Reviewing your own performance is a critical element to sustained profitability. If you take a minute to recall the most important trading moments from 2015 you’ll likely be thinking of your biggest wins, biggest losses, or biggest missed opportunities. For me, those memories only cover a tiny fraction of my trading activity – so the real lessons worth learning (or reminding yourself of) are found by going back to my day to day and month to month trading results to find out what the most important trading moments from 2015 really are.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

And That’s That

First off, there is a hub-bub going on Twitter about how it looked like I was wearing lipstick on my show. As appealing as that might be to some of my more troubled viewers, the truth is that my lips are parched and cracked from a week in bone-dry ski country, so they look bright red. Sorry to disappoint, but I’m still, regrettably, makeup-free.

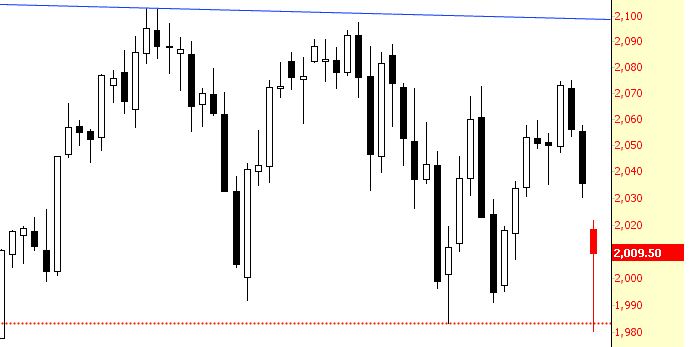

Second, today was a hard one to bear, but it ended not-too-terribly. I had a sleepless night, so I felt like hell, and I had that horrible I-am-totally-missing-out feeling persist for most of the day. The late-session recovery salved the wound some. I saw my “what if I shorted my 125 positions at the closing price of the 31st” spreadsheet (created merely to torture myself) rocket to $32,000 in profit, only to wither away to a $13,000 profit by day’s end. So, like I said, it didn’t sting as deeply as before.

Semi Bearish?

By Biiwii

A technical look at Semi stocks and the Semiconductor index

I must be bearish the Semi Equipment sector because I am short both LRCX and AMAT; the former a successful NFTRH+ long position that hit target and found resistance as anticipated by this chart originally included with the update. I am not so worried about the gap because it changed the trend and gaps that alter the trend of a stock can take a long while to fill.

I went through all the reasons I am bearish the Semi Equipment sector in this post at NFTRH.com, so we don’t need to cover that ground again. The Equipment sector is decelerating, period. But the Semis are more than the Equipment guys, they are the chip makers too, or even especially.