View: Spiked Super Bowl Shuffle BDI Style…….EP XLVII | Slope of Hope

Spiked Super Bowl Shuffle BDI Style…….EP XLVII | Slope of Hope

Good afternoon Denver Dopes, just though I’d entertain you with a quick BDI Shuffle before the main event, the Sherman Super Bowl Shuffle, begins in earnest. The suspect super strategy that I will attempt to tackle today should take us right into the end zone. However, not for the 7 additional points that typically get tacked on after a stylish Deion Sanders super shuffle, I’m afraid. Nope Dopes, this will be the super sucky “safety” variety of the obnoxious end zone jig, and those 2 crucial points against us may well cost us the big game.

Good afternoon Denver Dopes, just though I’d entertain you with a quick BDI Shuffle before the main event, the Sherman Super Bowl Shuffle, begins in earnest. The suspect super strategy that I will attempt to tackle today should take us right into the end zone. However, not for the 7 additional points that typically get tacked on after a stylish Deion Sanders super shuffle, I’m afraid. Nope Dopes, this will be the super sucky “safety” variety of the obnoxious end zone jig, and those 2 crucial points against us may well cost us the big game.

Nearly time for the zany zebra zeros to blow my wide wet whistle and let the EP XLVII games begin. What we can all agree on is that a ton of super bowl tickets have been circulated by big bad blocking back Ben Bernanke since that devastating 2008 super bowl blowout between the hapless Washington Bears and the well Fed NY Bulls.

Yes, my fair weather football fans, coach Benny Endzoni has printed up over $ 4 trillion tickets for the big show, way surpassing the record held by all previous NFL coaches before him combined. Collectively, they had only issued about 900 million tickets since the great federal game was invented back in 1910. Ben certainly threw one hell of a bomb, or was it a Hail Mary pass?

That’s about enough of my super stupid savantness, time for the idiot to get tackled. We have four losing plays to review.

NFL Playbook # 1 The Long Money Bomb

As mentioned above, our hot money Federal Chairman may have now thrown out his questionable arm by heaving way too many passes deep down field. QB Benny has now passed well over $ 3 trillion USDs during his unbalanced sheety career, without being removed from the game, even though he has punted throughout his undistinguish career. We now find ourselves behind by a whopping $ 4 trillon points due to his unbalanced approach to the game. Seriously, where do you think all this hot money has ended up and how do you think it will effect the economy in the long run? Do any of you really believe that there will be no adverse consequences to such deliberate disgusting debasement of our means of exchange? One of the Fed’s principle mandates it claims to uphold is stabilizing the currency, so as to keep the means of exchange reflecting a stable honest store of value in it of itself. Please, if that were truly the case, can you please explain to me why all this so called sound money is flowing just as fast and furiously as it can into all kinds of tangible hard assets; Important works of art (some of questionable merit), Exclusive high-end Rel-estate, Massive lots of venerable land, Esteemed Collectibles of all kinds, Prized Jewelry, Diamonds and other precious stones, Physical Precious Metals, Appreciating financial assets in all the capital market sectors (seemingly irrespective of the sectors productive performance). Have you stopped to ask yourself why? Surely those individuals that are piling into these hard assets must have a reason, after all, they are some of the wealthiest among us, one would think they receive better financial advice then the average bear?

by heaving way too many passes deep down field. QB Benny has now passed well over $ 3 trillion USDs during his unbalanced sheety career, without being removed from the game, even though he has punted throughout his undistinguish career. We now find ourselves behind by a whopping $ 4 trillon points due to his unbalanced approach to the game. Seriously, where do you think all this hot money has ended up and how do you think it will effect the economy in the long run? Do any of you really believe that there will be no adverse consequences to such deliberate disgusting debasement of our means of exchange? One of the Fed’s principle mandates it claims to uphold is stabilizing the currency, so as to keep the means of exchange reflecting a stable honest store of value in it of itself. Please, if that were truly the case, can you please explain to me why all this so called sound money is flowing just as fast and furiously as it can into all kinds of tangible hard assets; Important works of art (some of questionable merit), Exclusive high-end Rel-estate, Massive lots of venerable land, Esteemed Collectibles of all kinds, Prized Jewelry, Diamonds and other precious stones, Physical Precious Metals, Appreciating financial assets in all the capital market sectors (seemingly irrespective of the sectors productive performance). Have you stopped to ask yourself why? Surely those individuals that are piling into these hard assets must have a reason, after all, they are some of the wealthiest among us, one would think they receive better financial advice then the average bear?

