Users: Funatwork: ES Quantitative Analysis | Slope of Hope

ES Quantitative Analysis | Slope of Hope

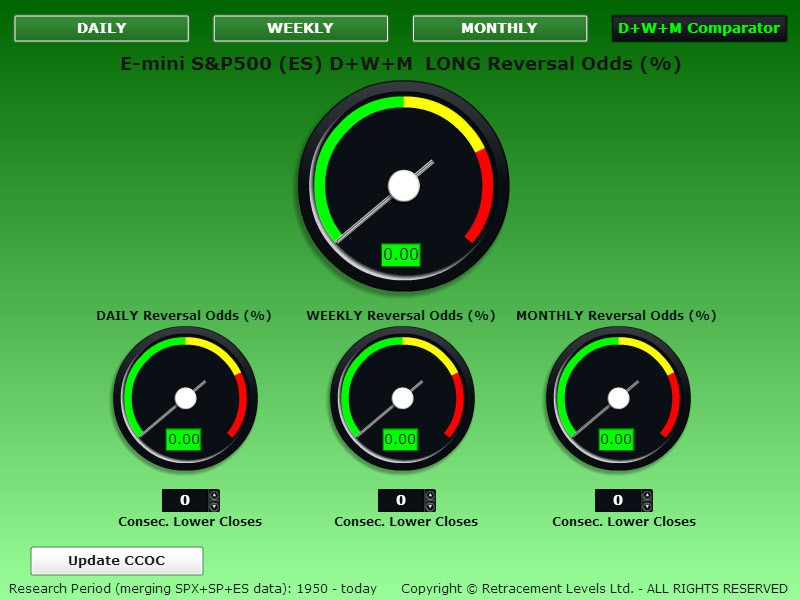

TO GO LONG ANALYSIS

The CCOC DAILY gauge below is showing 0% odds to GO LONG.

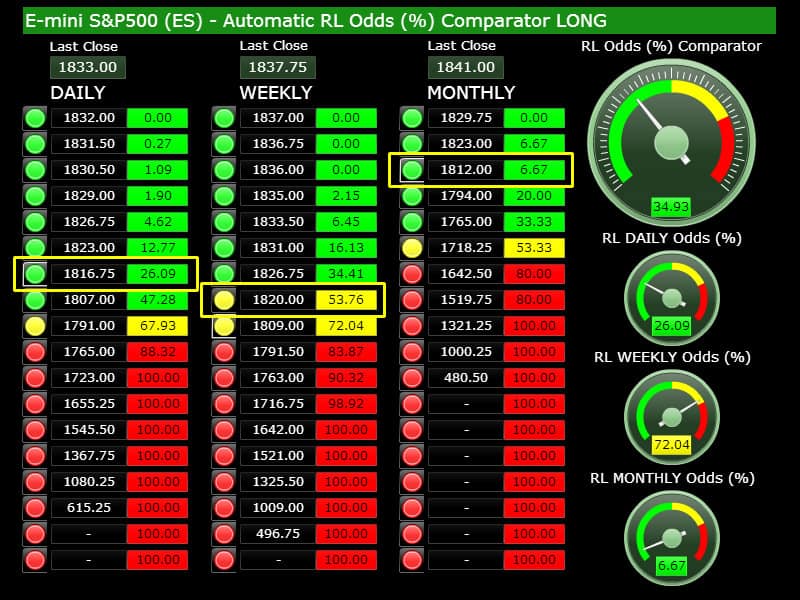

On the LONG Odds Table below we have the following relevant levels:

1723, 100% odds – Stop Loss level.

1816.75, 26.09% odds - First valid level to go LONG for the next trading session.

1807, 47.00% odds – First “safe” level to go LONG for the next trading session.

Yesterday we saw an (almost) complete reversal of the previous day’s dive.

If you did buy our 1822.50 and 1813.25 LONG levels posted the day before the plunge the plunge, you could have made roughly a 10 to 20 points gain in one single day. That is a perfect example of what Retracement Levels can do for you: identify high probability trades where you can place bets that will make you quickly profitable on the reversal. In a nutshell it is a sort of probability-based Swing Trading.

The ES LONG Odds Comparator below tells us what the odds to go LONG would be if the sub-1820 price area would be reached:

The overal odds (34.93%) aren’t particularly good for this trade, the Daily in particular has only 26.09% odds, but the Weekly has good odds (53.76%), so this could be a medium-term LONG trade (hold for at least one week) – but it has to be seen if the ES can reach 1820 today (or in the next 1-3 days).

