View: The Three Bears | Slope of Hope#more-32484

The Three Bears | Slope of Hope#more-32484

4/28 shj

Hopefully everyone caught my warning on twitter on Thursday night that we might well see more downside, and in that case I’d be looking for support in the 1860-2 range. SPX went a little lower than that and at the time of writing is below both the ES 50 hour MA, currently at 1867 ES, and the SPX 50 hour MA, currently at 1870 SPX. These are important levels to watch today, as they are now short term overhead resistance.

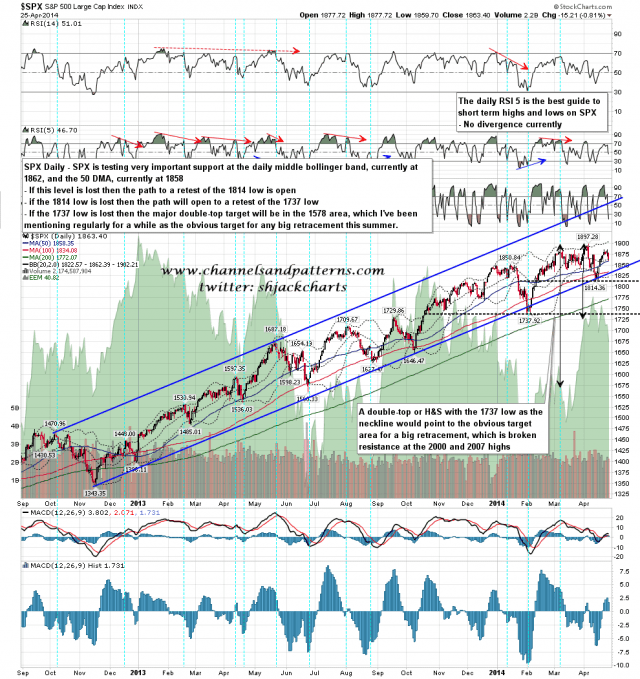

Support has been at the daily middle bollinger band, now at 1862 SPX, and the 50 DMA, now at 1858 SPX. These are important support, and if this area is lost with any confidence, then I would be looking considerably lower, with the first target on SPX at the last low at 1814.36. A break below that low would trigger a double top target in the 1730 area, effectively to test larger double-top support at the 1737 low. A break with confidence below the 1737 low would then trigger a larger double-top target in the 1578 area, which is in the ideal range for any serious retracement this summer as it is a retest of the broken 2007 high at 1576. This is a topping setup that I am taking very seriously, and the first stone in the landslide down to that low would be if the 1858-62 support range being tested on Friday were broken with any confidence. SPX daily chart:

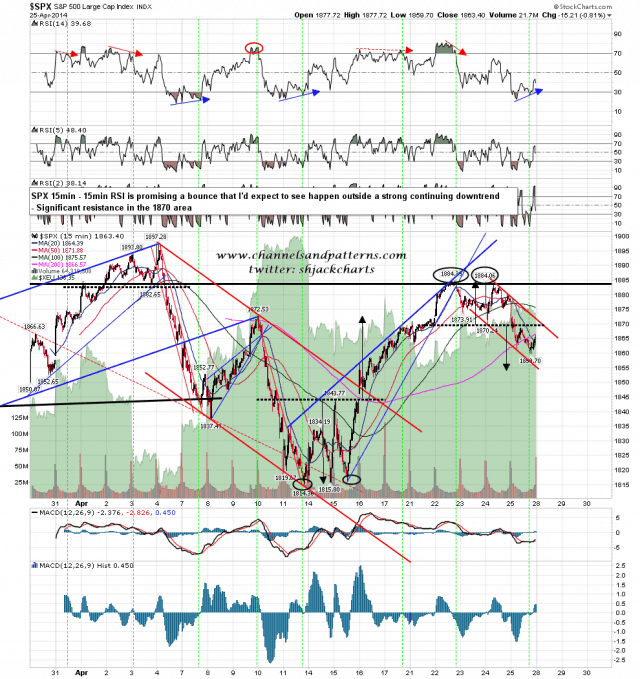

There are signs of a bounce on the SPX 15min RSI that I’d expect to deliver in the absence of a strong downtrend. There is also a small falling channel with resistance in the 1870 area, which would be a very good fit with a test of the SPX 50 hour MA from below. Also worth noting on this chart is the double-top target at 1854 that has not yet been reached. SPX 15min chart:

