View: ES Quantitative Analysis | Slope of Hope

ES Quantitative Analysis | Slope of Hope

Note: to complete the transition from “TA” mindset to “quant trading” mindset, we have completely removed the charts from our published market research. The focus now is exclusively directed on price levels and their probabilistic significance in the context of market price swings.

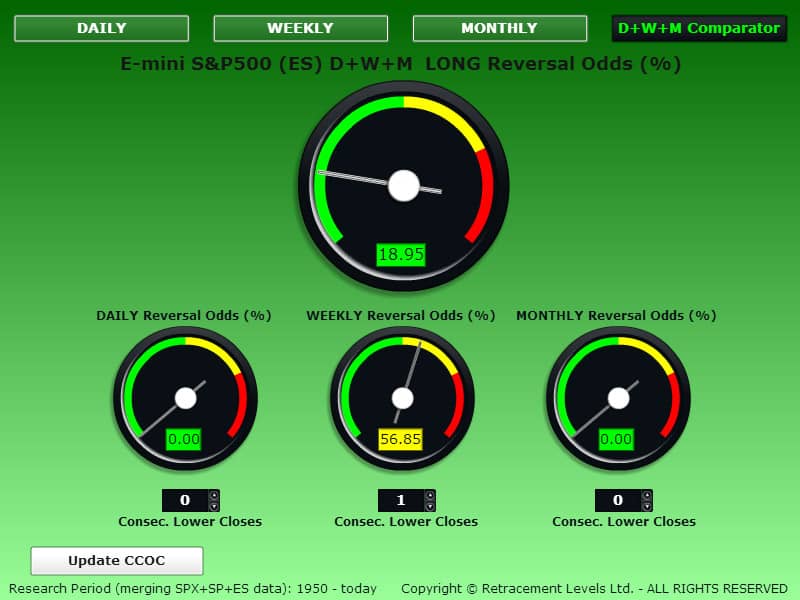

TO GO LONG ANALYSISThe CCOC DAILY gauge below is showing 0% odds to GO LONG.

1758.25, 100% odds – Stop Loss level.1822, 26.09% odds – First valid level to go LONG for the next trading session.1815.25, 47.28% odds - First “safe” level to go LONG for the next trading session.

As expected, esterday the ES closed up. The market remains buoyant today, the ES Futures are up at the moment of writing (>1838) so it seems unlikely to see the market at 1815 by the Open.1822 could be reached intraday if there is a correction and you could buy it safely.

Today is the Job Reports day, but our analysis does not care about any news because our approach is purely quantitative and so our strategy front-runs the news by tactically positioning us at key price levels BEFORE the news come out.

The ES LONG Odds Comparator below show us what the odds would be if the 1822-1823 price area would be reached:

DAILY 26.09% Odds

WEEKLY 8.97% Odds

MONTHLY 6.67% Odds

OVERALL 13.91% Odds

Unless the market reaches significantly lower levels the overall odds for a LONG trade at the moment are not particularly good, so we would shy away from long-term LONG investments in this phase.

In the short-term, buying dips can surely produce profits but today is the fourth consecutive day up in a row, a bit late to enter the trend (although for sure upward price spikes are always possible).

We expect the market will probably reverse SHORT between Friday and Monday and there is where you can BUY again.

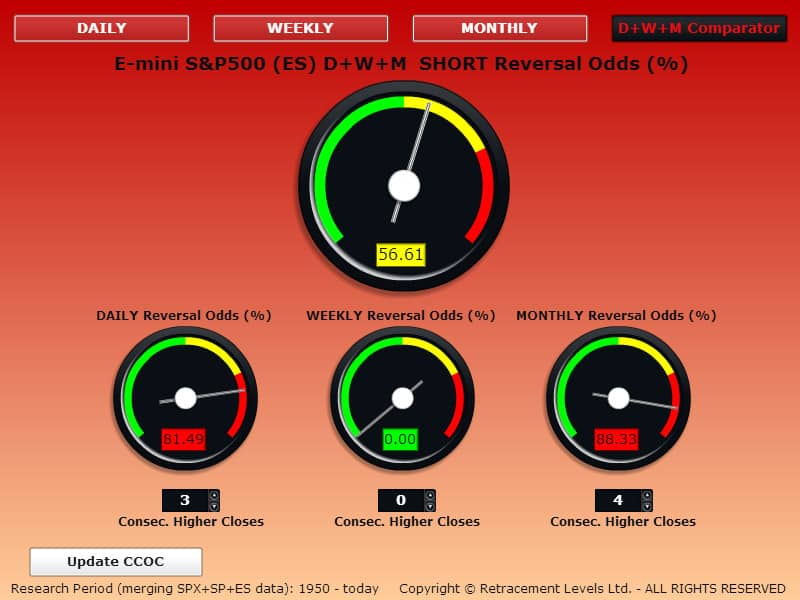

TO GO SHORT ANALYSISThe CCOC DAILY gauge below is showing good odds to GO SHORT.