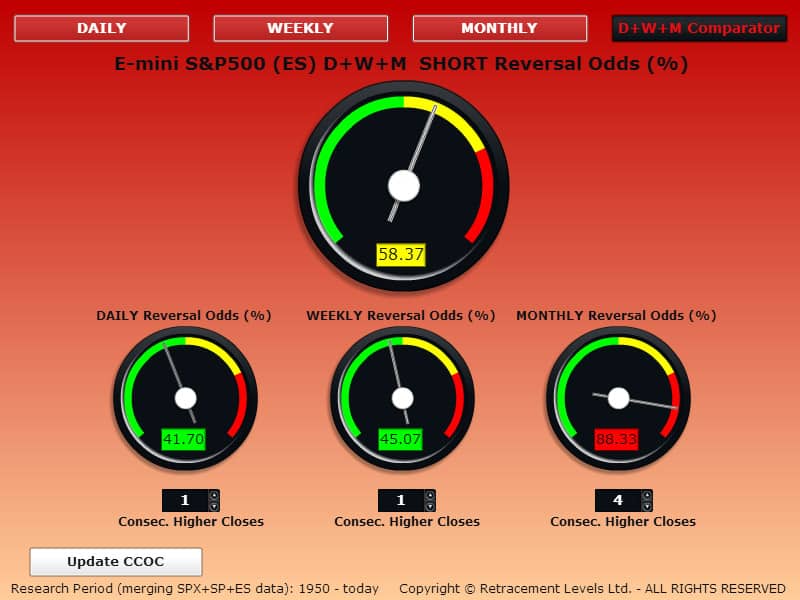

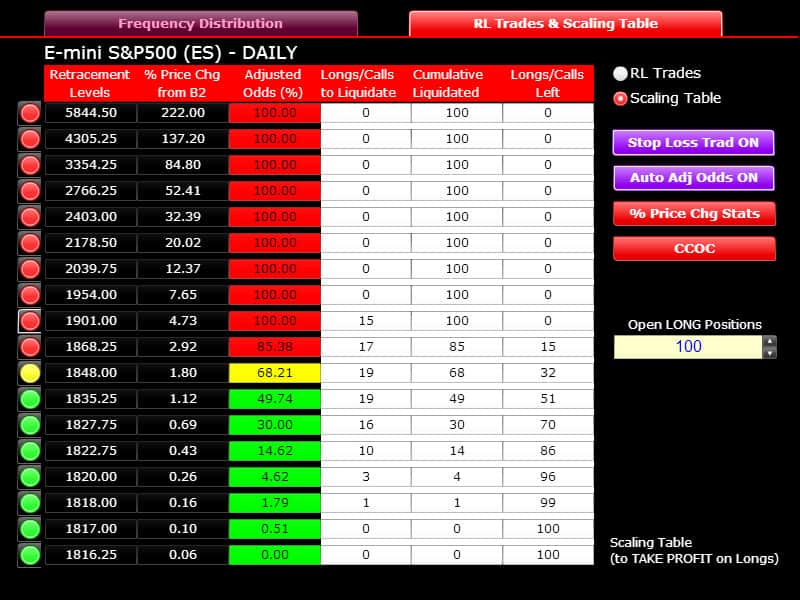

TO GO SHORT ANALYSIS

The CCOC DAILY gauge below is showing coin flip odds to GO SHORT.

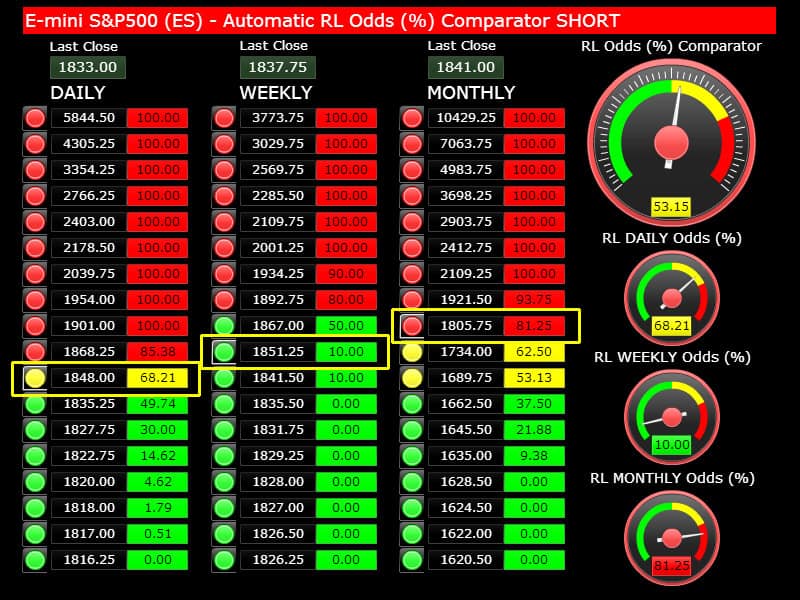

On the SHORT Odds Table below we have the following relevant levels:

1901, 100% odds – Stop Loss level.

1835.25, 49.74% odds – First “safe” level to go SHORT.

Yesterday we said that what is a bit concerning with the ES reaching again the 1835.25 level is that it would show a strong will to recover from Monday’s dive and in fact it now looks like Monday was just a blip on the way up (unless today the index tanks again). At the moment of writing we can see that 1835.25 has been reached overnight, yesterday we said you can try this level and place a Stop Loss not too far above it. It may just work. If 1835.25 does not work, 1848 is the next target price, the odds there start to be quite good (68.21%), we invite you to go SHORT without hesitation in that price area.

The ES SHORT Odds Comparator below tells us what the odds to go SHORT would be if the price area near 1848 is reached:

The Daily odds would be good (68.21%) and the Monthly as well (especially because the ES would be above the last Monthly Close @ 1841 and that reinforces the SHORT setup from the TIME perspective: 5 months up in a row).

What remains weak is the Weekly perspective, only 10% odds, but again, this may simply be because the correction started first on the Weekly as the indexes closed down 2 weeks ago and so the SHORT levels were re-set, and it will take a larger impulse to reach good Weekly odds.

In simple words: the Weekly is anticipating what may happen soon on the Monthly, it started to show some instability (up and down closes versus just up closes).

Copyright © 2014 Retracement Levels. All Rights Reserved

Comments

No comments yet.