View: ES Quantitative Analysis | Slope of Hope

ES Quantitative Analysis | Slope of Hope

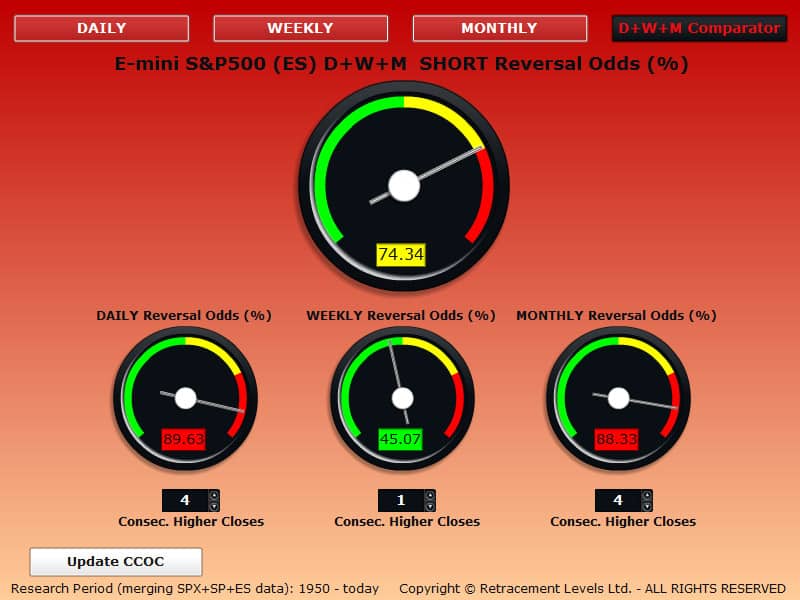

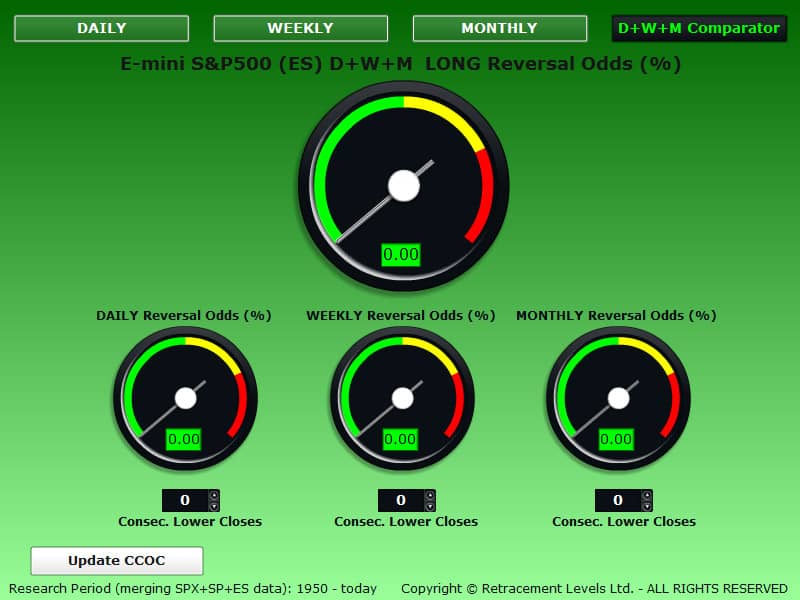

TO GO LONG ANALYSISThe CCOC DAILY gauge below is showing 0% odds to GO LONG.

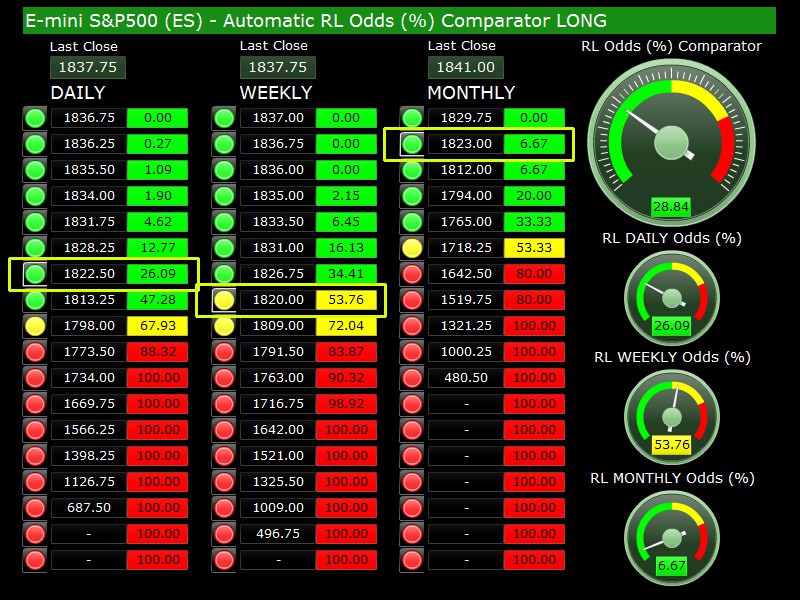

On the LONG Odds Table below we have the following relevant levels:

On the LONG Odds Table below we have the following relevant levels:

1734, 100% odds – Stop Loss level.1822.50% 26.09% odds – First valid level to go LONG for the next trading session.1813.25, 47.28% odds - First “safe” level to go LONG for the next trading session.

