Browse Symbol Stacks: FED: Blanks of the trader

Blanks of the trader

AUD/USD long hit second target last week for about +140 pips on the balance, this trade gave good lesson on patience and discipline as described in

previous post. The main headline last week was

ECB rates decision and conferenceafter. Personally i think the EUR sell off was very much exaggerated based on the fact that Draghi used his rhetoric as usual without changing anything to monetary policy for now. The head of ECB clearly has talent of doing it, something that new FED chair is yet to learn. This phenomena is very well detailed in Charles MacKay's book "

Extraordinary Popular Delusions and The Madness of Crowds", something that clearly has application in modern days financial markets.

Risk eventsSee events below that have potential to be market movers during the week (all listed events UK time).

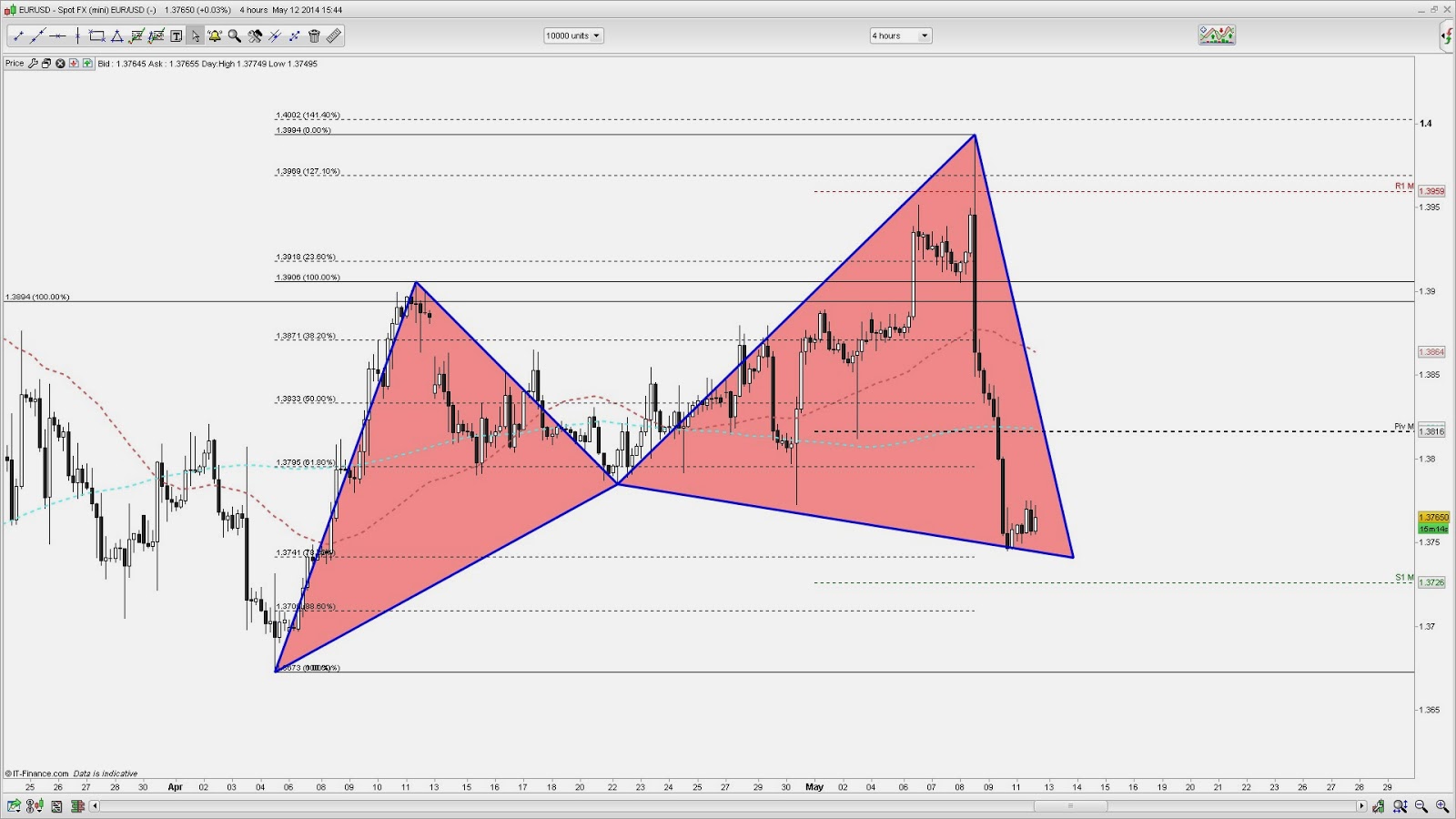

Tuesday China industrial production and retail sales (April), 6.30am: Industrial production rose in March, but we are still below the level of 10% seen in November and December. Meanwhile, retail sales have stabilised from a sub-12% print for February, and are forecast to remain steady around 12.1%. Market to watch: Copper, AUD/USD, FTSE 100German ZEW readings (May), 10.00am: The German confidence readings have shown mixed data of late, but the current situations survey is expected to improve slightly for May. Market to watch: EUR/USD, DAXUS retail sales (April), 1.30pm: Retail sales are expected to weaken from the prior month’s good figure of 1.1%, but we still forecast growth of 0.4%. Given the importance of US consumer spending to the global economy, a good number should bolster markets. Market to watch: dollar crosses Wednesday German CPI, final reading (April), 7.00am: This is expected to see another drop in price growth, but only a small shrinkage. Market to watch: EUR/USDUK unemployment (April), 9.30am: Unemployment dropped to 6.9% and below 7% for the first time in five years in March, and another drop, to 6.8%, is expected. Market to watch: GBP/USDBoE inflation report, 10.30am: This is the regular update from the Bank of England regarding expected developments in the coming years for UK inflation. Market to watch: GBP/USD Thursday Japan GDP (Q1 preliminary), 0.50am: Quarterly GDP is expected to see 1% growth, a substantial acceleration from a year ago. Market to watch: USD/JPY, NikkeiEurozone GDP (Q1 preliminary), and April CPI, 10am: Both of these figures are expected to show increased growth, although eurozone CPI is still low enough to raise the prospect of some form of action from the ECB. Market to watch: EUR/USDUS CPI (April), weekly jobless claims, 1.30pm: A small uptick in CPI, from 0.2% to 0.3%, is expected. Market to watch: dollar crosses Friday Eurozone trade balance (March), 10.00am: This measure of imports vs exports in the eurozone saw a trade gap of €15 billion. Market to watch: EUR/USDUS housing starts and building permits (April), 1.30pm: Housing starts are forecast to rise to 983K from 946K a month earlier, while building permits are projected to accelerate to 1015K from 990K in March. Market to watch: dollar crossesUniversity of Michigan consumer confidence index (May preliminary), 2.55pm: This is expected to increase to 84.5 from a month earlier. Market to watch: dollar crosses EUR/USDAs mentioned earlier the sell-off that happened last week on this major pair brought bullish Cypher pattern very close to completion on 4 hours chart. We are about 20-30 pips shy of completion @1.374's area at the moment. See the chart below

Have a good one traders and click the button below and contribute to further development of this blog.

Comments

No comments yet.