One of the earliest lessons I taught my children was that “whatever” was a much, much worse word than the word “fuck”. I never want to hear it. They know not to say it.

In this instance, though, I’m going to use it. Because there was a time that headlines from ZeroHedge like this one would get me all excited:

After eight solid years of disappointment, however, one eventually becomes jaded. The central banks of the world aren’t going to suddenly wake up and decide to let the markets actually engage in true price discovery. They are going to keep their hands wrapped around the market’s throat until they can’t do it anymore. It could be years, or decades.

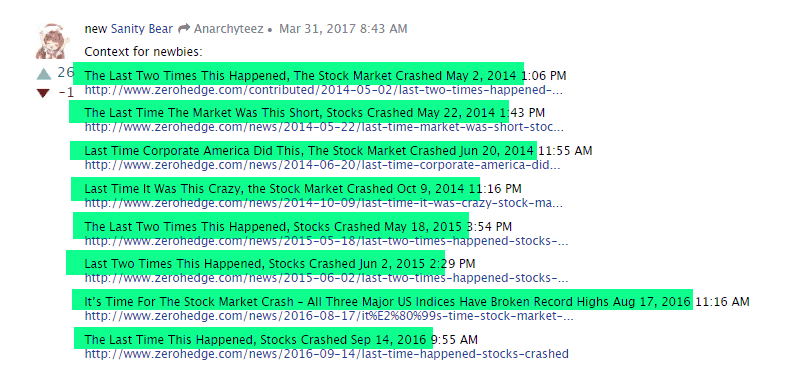

The hilarious aspect of this is shown below, which is a marvelous comment in the same article. It speaks for itself, and the author kindly provides links to every single one:

As you can see, ZH has been trotted out these “The last time….…….” articles for years now. I think the best choice is to ignore all of them from now on.

Whatever.