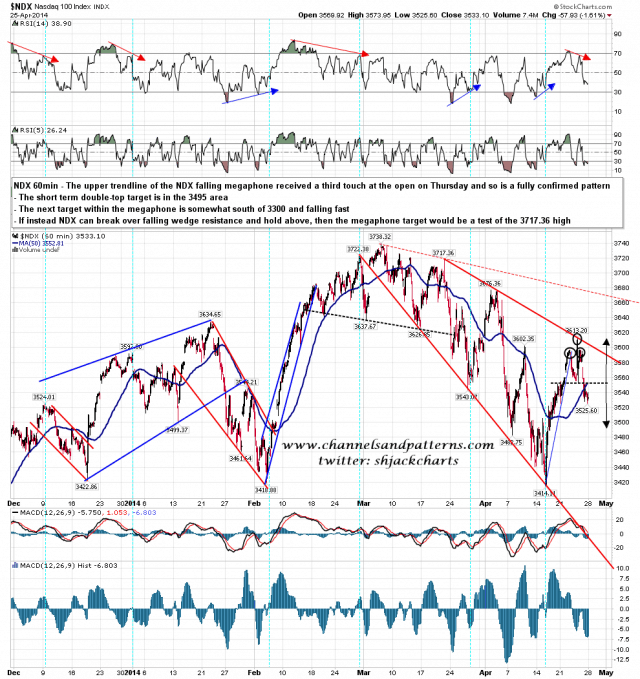

There is also an open double-top target in the 3495 area on the NDX chart I posted on twitter on Thursday night. The touch of falling megaphone resistance at the open on Thursday confirmed this as a valid pattern and there are only two clear target on this large (ultimately 70% bullish) pattern. The next target within the falling megaphone is south of 3300 and falling rapidly. If NDX can break and hold above falling megaphone resistance then the target would be the 3717.36 high. NDX 60min chart:

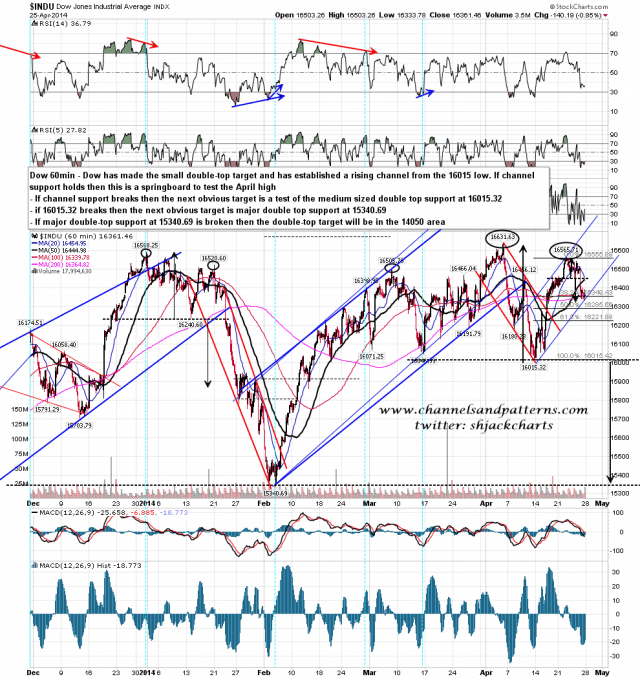

The overall topping setup here on SPX is textbook, and I may well save it for use in a book I’m planning if it breaks down. The setup on Dow is even more so, and that is where I drew the three bears title for this post from. There are three nested double-tops on Dow here, and the first broke down and made target on Friday. That has established a rising channel from the April low on Dow, and if we are to see a strong rally here, then ideally that should hold. If it breaks then the obvious next target is that April low at 16015.32.That level is the medium-sized double-top support and a break with any confidence below would target a test of the February low at 15340.69. That is the large double-top support and a break below there would target the 14050 area. INDU 60min chart:

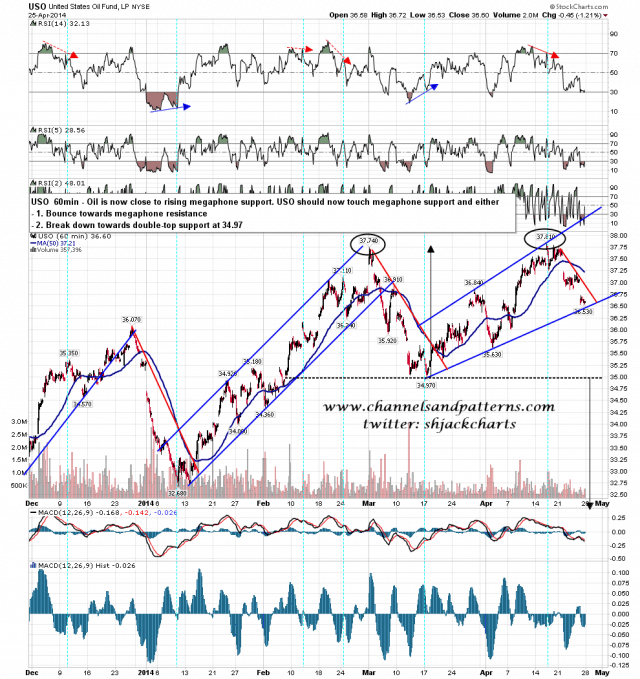

On other markets USO is now close to the rising megaphone support I was looking at last week, and when that is hit there would either be a strong reversal back up, or a strong break down towards yet another double-top support level. USO 60min chart:

This is an important support test and if bears can break this down then the spring high is most likely behind us now. There is a very decent topping setup and the seasonality is ideal. My only concern is that bear credibility is low at the moment but we’ll see whether they can rise to the occasion. Whatever happens today, there is a very decent chance that we will see a green day tomorrow, as Tuesdays have been consistently bullish so far this year.

Comments

No comments yet.