User: Hokie: Hokie's News Articles: Fleeced by a Fool — How Bloomberg Markets Magazine knowingly used counterfeit statistics to tell a lie | PeterLBrandt

Fleeced by a Fool — How Bloomberg Markets Magazine knowingly use...

The October 7, 2013 Bloomberg Markets Magazine hit piece “How Investors Lose 89% of Gains from Futures Funds,” by David Evans, contains more gross inaccuracies and questionable statements than can address in this brief rebuttal.

But, the bottom line is this: Evans is guilty of journalistic misrepresentation, agenda-driven word-smithing, statistical deception and a dishonest presentation of facts.

Journalistic misrepresentation. Some industry leaders quoted in the story have confirmed to us that Evans made no mention of the fact he was a reporter preparing a story. These same people are overwhelmingly outraged and shocked over the disparaging, one-sided and out-of-context statements that the story attributed to them. Widely accepted journalistic etiquette requires that reporters honestly present themselves and their intentions.

Agenda-driven word-smithing. Such wording and selective quotes as “fleeced by fees,” “return-robbing fees,” “escaped the notice…of regulators,” “license to steal,” “it’s a racket,” “hype by brokers” and the like would suggest that this story was written before it was even researched.

Statistical deception. The main theme of the article is that excessive fees have robbed investors of their gains. We completely agree with the author that fund charges of 6% to 9% of assets are excessive. But, the statistical fabrication of data in the story is dishonest and deceptive.

To simplify the author’s cunning statistical slight-of-hand, consider the following example. Assume that Fund A doubled its investors’ capital (after-all-expenses) over a five-year period in which the average Fund assets were $100 million. Thus, Fund A made its investors a net $100 million.

During the subsequent five years the assets under management exploded to an average of $1 billion, during which time Fund A’s net performance (after all fees) was zero. No investor lost money. No investor made money. However, the commission to equity ratio of 2% (not unusual in managed futures) resulted in brokerage expenses during the five year period of $100 million. Additionally, Fund A’s 2% management fee equaled a similar $100 million of expenses. Thus, the total expenses for second five year period were $200 million.

So, while investors over the full 10-year period doubled their capital, and investors over the last five years broke even, Evans would claim that Fund A’s excessive fees not only consumed all of the initial five years of profits but also robbed investors of another $100 million during the second five year period. Rather than presenting a slight-of-hand and confusing dollar amounts not connected to the amount of underlying assets, net rates-of-return data should have been presented.

According to Evans’ logic, a strawberry farmer who sells his harvest at $85 per cwt. only to have it retail at $240 per cwt. would be robbed of $155 per cwt.

It is astonishing to us that a sophisticated financial organization such as Bloomberg would allow such mathematical counterfeit to be published. The only reason “responsible” editors would allow the publishing of such mathematical manure is if a management decision has been made to attack a certail investment category.

Dishonest representation of the facts. The story calls into serious question the integrity of data from Barclay Hedge, a primary source of performance statistics used by the managed futures industry. Evans claims that the Barclay data does not include the fees he falsely claims were responsible for the grand theft of investors’ capital. We compared hundreds of performance data points from Barclay Hedge for the components of the BTOP 50 (the index representing the industry’s largest managed futures funds) with the actual net-of-all fees performance reported to investors by the BTOP 50 funds. In no case did our examination find material differences – meaning that the Barclay Hedge performance data points we checked were all after fees and commissions.

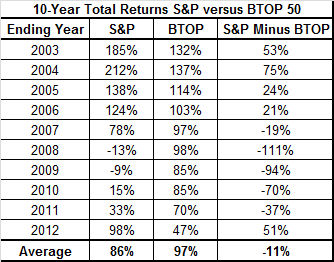

The story’s comparison of managed futures to the equity and fixed income markets was equally deceptive. Comparing the S&P to managed futures for the decade ending 2012 is a very convenient time period if one is trying to demonstrate the underperformance of the latter. This date range conveniently eliminates the 2000-2002 bear market in equities. If, instead, the article had been written three years ago reflecting a decade ending in 2009, an even more extreme opposite conclusion could have been implied with BTOP50 up a cumulative 85% with the S&Ps down 9%.

But, any analysis so dependent upon a start date, including the one just presented favoring managed futures, is meaningless and misleading. A better comparison would match the cumulative performance of the S&Ps vs. the BTOP50 over the last ten 10-year time frames. Using this approach, the commodity fund managers have ranged from underperforming equities by 75% to outperforming equities by 111%, depending on the starting year for the 10-year period. The average of the last ten 10-year periods is a toss-up, with the BTOP50 at 97% and the S&Ps at 86%.

Managed futures have proven to be a sound alternative investment uncorrelated to equity returns. The Bloomberg story completely discounts the many benefits managed futures have brought and will bring to the overall investment portfolio of sophisticated investors. Managed futures are not for everyone. But a good starting point for examining managed futures would be an honest representation of facts.

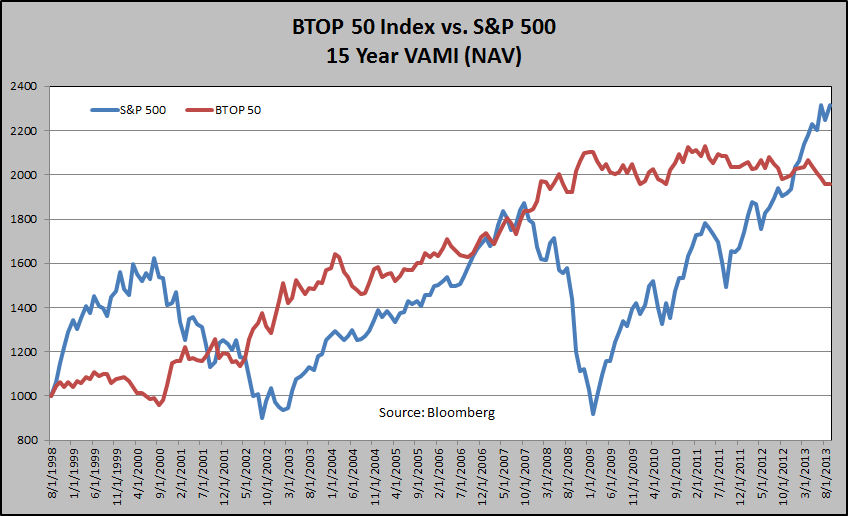

The graph below shows the NAV of a $1,000 investment in the BTOP50 vs. the S&Ps (with dividends during the past 15 years. Only with the historic rally in equities over the past few years is the S&P in a leading position. But note the volatility of growth curve of each asset class.

I am writing this response to Bloomberg’s Blooper because I am a defender of futures trading. I am also a believer in managed futures, and have placed a significant amount of my own personal capital with other traders to compliment my own proprietary trading operations.

There is no doubt that the managed futures asset class has struggled in recent years. In fact, the rolling 24-month ROR of the BTOP50 is approach a record low level and has been below zero for 13 straight months. Yet, it is not unusual for managed futures to negatively correlate with the equity markets. Managed futures performance was outstanding during the 2007/2008 collapse of the U.S. stock market.

Good and bad performance cycles come and go in all asset classes. But during it all, it would be wonderful to expect honest reporting by the financial press. Bloomberg Markets Magazine has failed in this regard. In the process, Bloomberg has not done itself, the financial industry or the concept of integrity any favor.

Peter Brandt

###

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

View the discussion thread.

View the discussion thread.Comments

No comments yet.