing its gap. Sure, it could keep falling, but at least this goal has been met. Huzzah!

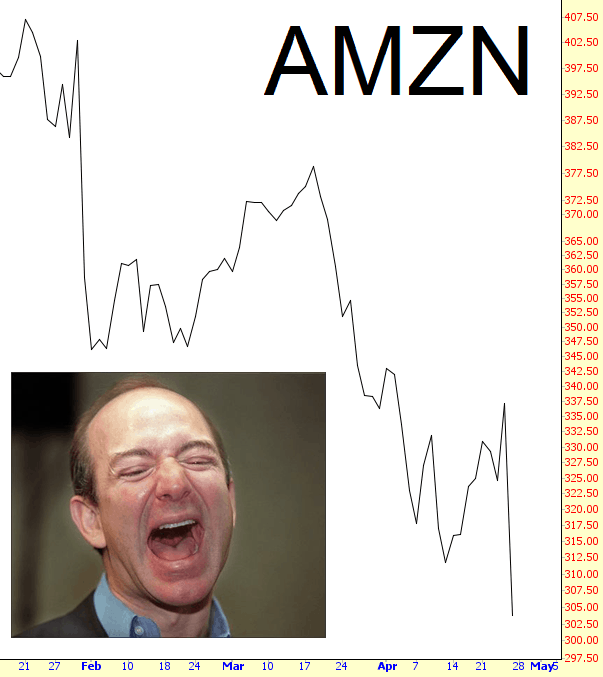

Most of you know that I’m hanging out in Bellevue right now, the land of Amazon and Microsoft (there’s a pretty fierce bidding war going on for Slope right now, and I’m weighing offers in the vicinity of eight hundred dollars, plus a box of my choice of office supplies, which is bundled with the Amazon term sheet). It’s pretty amazing how swiftly the likes of Amazon have lost value; the chart below doesn’t even capture today’s debacle, but Bezos & Company have seen over a quarter of the value of their organization (many tens of billions of dollars in former “wealth”) blown straight to hell. I think there’s plenty more to come. This is my kind of market.

Hopefully everyone caught my warning on twitter on Thursday night that we might well see more downside, and in that case I’d be looking for support in the 1860-2 range. SPX went a little lower than that and at the time of writing is below both the ES 50 hour MA, currently at 1867 ES, and the SPX 50 hour MA, currently at 1870 SPX. These are important levels to watch today, as they are now short term overhead resistance. (more…)

On March 8th, I published this post for my beloved Slope+ subscribers. The really smart guys who do financial predictions cleverly use a lot of words to ensure that they will be able to claim success in the future. In flowery language, they describe How Things Could Go Up or How Things Could Go Down, and one or the other will happen, and it’s time for the trophy.

Since I’m not that sharp, I actually take a position, and in the aforementioned post, I gave extremely specific values and corresponding dates I thought were forthcoming. I’m not going to share the “meat” of the post, but I will share a scribbling I did of the Russell 2000 (I remind you, this was done nearly two months ago):