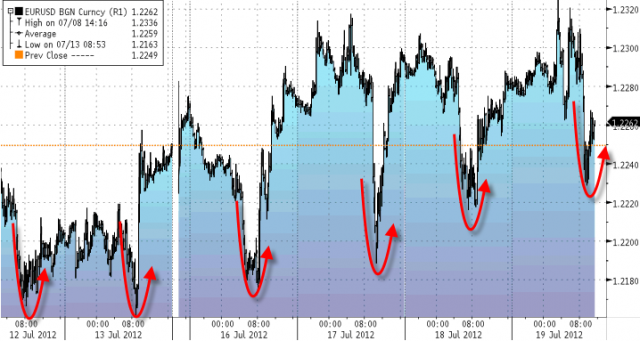

Browse Symbol Stacks: FXE: 20120719_EUR.png (718×383)

20120719_EUR.png (718×383)

For the sixth day-in-a-row, a rather interesting price action has occurred in the most liquid FX pair in the world. Each day we see EURUSD crumble rapidly into the US day-session open, only to recover rapidly as the European market closes. These are not 10pip swings. These are 40-100pip gaps! What is going on? Its unclear for sure but we suspect some large entity is helping the market out with its dire need for European banks to repatriate their EUR to cover collateral and liquidity needs (remember we are seeing ECB margin calls rising and at these levels LCH will for sure be raising collateral on the very bonds that the most risky banks own). In other words, someone stomps on the USD bid (lowers the price of EURUSD) - which everyone loves as it correlates so highly with lower implied vol and higher stock prices - which gives the European banks a better (lower) rate of exchange to get out of their USD into the much needed EUR - and hence the flood comes in and we revert back to pre-day-session levels. Another

Comments

No comments yet.