NFL Playbook # 2 Sherman’s Trash Talking Inflation

So why is this happening? I’ll tell you why, money itself has lost its most important role of all, which before anything else is supposed to act as a store of value. Well, my friends, don’t kid yourselves it obviously NO longer does, and these well off sharp cookies mentioned above clearly all know this. If our currency still did hold intrinsic value, they would not all be ridding themselves of their hard earned dollars just as fast as they possibly can. Moreover, the outcome of this unrestrained feeding frenzy sure stinks of asset inflation to me. Oh, and I nearly forgot to mention money’s second most important role. It’s supposed to have a time value to it, and, at the very least, it certainly should be able to earn enough interest to keep up with inflation, right? Not to worry, as your trustworthy Government officials will tell you not to be concerned at all, apparently inflation on the ground for the common man’s economy is completely checked and will stay that way for the foreseeable future. CPI is not high at all according to their carefully quantifiable calculations. Well, if that were truly the case, why has the average American’s standard of living steadily eroded for the past 20 years.

So why is this happening? I’ll tell you why, money itself has lost its most important role of all, which before anything else is supposed to act as a store of value. Well, my friends, don’t kid yourselves it obviously NO longer does, and these well off sharp cookies mentioned above clearly all know this. If our currency still did hold intrinsic value, they would not all be ridding themselves of their hard earned dollars just as fast as they possibly can. Moreover, the outcome of this unrestrained feeding frenzy sure stinks of asset inflation to me. Oh, and I nearly forgot to mention money’s second most important role. It’s supposed to have a time value to it, and, at the very least, it certainly should be able to earn enough interest to keep up with inflation, right? Not to worry, as your trustworthy Government officials will tell you not to be concerned at all, apparently inflation on the ground for the common man’s economy is completely checked and will stay that way for the foreseeable future. CPI is not high at all according to their carefully quantifiable calculations. Well, if that were truly the case, why has the average American’s standard of living steadily eroded for the past 20 years.

I don’t know about you, but it certainly seems that my everyday fixed operational costs are rising steadily. My gasoline costs at the pump have gone up considerably since 20 years ago, my rent has more than doubled, my weekly food bill seems to be higher every year. The money I shell out monthly for combined Phone/TV/Internet services is substantially more than when I was watching StarTrek and calling my local friends to come on over to view the latest Captain Kirk episode together. My utilities bill seems to regularly increase year after year. My healthcare costs are through the roof. My closest friends are constantly wailing about the astronomical costs of their children’s education. And, worst of all, my beloved Dewars mist no twist which use to run me five bucks at my local dive a few years back, now sets me back nearly an entire Jackson! Meanwhile, our trusted U.S Bureau of Labor and Statistics tells me CPI is coming in at only a meager and very manageable 0.8%. My ass it is! Your money is not stable, it’s falling to pieces. Get your head out of your collective asses, you’re getting ass raped and gang debased. Stagnating Inflation is indeed right around the corner, it may well be already here, and you’re about to feel it right between your ass cheeks!

This by James E. Miller of the Ludwig von Mises Institute of Canada sums it up effectively:

“To think that Bernanke’s extreme measures during the financial crisis will quietly slink away without consequence is an act of false comfort. The trillions added to the Fed’s balance sheet are not sitting quietly on the sideline. The dollars are working their way through the country’s largest corporations. Banks are pyramiding credit, creating money ex nihilo. The funds are likely finding their way to the stock market, often times reflective of investment in the capital goods sector. On numerous occasions, Bernanke has bragged about the robustness of Wall Street. Millions of folks might still be out of work but the banker class is living fat and happy. This is a central bank’s version of progress. In recent months, the Fed has indicated it plans to incrementally scale back its economy-boosting efforts. This will be the final hurrah of Bernanke’s legacy – a calm unwinding of his life’s work. Even now, the delicateness of this plan is starting to show. Stocks are jittery about a Fed pullback. Traders know the free ride must come to an end sometime. The amount of money creation occurring can’t go on forever. Doing so risks a truly inflationary event, with the effervescing dollars threatening to spill over into the larger economy.”

