Good God, this trading business is for the birds. There’s no such thing as a real vacation. Particularly when I’ve got a blog that I feel compelled to contribute to (although I’m insanely grateful to iggy and contributors for keeping things going).

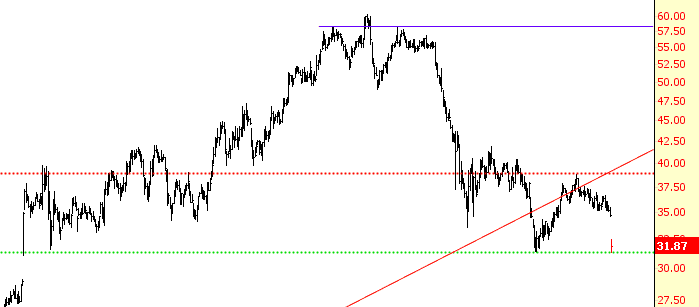

Anyway, there are a ton of success stories lately with ideas offered here, but one I’ll toss out is Ocwen Financial, which I’ve been harping on endlessly both here and on Tastytrade. My options are zooming higher today. I’ve closed 25% of the position but am cheerfully holding on to the rest for potentially bigger profits.