It was only last month that the media felt the need to offer a reassurance like this one:

Anyone notice that, now that the Dow Industrials has risen about 7,000 points, no one is running around screeching and wringing their hands about closing the markets? Yeah, I thought not. The world hates bears and loves, loves loves the bulls.

I got in my head an epic piece I want to write about this entire situation, but that’s probably best for a weekend.

Instead, let’s take a look at these more-insane-every-day markets of ours (oh, sorry……….”markets“).

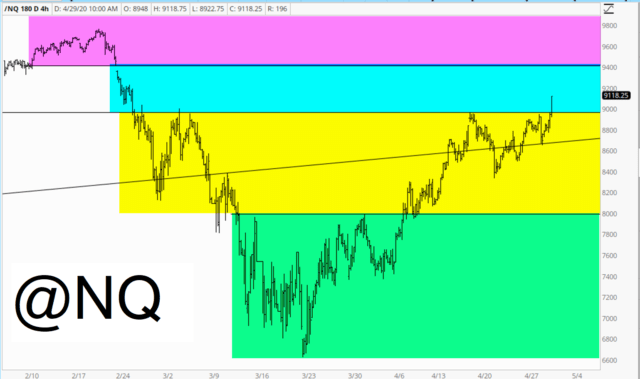

The NQ is, in defiance of all good sense and logic, down only 6% from the highest levels in human history. Yes, in spite of unemployment in the double digits, $25 trillion in debt, multi-trillion dollar deficits for years and years ahead, and the worst economy since Herbert Hoover was in office, the NQ has a full 94% of its peak value. In. Fucking. Credible.

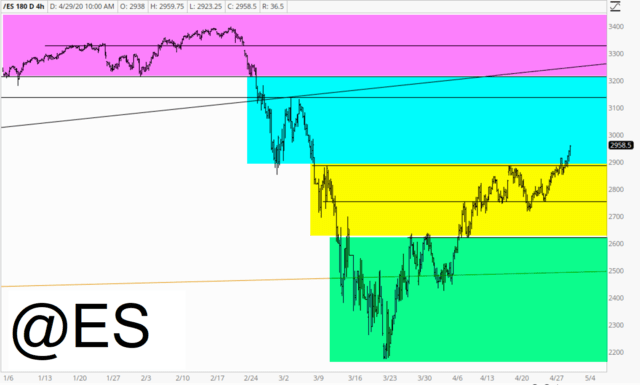

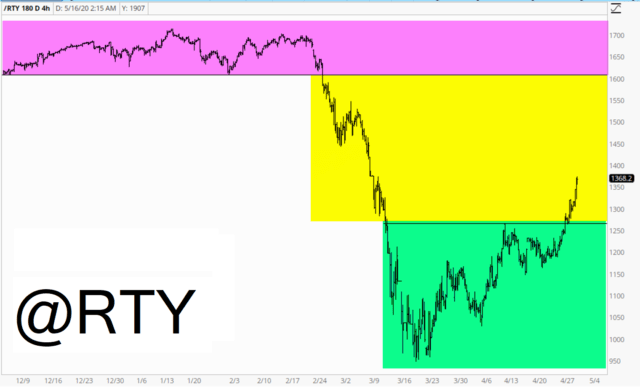

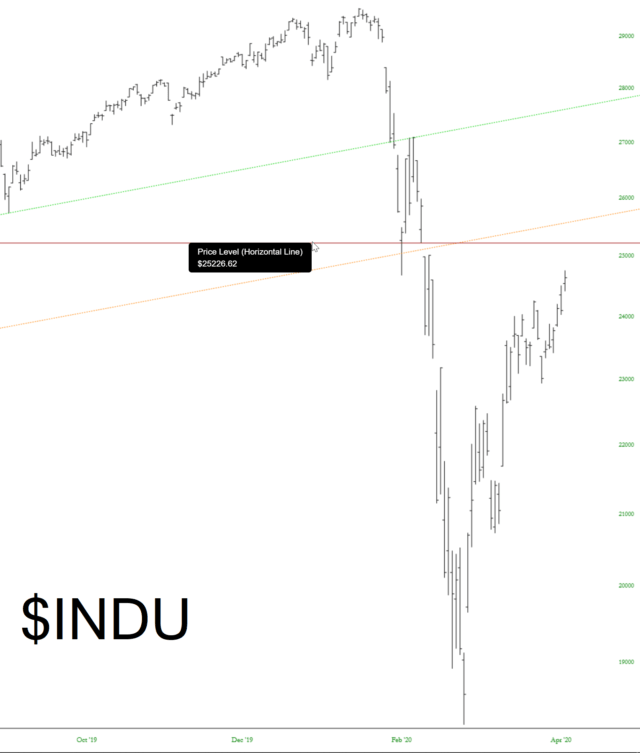

The tinted zones in these charts are my own. The colors don’t mean anything in particular. I simply want to highlight the various “zones”.

In the NQ above, the magenta zone represents the January/February top, the cyan area – – by far the least resistant of the zones, given the speed of the drop – – is where we are at now, the yellow zone was conquered thanks to Powell’s “infinite bond purchases” promise, and the green zone represents the bottom and the base.

April, as you might guessed, has sucked out loud for me. I was not shy about crowing about how great things were in February and March. The world of financial commentary is full of liars, scoundrels, and thieves, and I am none of these things. I will come right out and say that this has been a horrible, wretched, terrible, shit-tastic month that I wouldn’t wish on anyone. It isn’t just the equity gains that bug me. It is the basis behind them I find sickening.

The ES is a somewhat milder version of the NQ. The tinted zones are similar, but we’re farther away from lifetime highs than on the NQ. I seriously, hand-on-the-Bible, thought this would stop at around 2750 or so. The fact that we’re close to 3,000 is appalling to your humble narrator.

The weakest of all – – although it’s been ball-choppingly strong this week – – is the world of the small caps. This one finished its cup-with-saucer pattern earlier this week, and it’s been off to the races ever since.

Price gaps haven’t meant a whole hell of a lot these days, but I still think they are worth noting. Please take note of the gap that took place, as so many of them did, between the March 6th and 9th trading sessions.

I was curious what I was writing prior to March 9th, and I find this post from March 8th which absolutely crackled with life and excitement. How I miss those days. It felt about 500 times more fun and electrifying than now, which is more like a morass of endless bailouts, accommodations, and government horseshit. I’ve definitely got some things to say about this, but that’s the kind of post that requires a lot of time and thought.

And that’s your dose of sunshine from me for now.