Users: Funatwork: ES Quantitative Analysis | Slope of Hope

ES Quantitative Analysis | Slope of Hope

Before we publish the ES Quantitative Analysis for today, a couple of clarifications:

1) the Analysis product presented here is NOT a trading system, in other words we simply use our quantitative metrics to analyze the chances (odds) for the ES market to change trend direction at certain price levels – the decision about Position Sizing, Stop Loss and exact price trading execution levels are entirely up to the single trader/investor

2) our analysis is re-updated every day on the side of the impulse that did not change, for example currently the ES market has been closing up 2 days in a row (today may be the third), so we are only updating the LONG version of the trades, since yesterday’s UP Close has generated new LONG price levels. The SHORT trades are unchanged from yesterday. For your convenience we’ll always publish both the LONG and SHORT analysis, but usually only one of the two (the “changed” one) will contain significant updates.

3) after yesterday’s very long introductory post, today we are going to limit our observations to price levels and related odds of reversal.

TO GO LONG ANALYSIS

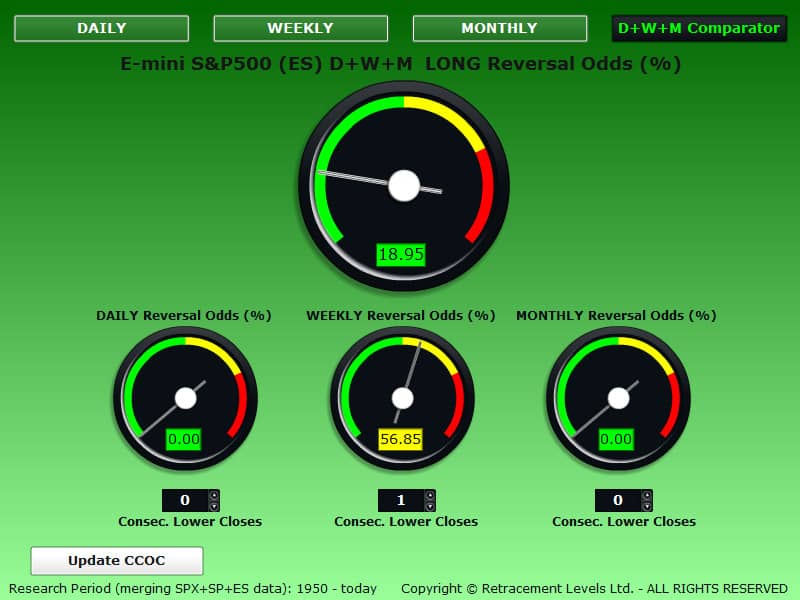

Here below you can see the LONG chart updated with the latest LONG levels after yesterday’s UP Close.

On the LONG Odds Table below we have the following relevant levels:

1760.75, 100% odds – Stop Loss level.

1822, 26.09% odds – First valid level to go LONG for the next trading session.

1815.50, 47.28% odds - First “safe” level to go LONG for the next trading session.

The market is buoyant at the moment, the ES Futures are up at the moment of writing (>1838) so it seems unlikely to see the market at 1815 by the Open.

1822 could be reached intraday if there is a correction and you could buy it safely, but our bet is that today the market will simply stay up and Close up, so there will be no occasion to go LONG based on our levels.

