View: Blanks of the trader

Blanks of the trader

It is great to be back after the summer break in this blog-space with some new ideas that could lead on to make this blog more useful for readers. There will be gradual upgrades to this blog week over week as we move along, so please check out this space. Predominant focus will still remain on market analysis for short-mid term opportunities and tools that readers may find useful in their trading, although more integration with the powerful trading resources like myfxbook, tradingfloor etc will take place. Hopefully will have a good run till the end of the year.

Despite not taking the trades during this time i was looking periodically at the market action across the instruments in my watchlist portfolio. What came across was very strong recent correlation between EUR/USD and USD/JPY pairs, which lead to replacing later with GBP/USD pair in FX side of my list.

Equities side remained pretty much the same with French CAC40 as main instrument there as well as China A50 index that had improved their trading conditions with 24x5 hour trading available on this market. Despite long term charts (4hours - daily) looking very spiky, will keep it under the radar.

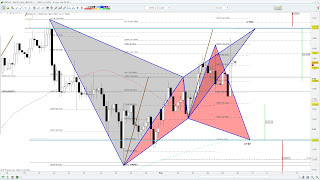

As of the next week i have 3 setups to cover, first one come from CAC40 index, bearish BAT pattern with close to ideal Fibonacci confluence. With very much anticipated in May sell-off not having many legs this could be perhaps one of the last opportunities from technical perspective for the move south.

4073-4096 area looks like a fine place to get involved depending on the risk tolerance having stop higher than 30 pips would make a lot of sense during these market conditions.

FX side has 2 potential self excluding setups on GBP/USD pair. Bearish Gartleys (in grey) is very much against the prevailing current uptrend. Short entry at 1.57 should provide good R multiple. Another pattern is bullish Cypher (in red) will be very much with the trend or in sideways conditions. As it stands at this weeks open we are much closer to Gartleys completion.

As usual have a good one traders, let me know if you have any issues viewing this blog.

Comments

No comments yet.