An Amazon delivery agent at work (photo via our Shutterstock subscription).

(more…)Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

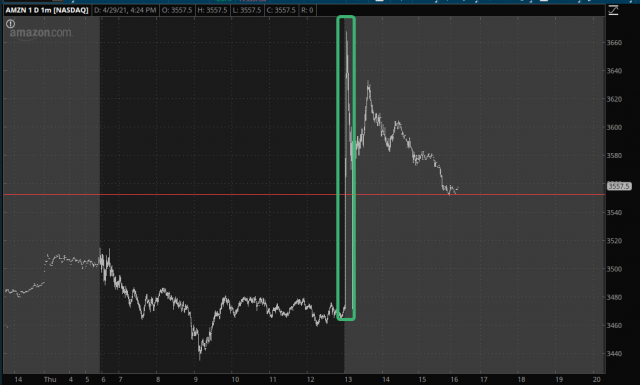

Well, Amazon blew the doors off everyone Thursday afternoon, just like Apple did on Wednesday afternoon (although I’d like to point out that 50% of the pop has already vanished).

While every other asset on the planet is vomiting to lifetime highs every single weekday, Bitcoin has lost its mojo. It is down over $10,000 from its peak, and if you can put on your science fiction hat and imagine a day in which assets are deflating, I think you’ll see cryptos collapse.

In the meanwhile, let’s look at a few corporations which have utterly abandoned their normal business and have completely tied their fate to the $BTC chart. We start with MicroStrategy – – a firm which has been around for decades, although no one has ever met anyone who has ever done business with them – – – and they are neck-deep in BTC purchases, having even borrowed billions to buy more. Let’s just say a failure of that horizontal would mean doom-a-palooza.

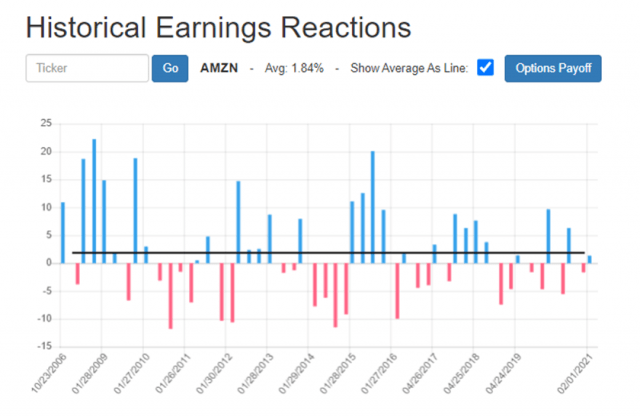

The big event this afternoon will be Amazon’s earnings report. That’s pretty much the high water mark for this earnings season, and things will die down day after day, so that in a couple of weeks it’ll be down to companies no one has ever heard of. Here are a few views into Amazon from Slope………

Here are prior reactions the day following earnings announcements:

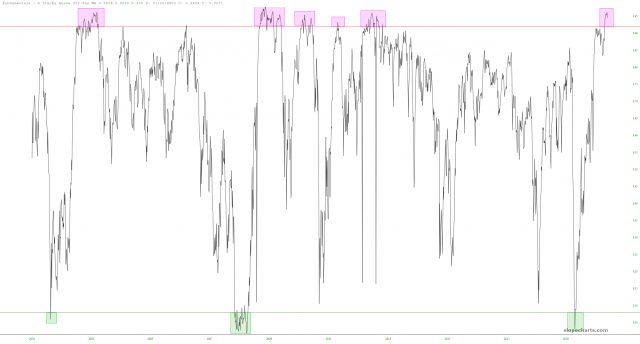

If you look at the Fundamentals Data Panel in SlopeCharts, you can find some real treasures. Below, for example, is a chart of the quantity of stocks above their own 200-day moving average. The chart is, naturally, rather cyclic, and I’ve drawn two horizontals at the 8% and 92% marks. I’ve also taken the time and trouble to tint the zones above and below these levels.