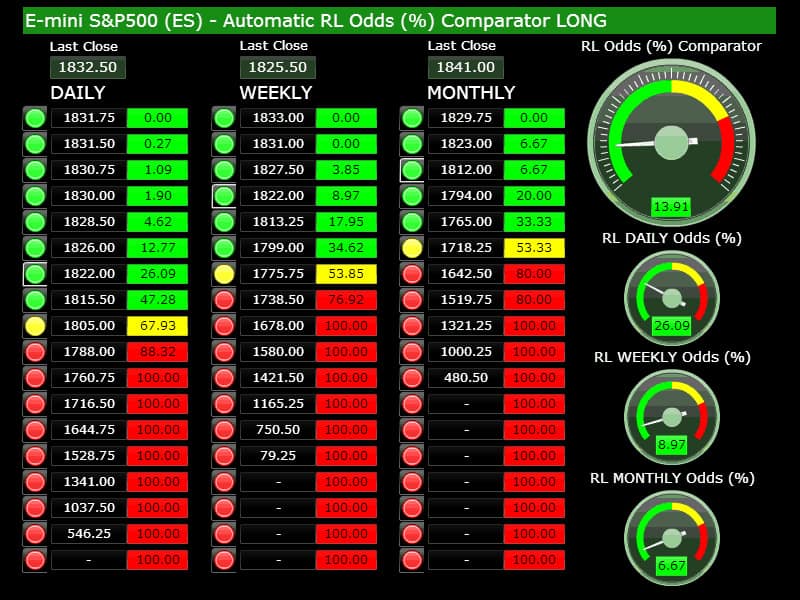

The ES LONG Odds Comparator below show us what the odds would be if the 1822-1823 price area would be reached:

DAILY 26.09% Odds

WEEKLY 8.97% Odds

MONTHLY 6.67% Odds

OVERALL 13.91% Odds

Our comment to the above Daily+Weekly+Monthly Comparative Odds analysis is that unless the market reaches significantly lower levels the odds for a LONG trade are not particularly good, so we would shy away from long-term LONG trades in this phase.

In the short-term, buying dips can surely produce profits but today is the third consecutive day up in a row, we would prefer to buy dips on the first or second day up, now is too late, the market will probably reverse SHORT between Friday and Monday and there is where you can buy again.