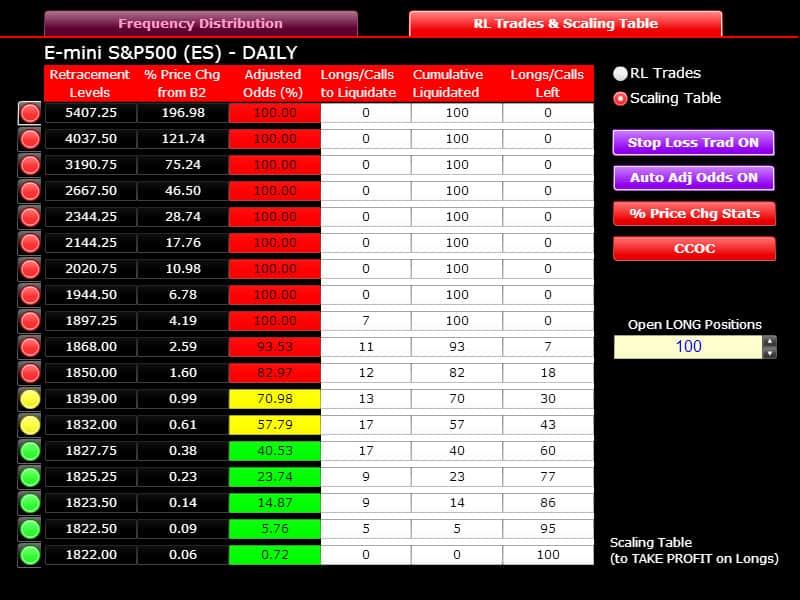

On the SHORT Odds Table below we have the following relevant levels:

1897.25, 100% odds – Stop Loss level.

1839, 70.98% odds – First valid level to go SHORT for the next trading session. This level was hit yesterday, you should be SHORT now, accumulating positions for the upcoming SHORT reversal.

If the market today shoots up because of a positive Jobs Report, the next level to go SHORT is 1850, with 82.97% odds. Yesterday we said that if the market keeps pushing higher for another 2 days, then 1850 can be reached: the odds for a SHORT trade are excellent there.

We don’t see the market going at 1868 on this impulse, before making at least a 1-day SHORT reversal.

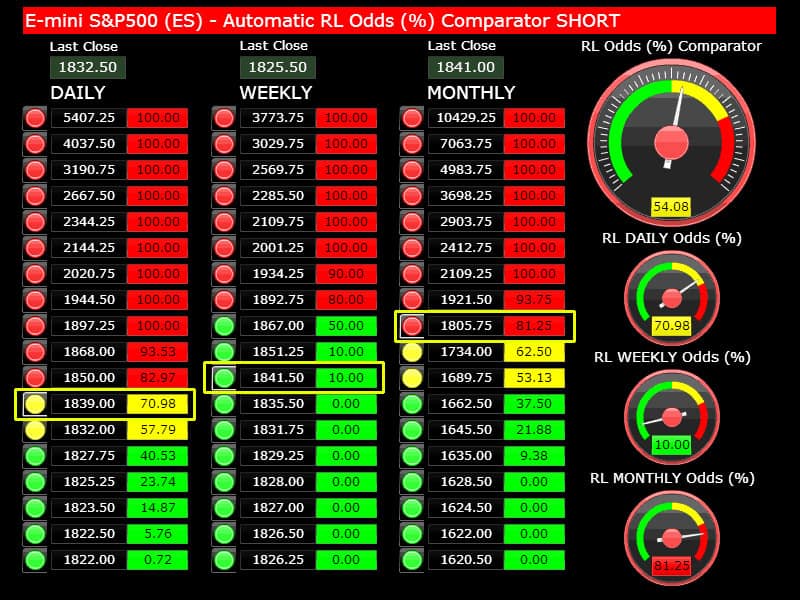

The ES SHORT Odds Comparator below show us what the odds would be if the price area near 1839 would be reached (note: this DAILY price level has been reached yesterday):

DAILY 70.98% Odds

WEEKLY 10% Odds

MONTHLY >81.25% Odds

OVERALL 54.08% Odds

Looking at the Comparator we can infer that the market is quite overbought Monthly (and the Daily as well it’s reaching overbought levels) so a Daily correction (at least one day down) is becoming more likely and if there is a catalyst, it may turn into a Monthly correction. The Weekly at the moment is not overbought (because it closed down last week), but this may be read as a Weekly downtrend that has already started, and so the current upswing may be some sort of Daily re-test of the latest highs at 1846.50 – if that happens during the current upward impulse, then 1850 would be the perfect place for a big, medium-term SHORT bet, with a chance to see the market correcting down for the whole month.

Copyright © 2014 Retracement Levels. All Rights Reserved

Comments

No comments yet.