Browse Symbol Stacks: EURUSD: Blanks of the trader

Blanks of the trader

With blips of volatility last week, the markets seem to be more promising for coming weeks in terms of longer term moves. The fundamental decision by ECB to go negative with deposit interest rates is likely to send EUR much lower from where we are at the moment. As far as the setups from the last week, trend continuation long play on CAC40 got filled @4497's level and stopped me out almost immediately for -24 pips, however 4 hours candle closed @4497 level sharp, that lead me to long re-entry from there. The rest is a history as anticipated target 3 was hit by the end of the week for +100 pips, netting about +75 pips net in total with initial loser. This trade had far from ideal execution, but these are the dangers having positions exposure around major events like we had last week. Other setups did not come into play with EUR/USD and GBP/USD setups coming very close to completion, before moving the anticipated direction. See the list of events that can have potential impact across the assets this week.

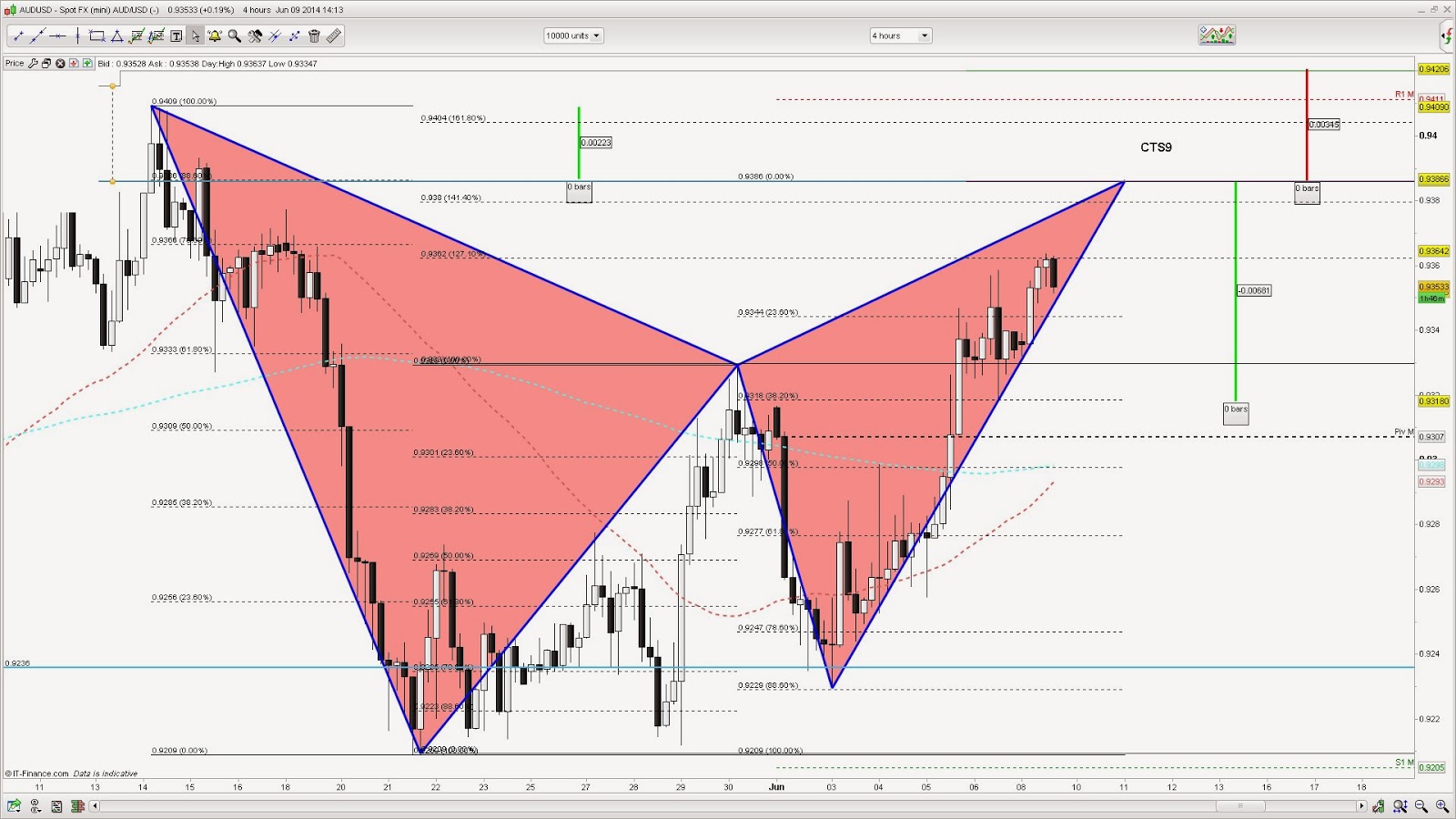

Risk events (UK time) Tuesday China CPI (May), 2.30am: Price growth in the world’s second largest economy is expected to accelerate to 2.4% for the month, up from 1.8% a month earlier. Market to watch: AUD/USD, China A50UK industrial and manufacturing production (April), 9.30am: Although not crucial for sterling, output from the UK’s industry will be a useful barometer of performance. Industrial production is expected to rebound with 0.4% growth from a drop of 0.1% in March, while manufacturing is also expected to increase, up from 3.3% to 4.1%. Market to watch: GBP/USD, EUR/GBP Wednesday UK unemployment (May), 9.30am: These readings are the crucial one for sterling this week. Jobless claims are forecast to drop by 25,000, from 25,100 in April, while growth in weekly earnings is expected to drop back from 1.7% to 1.2%, which could give the Labour party succor in its ‘Cost of Living’ campaign. Market to watch: GBP/USD, EUR/GBP Thursday Australian unemployment rate (May), 2.30am: Jobless numbers from Australia could be negative for the Aussie, as economists expect the rate to edge to 5.9% from 5.8%. Market to watch: AUD/USD, ASX 200ECB monthly report (May), 9am: This regular update helps investors to gauge inflation expectations. Although the ECB has fired the gun on easing, quantitative easing could still be enacted if the bank thinks price growth will remain weak. Market to watch: EUR/USDUS retail sales (May), 1.30pm, initial jobless claims: US consumer spending, as measured by retail sales, should increase in May, up to 0.5% MoM (including cars and fuel) and 0.4% excluding cars and fuel, both of which would be a significant improvement over the lack of growth in April. Jobless claims hit 312,000 this week, up slightly, but the four-week moving average reached a seven-year low. Market to watch: Dow Jones, S&P 500, GBP/USD, EUR/USD, AUD/USD, USD/JPY Friday China retail sales (May), 6.30am, industrial production (May), 7am: Retail sales are expected to increase by 12.2% year-on-year, while industrial output is forecast to accelerate by 8.9% from 8.7% last month. Market to watch:AUD/USD, China A50, copperGerman CPI (May, final), 7am: Price growth in the German powerhouse is forecast to remain at 0.9% in the final revision of the May figure. Market to watch: EUR/USDEurozone employment (Q1), 10am: The previous figure for the first quarter was a drop of 0.5%. Market to watch: EUR/USDUniversity of Michigan confidence index (June, first reading), 2.55pm: This gauge of US consumer confidence is expected to increase to 83 from 81.9 last month. Market to watch: Dow Jones, S&P 500, GBP/USD, EUR/USD, AUD/USD, USD/JPY AUD/USDThe only potential setup seem to be short play on Aussie currency at the moment. We are currently at the levels close to BAT pattern completion @0.9386's. Will be looking to sell this level if we will get there.

Have a good traders and click the button below if you chose to contribute to further development of this blog.

Comments

No comments yet.