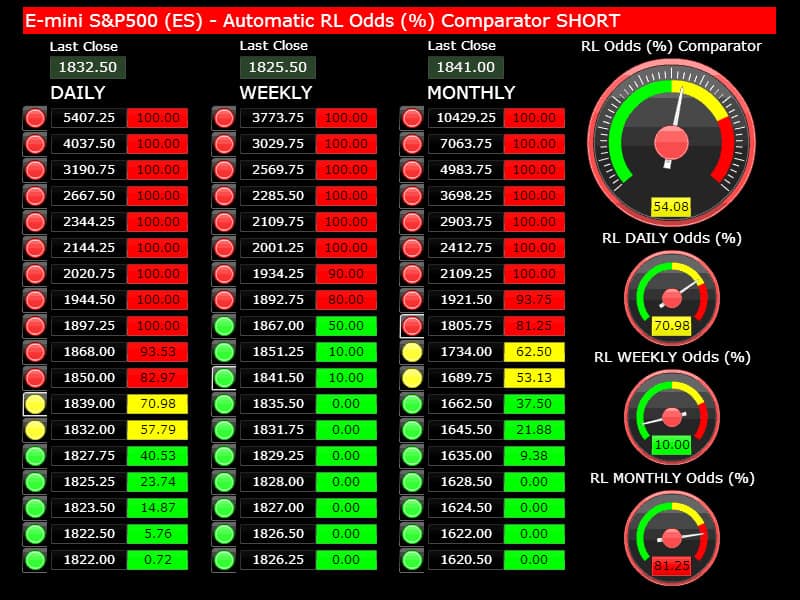

TO GO SHORT ANALYSIS

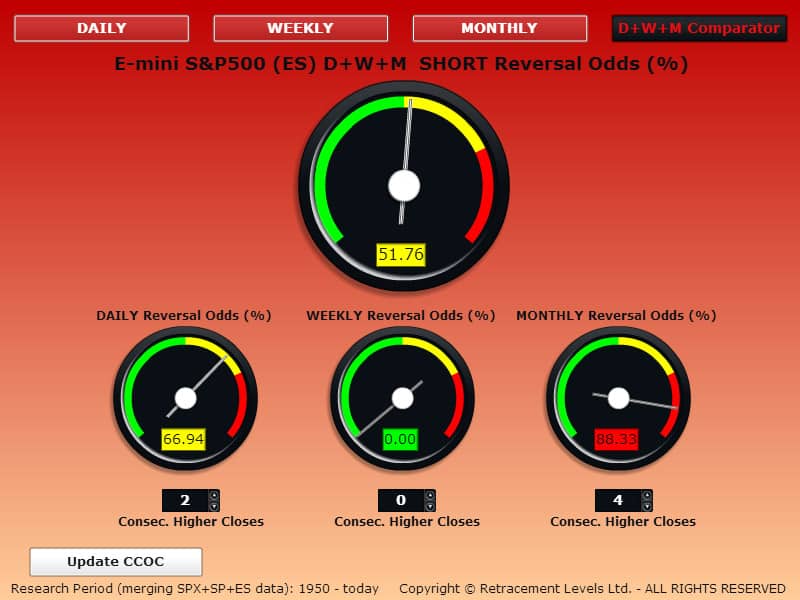

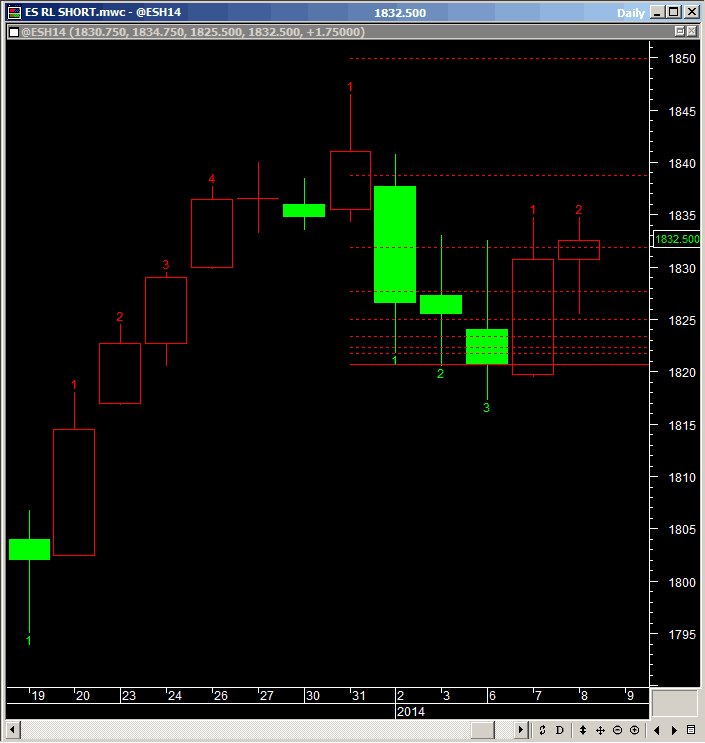

Here below you can see the SHORT chart: it has not changed from yesterday.

The CCOC DAILY gauge below is showing good odds to GO SHORT.

The CCOC DAILY gauge below is showing good odds to GO SHORT.

On the SHORT Odds Table below we have the following relevant levels:

1897.25, 100% odds – Stop Loss level.

1839, 70.98% odds – First valid level to go SHORT for the next trading session.

The 1839 level has already been reached at the moment of writing, if the market pulls back a bit from here this will be a valid level to go SHORT for today’s session. The odds for a SHORT reversal are very good at this level (> 70%).

As already said in the LONG section, the market seems buoyant at the moment, so most likely we would expect higher prices for today, although 1850 seems a bit far. If the market keeps pushing higher for another 2 days, then 1850 can be reached: the odds for a SHORT trade are excellent there, 82.97%.

We don’t see the market going at 1868 on this impulse, before making at least a 1-day SHORT reversal.

The ES SHORT Odds Comparator below show us what the odds would be if the price area near 1839 would be reached (note: this DAILY price level has been reached overnight):

DAILY 70.98% Odds

WEEKLY 10% Odds

MONTHLY >81.25% Odds

Our comment to the above Daily+Weekly+Monthly Comparative Odds analysis is that the market is quite overbought Monthly and the Daily as well it’s reaching overbought levels, so a Daily correction (at least one day down) is becoming more likely and if there is a catalyst, it may turn into a Monthly correction. The Weekly at the moment is not overbought (because it closed down last week), but this may be read as a Weekly downtrend that has already started, and so the current upswing may be some sort of Daily re-test of the latest highs at 1846.50 – if that happens during the current upward impulse, then 1850 would be the perfect place for a big, medium-term SHORT bet, with a chance to see the market correcting down for the whole month.

We will re-update you on all this tomorrow.

Copyright © 2014 Retracement Levels. All Rights Reserved

Comments

No comments yet.