Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

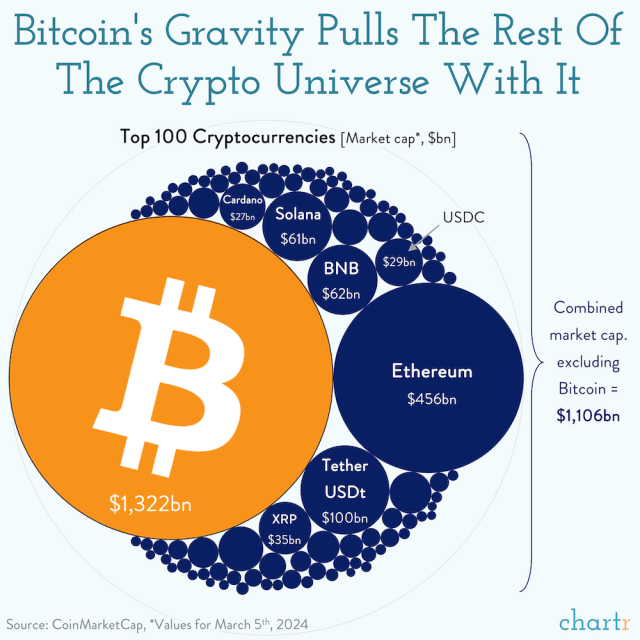

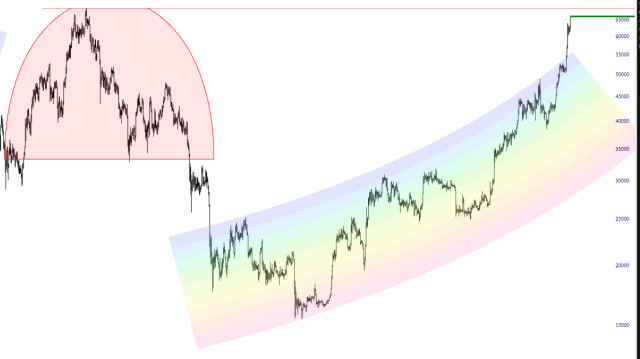

Crypto New Highs Ahead

Maybe today. Maybe tomorrow. But it seems that, very soon, BTC is going to push over its lifetime high set in late 2021. The screams you may be hearing are emanating from the Metropolitan Correctional Facility, courtesy of SBF.

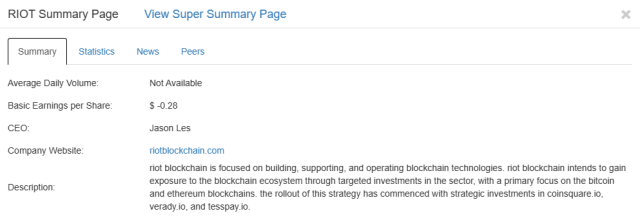

Crypto Equities Faltering

In a post yesterday, I pointed out that RIOT, a firm that one would assume follows crypto tick for tick, was actually down on the same day that BTC was thousands of dollars higher. That, to me, seemed to be a pretty negative sign. It seems clear that oddity is playing out not just for RIOT, but across the board.

Crypto Pages

Now that Bitcoin is all the rage again, I’d like to remind folks that Slope has a ton of cryptocurrency charts, streaming quotes, news, and other information right here. You can check out the main pages here.