NFL Playbook # 3 Overseas Exhibition Games

Ben’s $4 trillion dollar play has not only adversely effected the home team’s entire salary cap. This high pressure money sprinkler system has over sprayed the the recently built stadiums and playing fields of many promising new international franchises. These historically hot money flows are not just effecting the price of your favorite alcoholic beverage, no sir, it has found its way into emerging market establishments serving up dinner and drinks to fanatical world cup fans throughout the globe. And, if you think your hot chocolate and Stolichnaya enjoyed at the Sochi Winter Olympics won’t be effected, think again, how else will they pay for all the shiny new athletic infrastructure built for hosting the international Olympic games. Yep, the hot money has indeed infiltrated many overseas economies. Nowhere else is this more striking than than the emerging markets. Rest assured, those beloved BRICS constantly pointed to as the pinnacle of the global growth effect, have been built brick by brick with hot money inflows. Well, guess what, all that fabricated funny money flew over there in order to invest in soaring infrastructure touching the sky, has gotten too close to the sun, and seems to be tumbling down. Holy Icarus! Now what? Well, the suspect hot money flows are rushing back onto our shores in a terrific tsunami of loose liquidity, completely unhinged from grounded reality. Can you say inflation? Not to worry I’m sure it won’t show up in CPI. Is the hot wax finally melting?

Ben’s $4 trillion dollar play has not only adversely effected the home team’s entire salary cap. This high pressure money sprinkler system has over sprayed the the recently built stadiums and playing fields of many promising new international franchises. These historically hot money flows are not just effecting the price of your favorite alcoholic beverage, no sir, it has found its way into emerging market establishments serving up dinner and drinks to fanatical world cup fans throughout the globe. And, if you think your hot chocolate and Stolichnaya enjoyed at the Sochi Winter Olympics won’t be effected, think again, how else will they pay for all the shiny new athletic infrastructure built for hosting the international Olympic games. Yep, the hot money has indeed infiltrated many overseas economies. Nowhere else is this more striking than than the emerging markets. Rest assured, those beloved BRICS constantly pointed to as the pinnacle of the global growth effect, have been built brick by brick with hot money inflows. Well, guess what, all that fabricated funny money flew over there in order to invest in soaring infrastructure touching the sky, has gotten too close to the sun, and seems to be tumbling down. Holy Icarus! Now what? Well, the suspect hot money flows are rushing back onto our shores in a terrific tsunami of loose liquidity, completely unhinged from grounded reality. Can you say inflation? Not to worry I’m sure it won’t show up in CPI. Is the hot wax finally melting?

This from the MSM UK Newspaper “The Independent” :

Turkey — gripped by a corruption scandal engulfing the government — is laboring under a big deficit and its currency is the latest to be rocked by the flow of “hot money” out of emerging markets as the US Federal Reserve slows the pace of its money-printing programme.

The nerves began last week when disappointing Chinese manufacturing figures and a run on the Argentinian peso put emerging market currencies under the spotlight.

India responded this week with a surprise rise in interest rates, while Brazil’s central bank has also tightened policy for six meetings in a row and South Africa is now under pressure to raise borrowing costs.

Brazil’s central bank governor Alexandre Tombini warned at Davos of the “vacuum cleaner” of rising interest rates in the developed world, sucking money out of emerging markets.

Deutsche Bank analyst Jim Reid said: “The question remains whether the actions are sufficient enough to stabilize sentiment which has deteriorated sharply in recent weeks.

But it also raises serious concerns that the internal shock of these rate hikes will curtail any growth there is in the short term, and in turn hurt profitability of any companies who do business in these markets.”