As predicted, the ES started to correct “between Friday and Monday” and today we may have a negative Close. If the price reaches any of the levels indicated in the next few days, it may be a new occasion to BUY (to be confirmed).

The ES LONG Odds Comparator below show us what the odds would be if the 1822.50-1823 price area would be reached:

DAILY 26.09% Odds

WEEKLY 53.76% Odds

MONTHLY 6.67% Odds

OVERALL 28.84% Odds

There has been an improvement from last week, for this specific price area, if these price levels are reached, and if the uptrend still has force, it could be a good idea to BUY there or right below it.

TO GO SHORT ANALYSIS

The CCOC DAILY gauge below is showing good odds to GO SHORT (this refers to the Friday’s Close, because it is a tool updated “at Close”, so you should have gone SHORT on Friday, right before the Close, the odds were VERY good, 89.63%).

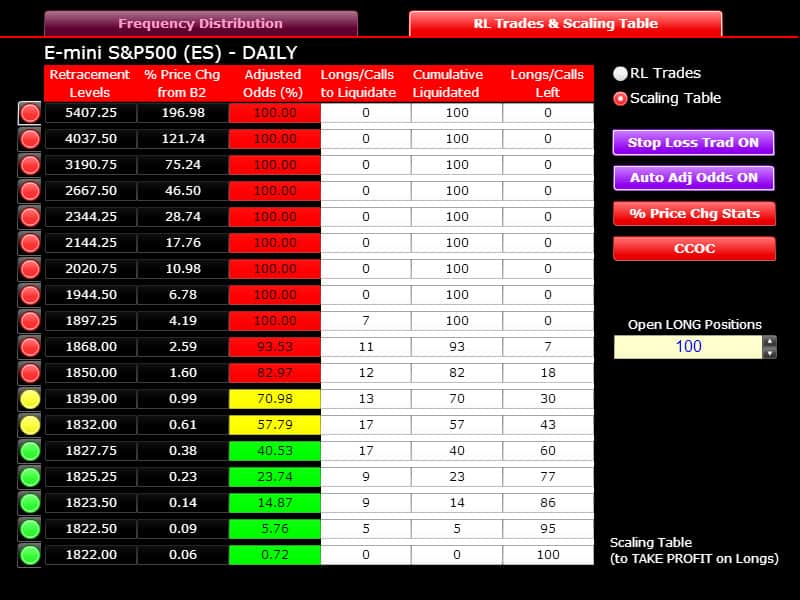

On the SHORT Odds Table below we have the following relevant levels:

1897.25, 100% odds – Stop Loss level.

1839, 70.98% odds – First valid level to go SHORT for the next trading session. This level was hit Thursday and Friday, you should be SHORT now, we already said this last Friday and if you followed our advice you should be profitable at the moment. Look at LONG levels/odds to find an exit for your SHORT trade.

The next level to go SHORT for today would be 1850, with 82.97% odds but since the market is trading around 1832 before the Open it may be hard to see the index up there today.

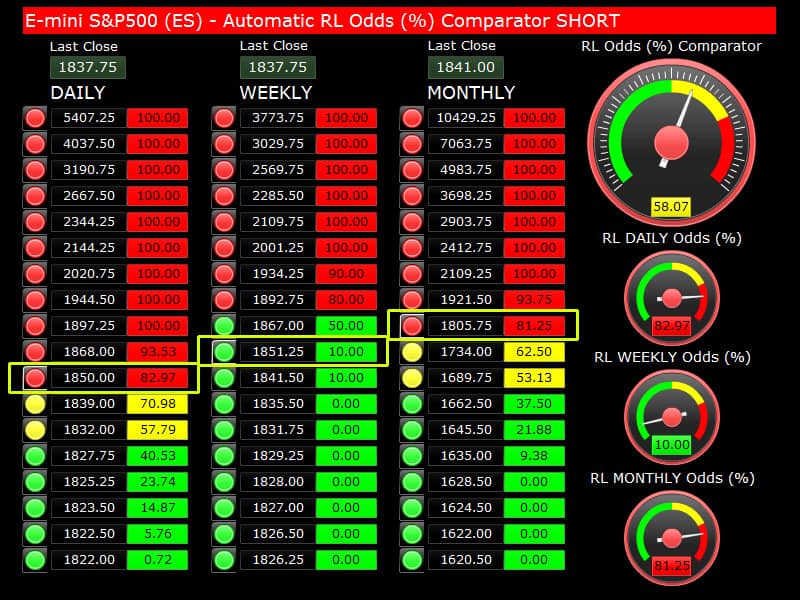

The ES SHORT Odds Comparator below show us what the odds would be if the price area near 1850 would be reached:

DAILY 82.97% Odds

WEEKLY 10% Odds

MONTHLY >81.25% Odds

OVERALL 58.07% Odds

Looking at the SHORT Odds Comparator above we can say that if the market suddenly shoots up and reaches the levels indicated, the odds would be VERY good: go SHORT there without hesitation.

Copyright © 2014 Retracement Levels. All Rights Reserved

Comments

No comments yet.