The one Christmas character I most closely identify with is the Grinch (the pre-reformed one). I’ve always been interested in the voice behind the Grinch Song (who is also the voice of Tony the Tiger, along with countless other characters), and today I found a fascinating interesting with Thurl Ravenscroft, which I recommend you enjoy:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

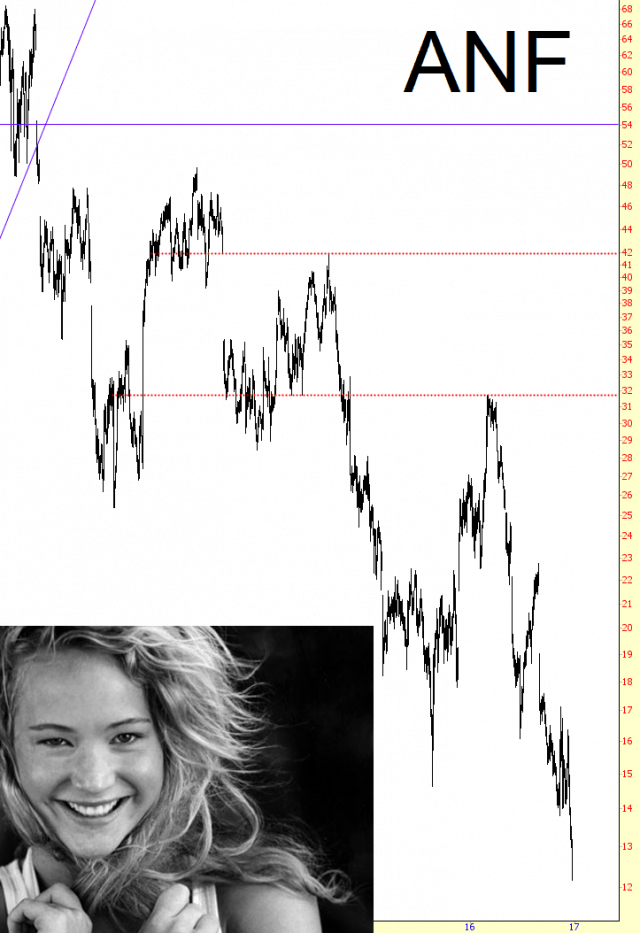

Son of a Fitch

Abercrombie & Fitch (usually referred to here on Slope as simply “Skank”) has been in a slow burn for a long time. I’m a big fan of retail shorts these days (KATE, PIR WSM, etc.) and this is the absolutely king of the clobbered.

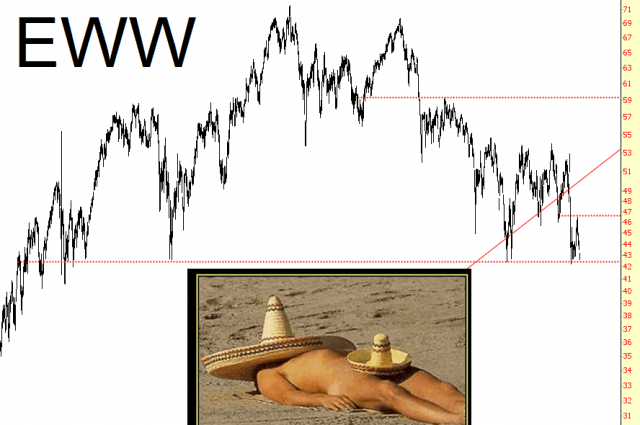

2017 Will Be Bad for Mexico

That topping pattern is almost complete. Once the lower horizontal breaks ($42.47), it’s adios.

Ho Ho Ho Hum

The tape is low volume and has been pretty dull this week on indexes, particularly on NDX/NQ. Volume is unlikely to increase much before next week and the tape may well remain boring, though at the time of writing ES and TF are making a spirited attempt at converted the weekly pivots there to resistance, and if that attempt is successful then this might get more interesting, though it might just establish a tape just as boring with a different underlying bias.

Until we see ES and TF convert their weekly pivots to resistance my overall lean is towards seeing retests of the all time highs. Even in that case I’d note that the downside targets on ES and TF to establish ideal bull flag channels (to then retest the all time highs) would currently be in the 2238 and 1345 areas respectively. On weekly pivot conversions today then those (moving) targets would be the obvious next targets. If the indices head there then that move might be just as dull. I tweeted my premarket video today looking at the setups on ES, NQ, TF, DX, CL, NG, GC & ZB. As usual the indices were among the least interesting looking instruments to trade today. You can see that video here.

Perfect Saucer

One of the simplest, most basic bullish patterns is the saucer. Well, my friends, this one is a hall of famer with respect to clarity and quality, and it’s from a most unlikely financial instrument – bitcoin! I guess 2017 is going to be very good for crypto-currencies.