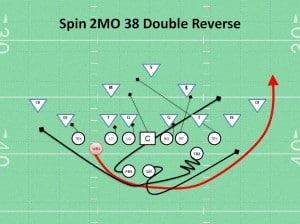

NFL Playbook # 4 The Ineffective Double Reverse

The NFL has experienced phenomenal growth since its inception, and has likely surpassed Baseball as America’s favorite pastime, well, with the notable exception of national “Twerking” of course. Emerging new NFL talent often disappoint and fade away faster than the likes of Justin Bieber eventually will. The vaunted super BRICS themselves could well be in for some time out from the limelight of overly professed success as well.

The Federal Bulls’ quickly losing momentum in the big game, was discussed at length in the locker room during halftime, coach Ben’s half assed hail Mary pass approach to the game seems to be flailing. In fact, the entire season’s playbook was questioned by the team’s outraged owner, as a suspect offensive abomination of the fundamentals of the game. The low down in the sports pages is that he intends on firing Coach Endzoni right after the game, and his replacement is rumoured to be the owner’s very own secretary Janet. Seriously, how can you expect such an unbalanced game plan to achieve consistent results and positive overall GDP (Ground game, Defense, Points) for the hapless team.

It’s crystal clear at this point what the Federal Reserve’s overall game plan is. And, that is to reflate our way out of the nation’s uncontrollable and rapidly growing sovereign debt, which is now in excess of $100 trillion, if you include all the unfunded liabilities. Their preposterous theory is that if they throw enough unearned and unprincipled printed money at the problem, we can somehow reach escape velocity, which should eventually stimulate enough real actual productive growth in the real economy to get us out from underneath the massive monumental mountain of debt they unwittingly created. This would be a kin to Payton Manning throwing a hail Marry pass every single down of the game. Sound like a winning strategy to you? The other unconscionable and disgraceful idea is to deflate the currency to such an extent as to render all the Country’s debt obligations worthless. Do they really expect that the rest of the world will simply take it up the ass as they print the Globe’s reserve currency into oblivion. To use another football analogy, this would be like the refs continually moving the chains, extending the 10 yards required to obtain a first down after every play no matter what the yardage achieved. For example, it could be 3rd and 10 and Manning throws a 20 yard completion, yet after the the refs move the chains, it would be 4th down and out. You think that the team’s fans in the stands and players on the field would simply sit by quietly accepting their fate. I don’t know about you, but I see them rushing the field, grabbing hold of the chains and hanging the refs on the goal post’s cross bars.

It’s crystal clear at this point what the Federal Reserve’s overall game plan is. And, that is to reflate our way out of the nation’s uncontrollable and rapidly growing sovereign debt, which is now in excess of $100 trillion, if you include all the unfunded liabilities. Their preposterous theory is that if they throw enough unearned and unprincipled printed money at the problem, we can somehow reach escape velocity, which should eventually stimulate enough real actual productive growth in the real economy to get us out from underneath the massive monumental mountain of debt they unwittingly created. This would be a kin to Payton Manning throwing a hail Marry pass every single down of the game. Sound like a winning strategy to you? The other unconscionable and disgraceful idea is to deflate the currency to such an extent as to render all the Country’s debt obligations worthless. Do they really expect that the rest of the world will simply take it up the ass as they print the Globe’s reserve currency into oblivion. To use another football analogy, this would be like the refs continually moving the chains, extending the 10 yards required to obtain a first down after every play no matter what the yardage achieved. For example, it could be 3rd and 10 and Manning throws a 20 yard completion, yet after the the refs move the chains, it would be 4th down and out. You think that the team’s fans in the stands and players on the field would simply sit by quietly accepting their fate. I don’t know about you, but I see them rushing the field, grabbing hold of the chains and hanging the refs on the goal post’s cross bars.

You simply can not print your way to prosperity, same as it ever was! The Fed’s ill-conceived game plan will prove disastrous, as they attempt to cut back on the money printing extravaganza. The following is what to expect by the time the 4th quarter runs out. Capital flight from the flailing emerging markets will promptly shut down global growth, the reaction to this will be to raise interest rates in the BRICS in order to defend their sinking currencies, obviously not a pro growth measure either. Also, drastic currency swings are not easy for businesses on the ground to negotiate The exporters may benefit, although their input costs can move against them. However, the importers clearly get trounced. Moreover, the public in general loses significant purchasing power. Again, all of which is bad for the global growth paradigm we constantly hear about.

