Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

After the Fall

There’s something I’ve noticed on Slope that I find perplexing, a little troubling, and ever-so-slightly amusing. Whenever I write anything that seems to be a prediction, some people get their feathers quite ruffled. Indeed, it seems to kind of piss them off, and they pound their virtual fists on the virtual table and declare that no one can predict anything, and that it’s an arrogant waste of time to even attempt it.

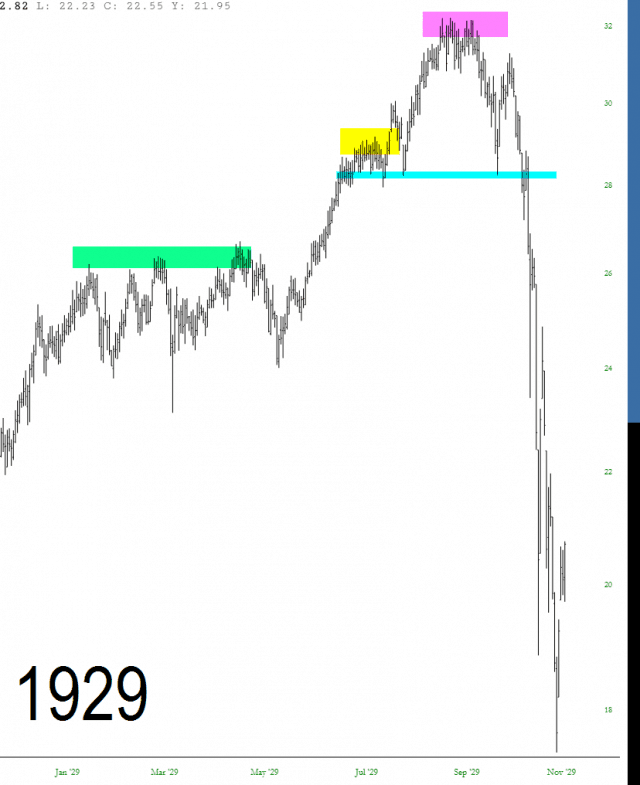

I’m in the business of prediction. Principally, I use historical price charts to try my best to suggest what the future holds. That sort of thing doesn’t seem to bother folks. On the contrary, it’s kept Slope popular, to varying degrees, for nearly fourteen years.

However, when I make, shall we say, textual predictions, some people object. I guess all I can say to that group is………you might as well stop reading the post now, because I wanted to offer up a few speculations about what’s ahead. I am by no means a futurist or an expert in societal trends. By far my biggest “this is what’s coming” success was the 1983 book I wrote, which I’ve mentioned here before, called The World Connection, which predicted our online world with Nostradamus-like accuracy. (more…)

What a Ride……….

Well, THAT was something, wasn’t it?

I’d like to recount the past 24 hours for me. Just a way for me to share some thoughts, for whatever they may be worth. Perhaps there are some insights buried in these words for others so that it’s not just a self-absorbed narrative.

As regular readers know, I had taken on the decidedly un-Tim-like stance of turning bullish. To be precise, last week I reduced my short positions from 90 to 30, increased my long positions from 0 to 4, and had reduced my overall exposure from 300%+ to 135%. In short, I was ending the week with much lower risk, much lower opportunity, and an eye toward a bounce.

I was eagerly awaiting the open on Sunday. I kept scanning the news, and there was nothing particularly market-moving going on, with the exception of the radical-right nut job winning the Brazilian Presidency, which was actually kind of bullish. Even ZH couldn’t seem to find anything really big to worry about. (more…)

Alphabet on the Fanline

An Ode to Gorilla Glue

This post has nothing to do with the markets. Nothing to do with SlopeCharts. It doesn’t even have to do with me prodding you into subscribing to a premium service.

Instead, it has to do with one of the greatest lies of the 20th century, which is as follows: