View: Blanks of the trader

Blanks of the trader

Last week brought some positive numbers to the general performance of the recent weeks, namely CAC40 long trade paid off very well, hitting two targets with about +85 pips of profit. Other two setups on EURUSD and GBPUSD completed and played out with a negative outcome, however position sizing kicked in this case due to the fact that those trades were against the trend. This part of money management is one of the crucial tools that can make or brake P&L numbers numbers in the long run. In general it is very good idea to take money management course at some stage on trading journey.

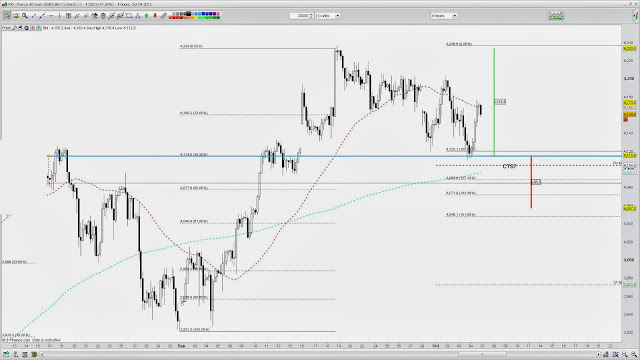

Looking at the next week, there is some downside correction on all of thee charts in my watch list. Hopefully will be able to join in when and if action to the upside will kick in again. CAC40 index has very appealing Fibonacci confluence with the pivot support at 4115 area. This is ideal setup for trend continuation with 0.382 fib retracement of the last impulse leg and additional test of this area. Will be looking to get long with anticipation of testing recent highs and further breakout to the upside.

On FX side both EURUSD and GBPUSD pairs that i'm watching have potential bullish setups as well. As of supply of US currency will be increasing due to the FED actions, positioning against USD will make a lot of sense in next couple of weeks in my book. EURUSD pair has two potential bullish Cypher patterns. The immediate one to be completed @ 1.34 area is in line with pivot on 4 hours chart. This is very appealing confluence, hovewer will be looking for more confirmation in order to get involved as about 100 pips of risk has to be taken onboard, therefore will be looking to get involved in retest of 1.34 rather that catching falling knife.

GBPUSD has bullish setup @1.5967's area where again Fibonacci confluence lines up with pivot support area. Again there has to be more confirmation to this bullish setup in my book as stops have to go below 1.5885's, which is about 105 pips. Last two setups are sound examples on importance of having a grip on money management and position sizing while trading.

This will sum up this week have a good one traders!

On that one it made a gap up, bull flag, and move up just this evening.

10/6/13