Okay, so we see the negative consequence of the dubious Fed policy abroad. What about domestically you ask? Well, for starters, the incoming capital outflows from our decimated overseas friends will find itself either in the precarious safety of the US bond capital markets, putting further downward pressure on interest rates. At first blush, this may seems as a good development for the US, but I assure you that it is not. It will promptly accelerate the velocity of money, just as the Fed is trying to pare it back by reducing QE. Trust me, the Fed does not want to see this, as the overseas inflows will have serious inflationary consequences, forcing the Fed’s hand to reduce QE even faster. There can be no doubt that this will have an adverse effect on growth, as the synthetic stimulative effects of QE are reigned in. Moreover, because the Fed has captured and distorted real market interest rates to such artificially rediculous low levels, it can no longer count on the proper addition to the money supply, which comes naturally from individuals, corporations and institutions earnings’ on traditional risk free savings at normalized rates of interest.

So basically, the Fed is in a titanium box, having painted themselves in the corner of all corners. If they print more to stimulate the economy further, the ensuing forced capital flight from overseas will end up directly in the US financial system, overwhelming the money supply, causing rapid inflation. If they respond by accelerating their current reduction plans, the US joins the rest of the world in the global slow down Finally if they simply choose to keep QE at the current levels, the juiced up velocity of money caused by the hot cash inflows from abroad and a continued ZIRP/QE policy, will produce stagnating inflation as well. To quote one of our favorite Slope-a-Dopes, Market Sniper, “they are flat out fucked!”

So basically, the Fed is in a titanium box, having painted themselves in the corner of all corners. If they print more to stimulate the economy further, the ensuing forced capital flight from overseas will end up directly in the US financial system, overwhelming the money supply, causing rapid inflation. If they respond by accelerating their current reduction plans, the US joins the rest of the world in the global slow down Finally if they simply choose to keep QE at the current levels, the juiced up velocity of money caused by the hot cash inflows from abroad and a continued ZIRP/QE policy, will produce stagnating inflation as well. To quote one of our favorite Slope-a-Dopes, Market Sniper, “they are flat out fucked!”

This from Mark Spitznagel recent book ”The Dao of Capital”

The somewhat improved economic activity that we’re seeing is based on a mirage—that is, the illusion created by artificial zero-interest rates.

When central banks lower interest rates in hopes of stimulating the economy, that intervention is not the same as a natural move in interest rates.

A genuine drop in interest rates is in response to an increase in savings, as consumers defer consumption now in order to consume later. In a high-savings environment, entrepreneurs put their capital to work to become more roundabout,1 layering their tools and intermediate stages of production to become increasingly productive. The time to make these investments is when consumers are saving, so that entrepreneurs can be in an even better position to make the products that consumers want, when they want them.

In an artificial rate environment, however, that’s not what’s happening. Instead of consumers saving now to spend later, they are spending now.

But because interest rates are artificially lower, entrepreneurs are being fooled into investing in something now that they will have to back out of later building-up what the Austrians call “malinvestment.” Therefore, the illusion is unsustainable, by definition. The Fed can’t keep interest rates low forever.

From an investor perspective, people are trying to extract as much as they can right now. Consider the naive dividend investment argument: “I can’t afford to be in cash right now.” Investment managers have to provide returns today.

Whenever investors sell a low dividend-paying stock to buy a higher-dividend stock, some piece of progress is sapped from our economy. (The cash needed to pay that higher dividend isn’t going to capital investment in the company.)

This is the exact opposite of entrepreneurial thinking that advances the economy. Consider the example of Henry Ford, who didn’t care about paying dividends today. He wanted to plow as much capital as possible back into making production more efficient for the benefit of the consumer who would pay less for a higher-quality product.

In summary, a major message of my recent book, The Dao of Capital, is recognizing the distortions that come from central bank intervention. Because of the Fed’s actions, interest rates are no longer a real piece of economic information. If you treat them like they are, you will simply do the wrong thing.

After all, when the government tries to manipulate things, the inverse of what was intended usually happens. On that point, history is entirely on my side.

Comments

No comments yet.