This is just a nice pattern example for your reference: a bullish inverted head & shoulders pattern with GE. Once it crossed above its neckline at about $72, it was off the races. It has already achieved its measured move target.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

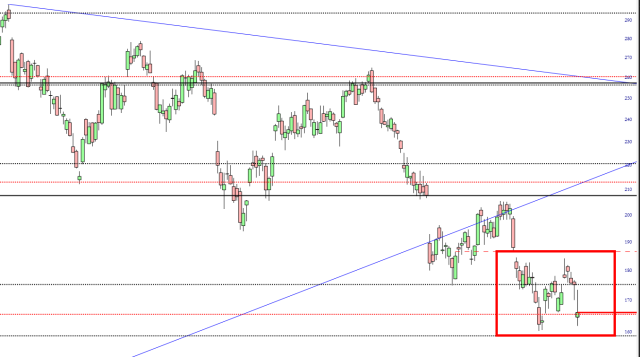

Just a couple of charts worth noting. First is Tesla, which has been the weakest (literally 500th place) of the S&P 500. This won’t help: it is sinking toward multi-year lows, bound as it is by powerful Fibonaccis which I’ve been pointing out since JFK was shot.

When I was a kid, April Fools’ Day was kind of fun, but as an adult, seriously, it’s really annoying to read every given news item and wonder if it’s a joke or not. Given the state of the world today, it’s harder than ever to tell.

Mercifully, April Fools’ Day (which follows the vastly more consequential Transgender Visibility Day, which I trust you all celebrated with verve) is just about over. Let’s look at a few index charts to catch up.

First is the S&P 500, which hasn’t violated its ascending wedge over the past half year, but goodness gracious me, it sure is getting close. One even slightly bad day which crack this sucker.

The index charts almost all say the same thing: (1) prices are in an ascending channel; (2) there hasn’t been a single violation of the channel since it began about half a year ago; (3) the government isn’t going to allow any kind of dip in equities until the election is over.